How much does university cost?

The cost of university in the UK is something that worries students and parents alike. But, how much does uni actually cost, and do you have to pay for it upfront? Allow us to explain.

Credit: Lana Kray (background), Krakenimages.com (foreground) – Shutterstock

People say that your time as a student will be the best three years of your life. And we agree – it definitely can be.

But, it can also be a very expensive time. With tuition fees and living costs, your outgoings can really add up.

To help you separate the fact from the fiction, we've broken down the numbers to work out the cost of going to university in the UK. And, we'll explain how this is different from what you'll actually end up paying.

What's in this guide?

How much does university cost in the UK?

Giving an exact figure for how much it costs to go to university is difficult. There are so many variables that affect the final total. But, using official data and the findings from our very own National Student Money Survey (NSMS), we can give a rough cost of about £68,349.

How did we reach that figure? From the 2025/26 academic year, the cost of tuition for the majority of students in the UK is around £9,535 a year (more on this shortly). And, most courses tend to last for three years. So let's say that tuition fees alone will cost most students about £28,605 over the course of their degree.

Living costs are a bit harder to work out than tuition fees. They're subject to a lot more variation. For this estimate, we'll use the average annual cost of living from our NSMS: £13,248 (or £39,744 over three years). But, as we'll explain later, this figure could be higher or lower depending on a few factors.

If we take the two figures and apply them to a three-year degree, we can say it costs about £68,349 to go to university in the UK. This breaks down to about £22,783 a year.

Although this sounds like a scary number, you're unlikely to pay that much. And, you won't need to pay that much when you're actually a student. Discover how the amount you pay is very different from what uni actually costs.

Keep in mind that these numbers are for UK students only. Tuition fees for international students vastly differ. Fees for the majority of subjects sit somewhere between £10,000 and £20,000 per year. However, the cost can be much more depending on what degree and uni you choose.

How much are tuition fees in 2025/26?

| Students from | Studying in England | Studying in Scotland | Studying in Wales | Studying in N Ireland |

|---|---|---|---|---|

| England | £9,535 | £9,535 | £9,535 | £9,535 |

| Scotland | £9,535 | Free | £9,535 | £9,535 |

| Wales | £9,535 | £9,535 | £9,535 | £9,535 |

| Northern Ireland | £9,535 | £9,535 | £9,535 | £4,855 |

| Republic of Ireland | £9,535 | £9,535* | £9,535 | £4,855 |

* Irish nationals need to pay RUK tuition fees in Scotland. However, if they meet the residency criteria, they may be eligible for full funding from SAAS.

As we touched on earlier, there is no one set tuition fee in the UK. Instead, the amount you'll be charged each year depends on where you're from and where in the UK you're studying.

For instance, if you wanted to know what the University of Edinburgh's tuition fees were, the question wouldn't be as simple as "What are Edinburgh's fees?". Instead, as Edinburgh is in Scotland, you'd need to check how tuition fees in Scotland vary based on which part of the UK (or beyond) you're from.

You'll notice in the above table that while the majority of annual tuition fees are £9,535, some are much lower. And, as mentioned earlier, international students (including those from the EU) often have higher tuition fees.

For Scottish students, your tuition will be free if you study in Scotland. EU students in Scotland who started in 2020/21 or earlier will have free tuition for their whole degree. But, EU students who started in the 2021/22 academic year or later will have to pay fees.

Similarly, tuition fees for Northern Irish students studying in Northern Ireland are roughly half (£4,855) what they are in the rest of the UK. EU students who started in 2020/21 or earlier still have access to these cut-price fees for the full duration of their courses. However, EU students who started in 2021/22 or later are not eligible for home-fee charges.

Living costs at university

The media seems intent on focusing on the price of tuition. But, living costs are arguably the real financial concern for most students in the UK. And, as we explained earlier, it's almost impossible to give an accurate figure for how much it'll cost you.

That said, we're able to make a reasonable estimate based on where you'll be studying.

Every year, thousands of students take part in our National Student Money Survey. As part of the survey, we ask students to tell us how much they spend each month. From this, we're able to give you a breakdown of how much you're likely to spend each month at uni.

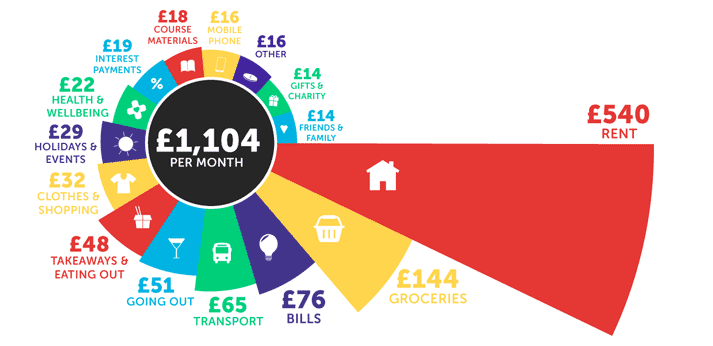

The graph below gives an overview of the average UK student's spending habits each month. As you can see, rent is by far the biggest cost (£540), accounting for nearly half of the £1,104 monthly spend. Food (including takeaways, eating out and groceries) is the second biggest expense, totalling around £192 a month all in.

There are also some 'hidden' costs that fall under the categories below. Whether it's paying to rent your graduation gown or stumping up the fee to join a society, things can add up.

And similarly, different students with different needs may incur different expenses. Your course may require you to buy special equipment.

Or, if you have a disability, you may find there are extra costs linked with going to university. However, the Disabled Students' Allowance should help you cover these.

Of course, these figures may be different to the actual costs of living at your uni.

The price of rent, transport and going out vary massively depending on where in the UK you are. This is why we're hesitant to put an exact number on the cost of going to university.

Instead, find out how much the average student spends at each university in the UK. Just check out our guide to student living costs for the full list.

And if you're thinking "uni won't cost much less if I study elsewhere", think again.

As an example, in our survey, City, University of London students spent £837 a month on living costs (excluding rent). That's £273 more than the average before rent is even factored in.

If we then look at the University of York, things are pretty different. Here, surveyed students are spending just £318 a month (again, excluding rent). That's £246 less than the national average and a massive £519 a month less than what students are spending at City.

Both City and the University of York are prestigious universities. Pretty much the only reason the cost of living is so different is that they're in different parts of the UK. It really is worth considering these figures when choosing a university.

How much do you actually pay for university?

The numbers we've outlined are big, there's no denying that. But, when it comes to Student Finance, remember that the cost of university is not the same as what you pay.

Pretty much all first-time students in the UK are entitled to a Tuition Fee Loan. This will cover the cost of tuition in full. Keep in mind that this is only the case for home-fee students. International students don't have access to Student Finance in the UK.

As for your living costs, most UK students are eligible for a Maintenance Loan to help with those. It's worth noting that the loan might not be enough to cover your living costs completely. You can find out about more funding options in our big guide to Student Finance.

Student Loans aren't like ordinary loans. You'll only repay 9% of your earnings over a threshold. If your salary drops below that figure, you automatically stop repaying.

What's more, any outstanding student debt in your name is cancelled around 25, 30 or 40 years after you graduate, depending on what Student Loan plan you're on. This is the case regardless of how much or how little you've repaid.

Our Student Loan repayment calculator takes all this into account when calculating how much you're likely to end up repaying.

We explain this in a lot more detail in our guide to repaying your Student Loan, but the take-home message is that you shouldn't be put off by the price tag of going to uni. There's a good chance you won't pay anything near it.

Make sure you receive all of the student bursaries you're entitled to.