Student Money Survey 2014 – Results

UPDATE: View our 2023 National Student Money Survey.

Towards the end of each academic year we stop talking and really listen to find out how current university students feel about their financial situation.

For our National Student Money Survey 2014, 2,820 students shared their experiences and opinions with us (admittedly we did lure them in with free Nando's).

This visual report documents our key findings.

What’s on this page?

How concerned are students when it comes to money?

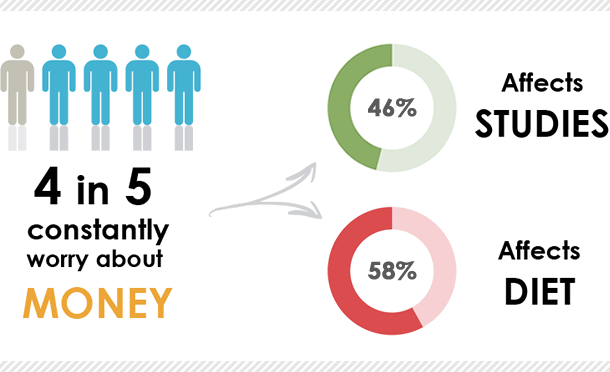

80% of students surveyed said that money worries are on their mind throughout university.

The impact of this on broader student welfare is clear, with almost one-half claiming that worrying about money adversely affects their course studies and the majority believing it causes their diet to suffer.

Student comments:

- Students are given a lot of money in loans, but rent and living costs are simply too much

- I can't afford to travel to a bigger uni for resources, and I can't buy books I need!

- There are days I had to starve myself so that I have enough food for the week

- My friend had to turn vegetarian because she can't afford to buy meat any more

- It's not difficult to live within your means, some people just don't know what their means are

- I think a lot of students exaggerate their money struggles as a point of pride

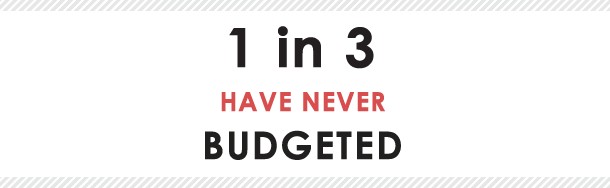

Save the Student has long campaigned for personal finance education in schools. It's clear that whilst many university students struggle to live on little money, some aren't taking account of their spending against their income to ensure it meets everyday needs over long periods.

Student comments:

- We should have been given finance lessons when coming to university, most students have never had to budget before. I came from earning £200 a month in a part-time job at Halfords to being given £1,750 in my first month at university. I spent the lot in the first two weeks and survived on pasta and lentils for the next two months!

- With careful planning of money it's easy to make it stretch further and not have to worry about it

How do students feel about their student loans?

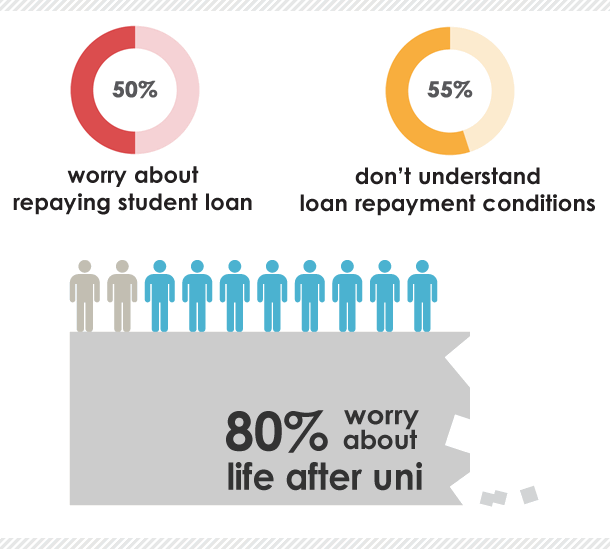

This year exactly half of all students surveyed said that they were worried about repaying their student loan, with slightly more admitting they don't actually understand the repayment conditions. This demonstrates a severe case of confusion and lack of finance education (if you're in the 55% you can find out everything you need to know in our guide to student finance).

Beyond the loan, a significant majority of students are worried about what's in store for them once they graduate. The quotes below highlight the most popular sources of worry.

Student comments:

- It is ridiculous that the student funding I receive makes me fully dependant on my parents

- If I was to survive just on the loan I was given, after rent was taken out, I would only have £24 a month

- Just because my parents are together I get hardly any money in comparison to someone with divorced parents who gets the maximum, even though one parent is richer than both mine put together

- I worry about getting a job when I graduate that can support me financially

- I'm so confused about the [loan] repayments that it worries me most weeks

How do students spend their money?

We've been publishing the results of our annual surveys on monthly student spending for several years now, but for 2014 there have also been some notable - verging on seismic - changes.

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on3.png)

Whilst rent has increased very slightly on 2013's surge, spending on food has plummeted. In fact, in most categories spending has fallen compared to last year, down £38 across the board.

The spend each month on "luxury" items such as clothes and socialising have taken a small hit, however travel costs have jumped from £40 to £44.

On average, £5 is spent on illegal drugs each month, which may come as a surprise to some.

It may be that students are becoming increasingly sensitive to their spending habits, perhaps due to a higher awareness of 'student debt' since the fee increase along with the wider economic climate of austerity.

How do students earn money?

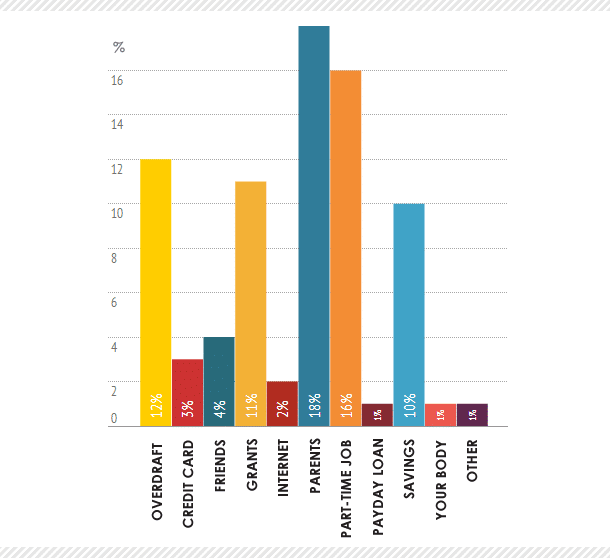

From the results above, we can see that the average student in 2014 spends £735 a month. When you consider that the average maintenance loan (for a student living outside of London) only covers £458 of living costs each month, it naturally makes you wonder where are students finding the extra £277 of income to supplement their spending?

Of course part-time jobs are typically seen as the first port of call, but in reality employment is only a source of income for one-in-six students. Assuming students can find part-time work in the first place, holding down a job to pay the bills during term time could have an adverse affect on academic study and other commitments.

Student comments:

- Having to work is having an impact on my studies and even getting in the way of my relationship

- I find it's practically impossible to be able to handle a job as well as the workload I have on my course for me to be able to get a good grade. I'm suffering as a result

Universities and wider student funding support just over 10% of students with living costs, however the most popular plug in the student's budget shortfall is the Bank of Mum and Dad (read on for more on this). High street banks also play their role, in providing student (hopefully 0%) overdrafts and a home for savings which encouragingly feed into the income streams of one-in-ten students.

Whilst relatively small, it is worrying to see some students turning to credit cards and payday loans to supplement their income.

Here at Save the Student we have also noticed an upward trend in students looking for alternative ways to make money, turning to opportunities online (eg. paid surveys) and even taking part in medical research. Plus these gems...

Strange/original ways students make money:

- I've taken trolleys back to Sainsbury's so I can have the pound in them

- Selling plums grown in my garden

- I once had to pretend I was dating a girl, and her Dad paid me for it

- Butler in the buff

- Matched betting (guide)

- Selling used soap online

- Webcam girl during college

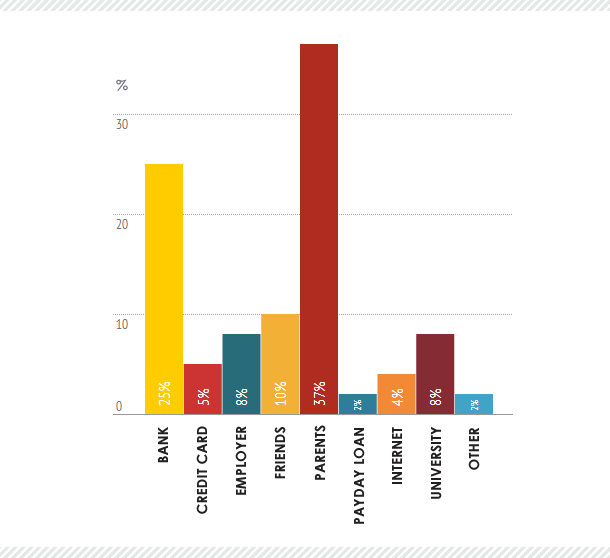

Where do students turn for money in an emergency?

With more and more students struggling to keep up with rent and the growing costs of living, it's important to think about who or where they turn to in a financial emergency. Here are our findings:

It seems that in a time in their life when students are looking to become more financially independent, the majority still depend on their parents for financial support. However, one-third of those surveyed also feel that they do not receive enough help from their parents.

The thorny issue of how much parents should contribute towards their child's growing university costs was prominent in the comments we received this year.

Students on parent support:

- My household income is higher, yes, but that doesn't mean my parents have spare money to put me through university. My student loan doesn't even cover my rent for a year. I have to borrow £1,000 off my parents and then use an overdraft, credit cards and savings (that I have none of now) to put me through uni each year

- I feel bad asking my parents for money as I know they have a mortgage, cars, loans and holidays to pay

- It's bad that the government expects parents to contribute to living expenses

- They base your student loan on your parents' income, but don't consider that your parents don't give you anything

- All I can say is thank God for my parents, I'm so grateful. They don't want me to get a job so I spend my extra time studying

- It's next to impossible to stay out of debt unless you have parents that help a lot

- My parents aren't able to compensate for my living costs, which leaves me in a much worse position than other students

- I rely heavily on my parents for income, if they were in a position that they couldn't give me money then I would be unable to attend uni

- Parents don't always recognise that the maintenance loan is completely reliant on them subbing you out the rest of the money to live

- I rely on my parents for EVERYTHING and they can't really afford to keep giving me money every week just so I can eat

- Why should my parents have to pay for me to be at university because my loan doesn't cover more than my accommodation?

- I'd rather accept more debt and not be reliant on my parents!

We were also alarmed to discover that students would rather turn to their bank or friends than contact their university support services for help.

But most worrying for us is that 2% of the students surveyed actually said they would contact a 'payday loan' (PDL) company. In fact just this week we received an email from an apparently desperate student asking us which PDL company would be best, even though they acknowledged themselves it was a bad move! Needless to say, we advised them of the alternatives.

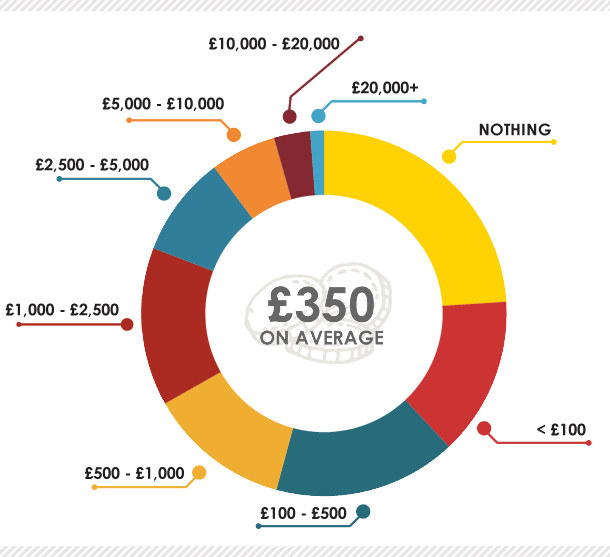

How much money do students have in savings?

We thought it'd be interesting to get an insight into the buffer students have in terms of their own personal savings. So we asked the question!

Our survey revealed that almost a quarter of students have nada in savings, but overall we were happy to see the majority do.

Having said that, we noticed that most students with savings built them up before going to university in expectation of high living costs. Therefore first years tend to have significantly more squirreled away than final year students.

Student comments:

- Before university I had nearly £5,000 in life savings. I will have used all of it funding my university life before I graduate

- I get the full loan and grant and have some spare to put into savings every term

- My student loan does not cover living costs, but fortunately I had savings prior to starting at university

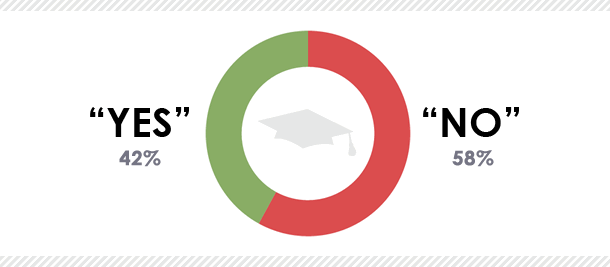

Is university worth it?

After asking all the above we wanted to gather an idea of whether students felt that university was actually even worth the financial costs and difficulties in gaining a degree.

It's a pretty even split. As you can see, the majority (though by a small margin) do not feel as though their degree is good value, with just over 40% having the opposite opinion.

Student comments:

- Student life is the best time however doesn't come without the costs and stresses

- Some students I know have dropped out of their course due to monetary worries

- It’s not just students that have to worry about money, it's society in general

Let us know your thoughts on this year's findings in the comments below!

For a complete guide to budgeting and student finance, download our free “Essential Student Guide to Finance” eBook.

We'd be happy to offer further comment and/or information on request - please contact us.

Sources:

- Survey statistics taken from the Save the Student National Student Money survey 2014. Conducted online. Sample size was 2,820 university students in the UK between 16-27th May 2014

- 2013 statistics taken from the same survey conducted last year.