How much money should your parents give you for university?

There's a good chance you're going to need some help from the Bank of Mum and Dad at university, but how much are they expected to contribute? We explain all here...

Credit: michaeljung, VikiVector – Shutterstock

Since the Maintenance Loan is often nowhere near enough to cover living costs in the UK, the government expects parents to pick up the shortfall. Basically, the more they earn, the more they're expected to contribute.

Depending on where you live at uni and how much your parents earn, they could be expected to contribute over £6,000 a year. According to our 2023 survey, the average student receives £227 a month from parents.

Read on to find out exactly how much your parents should be contributing, and how you can go about asking them for it...

What's in this guide?

Should your parents give you money for university?

The Maintenance Loan falls, on average, £582 short each month – National Student Money Survey 2023

The current Student Finance system uses your parents' income to determine how much money you get as a Maintenance Loan to cover your living costs – this means it's means-tested.

Whether this is fair or not is debatable. For starters, the system doesn't really take into account that some parents will also be supporting other children at university, which will strain their income.

Some parents will also have different attitudes to this than others. Some might think that because you're 18 (and they're no longer legally responsible for you), it's up to you to fund yourself. Other parents might be more than willing to dish out the cash.

On the other hand, it's important to recognise that many students have parents on lower incomes who simply aren't in a position to support them financially. So, the government has created a system that tries to ensure these students can still access higher education.

However, after scrapping Maintenance Grants, students with bigger loans will now also graduate with more debt than others – again, something we feel isn't fair.

Basically, even if you think your parents can't afford to give you all the money you need, or they're not willing to, the current Student Finance system works on the assumption that they're going to anyway. Unless that changes, it's a conversation you're probably going to need to have (these tips will help).

How much money should parents give students?

| Household income | Maintenance Loan | Expected parental contribution |

|---|---|---|

| £25,000 or less | £9,978 | £0 |

| £30,000 | £9,265 | £713 |

| £35,000 | £8,552 | £1,426 |

| £40,000 | £7,839 | £2,139 |

| £45,000 | £7,125 | £2,853 |

| £50,000 | £6,412 | £3,566 |

| £55,000 | £5,699 | £4,279 |

| £60,000 | £4,986 | £4,992 |

| £62,343 or more | £4,651 | £5,327 |

Note: This table only applies to non-final-year students from England who attend university in 2023/24, who are living away from home but outside of London. If this isn't you, check out the calculator below.

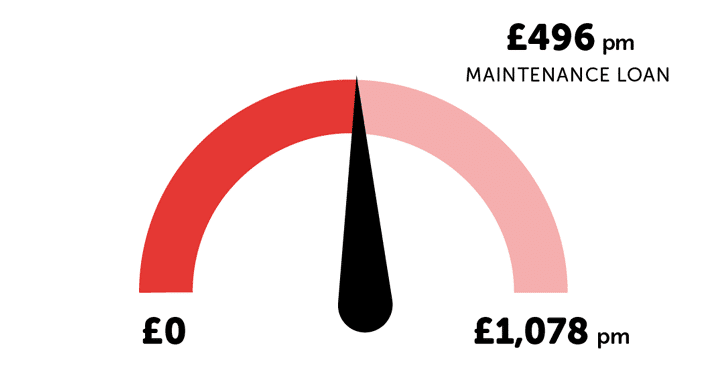

In reality, the amount of money your parents give you depends on lots of factors, like your individual financial circumstances and their generosity. But, the government works out how much you'll get for your Maintenance Loan based on your household income – assuming your parents will cover the shortfall.

All values in the above table add up to £9,978 as this is the maximum Maintenance Loan offered to students living away from home and outside of London. This amount is offered to students from low-income households. Since these students receive £9,978 a year, the assumption is that parents with higher incomes can make up the rest to ensure all students get around the same amount.

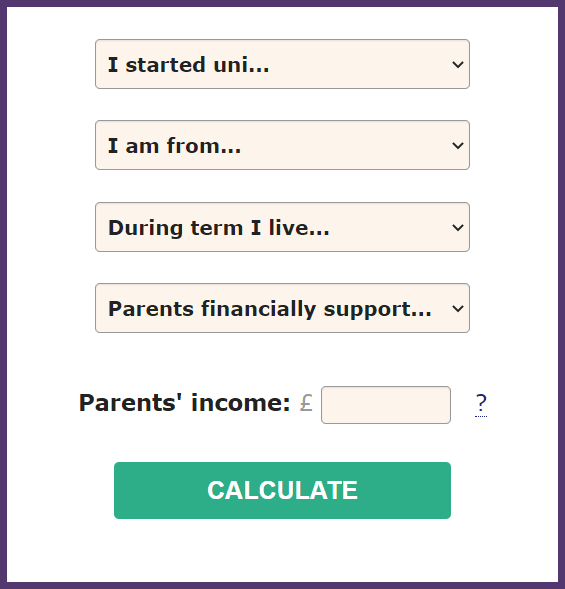

And, for students who started uni between 2020–2022, we've made a calculator showing what your parents are 'expected' to contribute each year.

Disclaimer: Please note that these are suggested parental contributions that should be used as a guide only.

The figures in the table and calculator are based on the fact that the more your parents earn, the smaller your Maintenance Loan will be (and the larger the shortfall your parents will have to cover). The calculations are made by the government based on the assumption that parents who earn below £25,000 won't be contributing.

How to ask your parents for money

Credit: TierneyMJ – Shutterstock

These tips will help you ask your parents for money in a way that's as comfortable, clear and effective as possible:

-

Be clear that you are taking university seriously

Your parents might have some reservations about whether giving you money for university is a good investment or not. They'll want to know that you're going to uni to study hard, get good grades and get a job after graduation.

Show them that you're not just going to uni for the nights out. Talk to them about particular modules you're looking forward to, any pre-reading you're doing or plans for the future.

They'll see that you're taking your degree seriously, you're committed to making the most of your time there and that, ultimately, it'll be a worthwhile investment.

-

Explain that the Maintenance Loan isn't big enough

If you're receiving less than the maximum amount of Maintenance Loan, it's important for your parents to know this so that they're aware of the government's expectation for them to contribute money.

This way, they'll know that you're not just asking for money for the sake of it. Instead, you're asking because, otherwise, your Maintenance Loan wouldn't stretch far enough.

By giving you money, your parents would be ensuring that you're getting the same funding as other students.

-

Prepare a detailed budget

If you just ask your parents for a large sum of money, without actually explaining what it's going to be used for, they might be a teeny bit hesitant.

Instead, show them you've thought carefully about your outgoings each week/month, and have it all written down clearly for them to see.

Use the table above as a starting point and see our guide to budgeting for advice on breaking it all down to individual expenses.

If you can give your parents an exact figure with a clear idea of where that money is going, they'll be more likely to give you some help than if you just ask for 'some money'.

-

Back up your request for money with research

A budget is one thing, but if you can go one step further and back it up with some solid research on the best student deals, they'll likely be even more impressed.

Luckily for you, Save the Student is packed full of useful guides and inside tips on how to save money at university. Check out our guides on the best value broadband packages and top ways to save money on food.

This shows you haven't just calculated how much things are going to cost at uni, but you've also looked at how you're going to keep those costs down. This will show that you will make the money they give you stretch as far as possible.

-

Be prepared to compromise on money

Your parents will likely appreciate it if you show that you don't simply expect everything to be handed to you, and that you're prepared to put in some work too.

Try and scout out some part-time jobs you could do alongside your studies, or start setting up a crafty side hustle to earn some extra cash.

A part-time job alone probably won't provide you with enough money to make up for the Maintenance Loan shortfall. But it will definitely help, giving you some financial independence while you study.

What to do if your parents don't give you money

At the end of the day, there are many families out there who won't be in a position to provide extra cash to top up the Maintenance Loan. And, similarly, there will be parents who don't want to for whatever reason.

This can be a tough situation to be in. It's a major flaw in the UK's Student Finance system, and one that Save the Student actively seeks to change.

Alternative ways to fund your studies

If you're struggling for cash at university, here's a quick list of other ways you can get more funding:

- Bursaries for students are widely available and don't need to be paid back (unlike Student Loans). Do some thorough research to see if there are any suitable for you.

- Get a part-time job – loads of students work part-time at uni, and they can be a crucial way of boosting your income.

- Working on a freelance basis lets you work flexible hours.

- Try setting up a website and monetising it. This can take serious hard work and dedication, but it can be a great way of making money out of your interests.

- Find out about university hardship funds – these are available for students who are struggling financially. Student services at your uni should have more information on this.

- Take a gap year to work full-time and save up some more money. You might be keen to get to uni, but you can easily defer your place for a year if you need more time to save.

As a student, you might find that you come across adverts for private loan companies, but we recommend avoiding these and first considering your lower-risk options, like the ones above. You can find out more about this in our guide to Future Finance and the alternatives.

Don't get caught out by any Student Finance myths...