How to invest in the stock market using eToro

Fancy yourself as the next Warren Buffett? Our eToro review shows you how to buy and sell stocks on a social trading platform. Over 18s only. I’ve always had an interest in the financial markets. But I had no real idea how to break through the castle walls and actually trade on the stock market.

I’ve always had an interest in the financial markets. But I had no real idea how to break through the castle walls and actually trade on the stock market.

The gatekeepers of Wall St. and The City have been committed to keeping the masses at bay so they can charge hefty trading fees.

That all changed when I was a final-year student and came across a trading platform called eToro. It blew open the doors and allowed me to start trading stocks online.

eToro is cheaper than traditional stockbrokers, with 0% commission on real stocks.

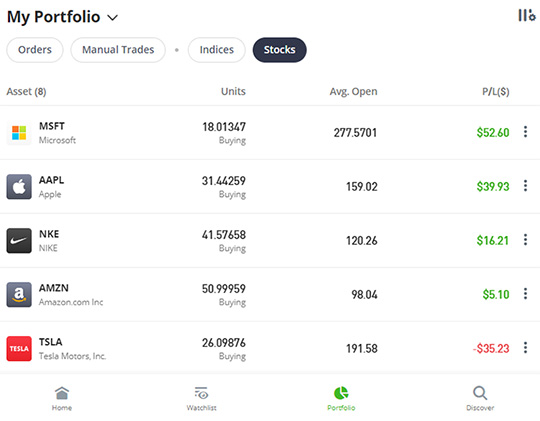

Example eToro Portfolio

It’s important for you to know that I have been on quite a learning curve with eToro.

Whilst I’ve enjoyed the whole experience of buying and selling stocks, I’ve also made some rookie trader mistakes where I've lost money.

For total beginners, the eToro trading platform and the concept of investing can be a little daunting at first.

With the benefit of hindsight and my own trading experience on eToro, I've written this no-nonsense eToro review to help others get the best results.

eToro review

What is eToro?

eToro describe themselves as an accessible and social trading platform for investing. I’d describe them as Facebook for trading stocks.

eToro describe themselves as an accessible and social trading platform for investing. I’d describe them as Facebook for trading stocks.

They launched in 2006, and are now the world’s largest investment network. eToro is fully regulated and a safe trading platform with a community of 25 million users from over 140 countries.

eToro and the wider phenomenon of social investing have been widely reviewed by mainstream media. Including a BBC documentary called Traders: Millions by the Minute.

All users have access to a Virtual account with $100,000 that perfectly replicates real trading. This is great for new traders to trial the platform without risking their own money.

The most unique feature of eToro is probably 'CopyTrader'.

It allows you to sort through other traders and see their trading history. This includes how much they have made or lost over any given period. If you find a trader you like the look of, you can allocate some funds to automatically invest and copy their trades.

Another big plus is the 'Popular investors' program.

This rewards users based on how many copiers they have in the form of monthly commission. The program also incentivises responsible trading. We’ll discuss this in more depth towards the end of the guide.

With the virtual account, free training, social feeds and copying features, you’ll learn a great deal relatively quickly on eToro. Most of the need-to-knows you’ll pick up by reading this eToro review and playing with a virtual portfolio.

Creating an eToro account

-

Sign up for eToro.com

Complete the short form and choose a username. You'll then be asked to verify your email address.

You’ve now opened up the world of trading stocks online and in real time. To actually make trades you'll be prompted to complete your eToro profile.

Disclaimer: eToro is a multi-asset platform which offers CFD and non-CFD products.

51% of retail investor accounts lose money when trading 'CFDs' with this provider. You should consider whether you can afford to take the high risk of losing your money.

CFDs are a type of leveraged product that we do not recommend in this guide, we are concentrating on buying and holding actual stocks you own.

-

Complete your profile

This is an important step to protect your account, tailor the eToro platform to your experience and ensure you invest within your means. All information is strictly confidential and necessary for eToro to meet its strict obligations as a regulated financial institution.

The first part covers basic personal information to help verify your identity, which is a regulatory requirement.

Next, there are a couple of trading experience questions. It's important to be honest.

Under the "Planned investments" section, this guide is only interested in "Stocks" as the other instruments are higher risk.

This guide is not interested in 'leveraged trading' or 'CFDs' as they are high-risk.

-

Deposit

Click 'Continue to deposit' (or 'Deposit Funds' at the bottom left).

The minimum you can deposit is $100. If you can afford it, this will allow you to get the most from this guide.

eToro will only accept deposits from a payment method under your own name.

Note: eToro’s main currency is $USD but you can deposit in £GBP and other major currencies. It will be converted to $USD in your account.

-

Familiarising yourself with the eToro platform

I’ll just give you a very quick overview of the main sections of eToro for now. These are found on the lefthand menu. We’ll delve more into each one later as I explain how to browse and trade in detail.

Home

This is a bit like the News Feed on Facebook. You can see everything the traders you follow have been doing and saying recently.

Watchlist

Organise the people and markets you're interested in copying or investing in. You can create multiple lists, such as 'promising stocks' or 'people to copy'.

Portfolio

The nerve centre of your investment journey. View all your open trades with live tickers and values, and monitor your performance.

Discover

The place to research and trade in the markets available to you: stocks (eg. Apple), currencies (eg. GBP/USD), crypto (eg. Bitcoin), commodities (eg. gold) and indices (eg. UK100), ETFs and NFTs. This guide is only interested in stocks.

CopyTrader

Also on the Discover page is eToro's CopyTrader (scroll down or click here). Search through other traders who you may want to copy or follow. There are loads of useful filters to help narrow down to the results you want, such as markets and performance.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Now that you’re a part of the eToro community and have explored the site a little, I’m going to review the 3 main ways to invest on eToro with you.

Copying other good traders (CopyTrader)

This is the simplest way to invest on eToro. When you copy someone, every trade they execute is simultaneously opened in your account and sold when they sell it on eToro.

It’s all proportional to what % of your total account’s funds you choose to allocate to them (more on this later). Ultimately you will achieve the same rate of return as they do.

Finding reliable traders to copy on eToro isn’t always easy. You need to know what to look for and what to stay clear of (more on this later on).

Allow me to help you master the art of copy trading…

Avoid the most common mistakes!

The number one mistake beginners make right away is being a sheep.

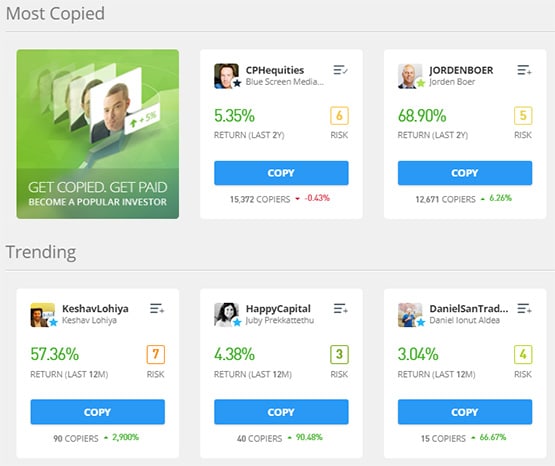

When you venture into the 'CopyTrader' section looking for a trader to copy, it’s intuitive to focus on ‘most copied’ and blindly copy the top results.

You’d think that the most copied people have lots of copiers for a reason, right? The wisdom of the crowd perhaps.

But the reality is that many people on eToro are complete beginners and don’t fully know what they are doing.

If a few people copy a trader for the wrong reasons, that trader can quickly ‘go viral’ with exponentially more copiers following suit without thinking for themselves.

Let me give you an example.

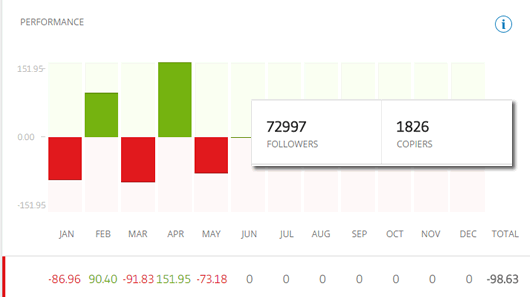

A popular yet under-performing eToro trader. Past performance is not an indication of future results.

Even though this eToro trader has extremely poor performance (he would have lost 98% of your money over the last five months if you’d copied him), he still has close to 2,000 people copying him! Bizarrely this happens quite a lot on eToro, so I’ll be explaining the process I follow when copy trading as part of this review.

Having warned against consistently underperforming traders, the other big pitfall beginners fall into is over-trading.

It’s incredibly tempting to keep checking how much you’ve made or lost every few hours, but emotions will cloud your better judgement and lead to tinkering.

No trader on eToro will make a profit every single week or month. So I highly recommend you take a medium/long-term approach. This requires patience and discipline, but you’re more likely to see better gains over time.

Finding the best traders to copy

First off click on 'Discover' on the eToro sidebar. Scroll down to 'CopyTrader' and click 'View All'.

You'll see a page of trending and popular investors.

Past performance is not an indication of future results.

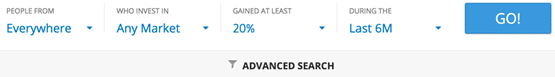

However, it's best to scratch under the surface and do some research using the search filter at the top. Everything in blue you can change to meet the criteria you're seeking in potential traders to copy.

Click 'GO!' for a list of matching traders, ordered by the number of copiers they have. To further drill down use the filters at the top.

5 attributes every trader you copy should have:

- Demonstrate their market knowledge and experience on their profile feed

- Have a low weekly drawdown. This is how much they’ve been ‘down’ over a given period. Anything more than 10% (in the 'Weekly DD' column) should be a red flag

- Don’t have ridiculous returns. This may seem counter-intuitive, but if you see someone with 100%+ returns in a very short period of time, realise that this is unsustainable luck and can only be achieved by being reckless

- Don’t have a 100% win rate. It’s perfectly normal to sell some trades in the red. This is a sign of discipline and experience. Beginners chase their losses, proper traders know when to cut loose

- Are communicative. You want to copy someone who can help you learn and is willing to share their trading methodology. If they don’t reply to your messages they either don’t care (likely to trade carelessly too) or they don’t know how to answer because they don’t have a clue what they’re doing!

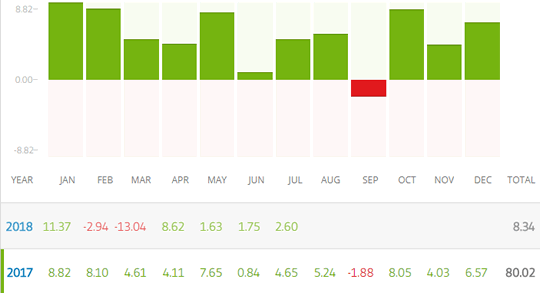

Viewing a trader’s past performance

I’ll now review how to assess an individual trader before outlining the exact steps to copy a trader. Then you can understand what to look for and how the process works within eToro.

By clicking on the 'Stats' tab in a trader’s profile you can access some very useful information to help determine whether they are worth copying or not.

A trader's performance. Past performance is not an indication of future results.

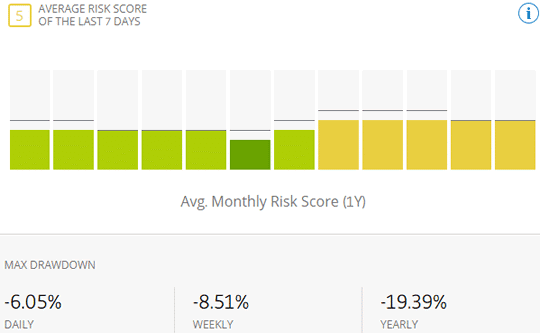

There are two other key things to look at further down the page. The risk score indicates how risky a trader is and the max drawdown shows the maximum a trader has 'been down' over periods of time.

The bar chart allows you to compare current risk to past months to see how their strategy has evolved.

Trader’s risk/reward stats

Anything green shows a safe, low-risk low-return attitude. The spectrum then moves through yellow, orange, red and black where the risk is highest.

I personally steer clear of anyone with more than an average risk score of five, but it can be good to have a mix of traders with different styles.

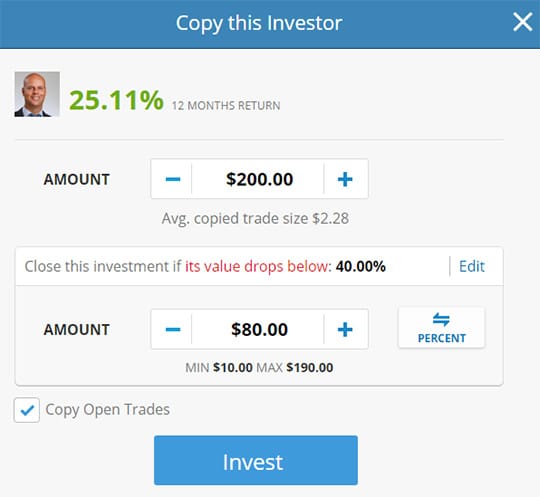

How to copy a trader on eToro

Copying itself is simple. Once you’ve found a trader who you feel is reliable, simply open their profile and click on the green 'Copy' button.

You’ll then be prompted to enter an amount with which to copy that trader, and you’ll see some useful information appears.

Copying a trader

Let's say you copy a trader with $200, then 'Avg. copied trade size' leads us to how the copying actually works in real dollar terms.

In the example above, each trade you copy would be (on average) $2.28.

Proportionally this is just 1.14% of the total ($2.28 out of the $200) of your total investment in them. In this case, it's a good sign as it shows a cautious and safe investment style.

You can also set a 'stop loss' by clicking 'Edit'. This is a means of protecting against heavy losses. Note eToro disclaimer: "'Stop loss' and 'Take profit' are not guaranteed and trading with leverage involves high risk."

In the example above, if the trader's investments you are copying drop by 40%, your account automatically stops copying them and sells assets. You can set this level to whatever you want, depending on how much risk you're prepared to take. Personally, I keep the number closer to 25%.

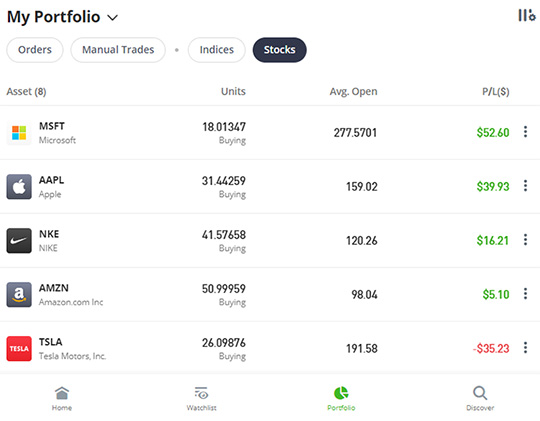

Monitoring your performance

Clicking on ‘Portfolio’ takes you to your open trades.

eToro Portfolio showing open trades

This is the actual trading area and your nerve centre. Here you can monitor all of your current open positions and close them, and also access a record of your eToro trading history.

All of your copied traders and any of your own investments will be listed in your eToro Portfolio.

You can see your overall return on the investment in a trader. Click on the person to see what positions they (and you) currently have open, and how these are performing individually. Usefully you’re able to close individual copied trades without uncopying a trader altogether.

Watchlist users

You can also just 'follow' traders (without copying or investing in them). Their updates show up on your Home page and Watchlist.

It’s a good way to gauge whether you think they’re worth copying and tune into useful information.

How to buy and sell on eToro yourself

Once you’ve familiarised yourself with the eToro platform and (hopefully) had some success copying other people, you can start thinking about placing your own trades.

You need to think a bit harder and do your research. Any shortcomings are squarely on you now!

Focusing your energies on the stock markets gets you used to the eToro platform and the whole process of buying and selling positions. You will have some familiarity as a consumer here too.

Which stocks should you buy?

Well, that’s up to you. I cannot offer specific investment advice. All I will say is that it pays dividends to do your homework, read the news frequently and listen to earning announcements.

Only invest in stocks or companies that you believe are in a strong and healthy position to resist market shocks, and ultimately have room to grow.

If you’re really serious, read up on the price/earnings ratio to identify undervalued/overpriced stock.

What I can do is review and take you through the steps of placing a trade on eToro.

How to buy stocks and shares

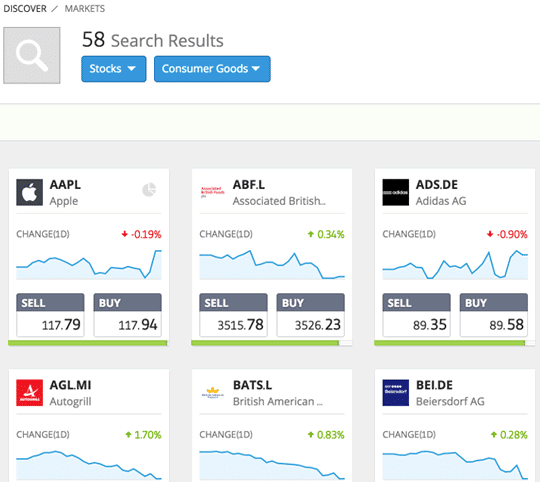

Click on ‘Discover’, then ‘Stocks’. Choose an industry, for example ‘Tech’.

You will then be presented with a list of all tech stocks tradable on eToro, along with their respective prices and change over the past day.

eToro markets

Let’s pretend we want to buy some Apple stock, say $10 worth.

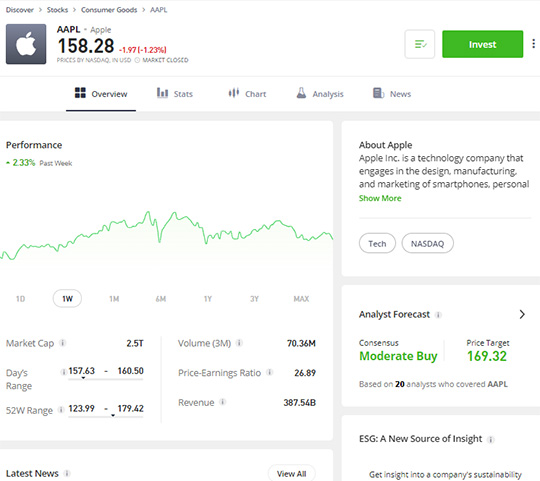

Click on ‘AAPL’ (this is the ticker used for Apple on the stock exchange) and you will see an overview of the company's performance, news and useful insights.

If you want to invest in Apple, click on ‘Invest’ in the top right corner.

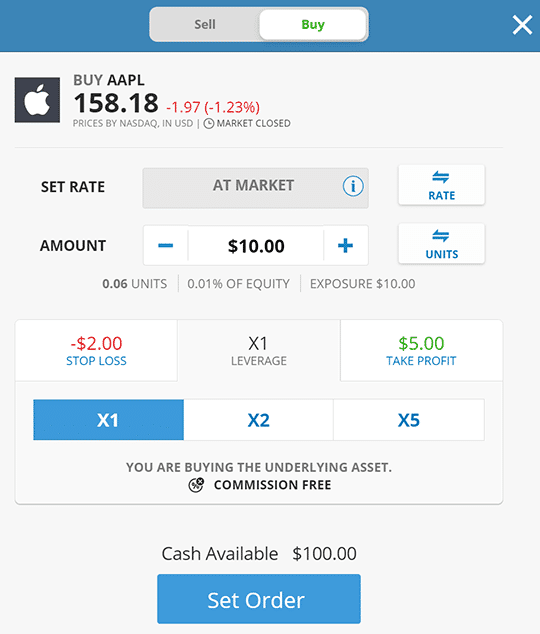

The minimum amount to trade is $10. Below you can set the amounts at which you automatically want to close the trade, for both loss and profit.

Finally, take note of the 'Leverage' figure. The number refers to how much you can multiply your gains (and losses) by. A higher number equals higher risk.

X1 is essentially buying the real stock. If you traded at X2, any price movement is magnified by 2 (doubles).

For beginners and for the purposes of this eToro review, I strongly suggest setting it to X1.

When you're ready click 'Set Order'.

Placing a trade

That’s it! You’re now invested $10 in Apple.

Monitoring your eToro performance

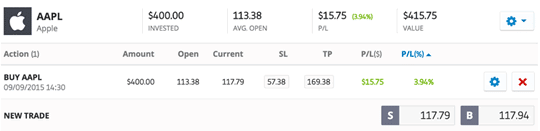

Click ‘Portfolio’ to see your open positions.

If you click on the Apple stock, you can see more info.

In my case below, I bought $400 worth and it shows I’m currently up 3.94% on this trade.

This translates to +$15.75 and is the amount I would profit if I decided to sell these stocks (close my position) right now by clicking on the ‘Close’ button.

Stock performance

As I warned earlier, do not fall into the trap of checking the real-time performance of your trades every hour! This just leads to over-trading which again, is very costly.

I’ve had to develop the discipline to let the markets take their course and hope that over the longer term, the value of my portfolio will rise (which it has).

It’s a strategy that has served me well on eToro and means I don’t make rash spontaneous decisions just because a company released some ‘bad’ news and the market overreacted in the short term.

Becoming a ‘Popular Investor’

This program incentivises eToro users to trade responsibly and be an active member of the community.

As soon as you start performing well on eToro you may notice other people start copying you. This is a really rewarding and exciting moment, allowing you to earn monthly commission as your copiers increase.

It can take some time to build up your copier numbers and it pays to be active in the community. Posting regular updates, getting involved in discussions and answering other people’s questions all help get your name out there to attract interest.

eToro fees

Just like any company, eToro exists to make money from providing a service.

Primarily they do this by charging users a small spread fee on positions.

The 'spread' is the small difference between the buy and sell price that all brokers offer. This is how eToro makes money (same as a Bureau de Change) and similar in magnitude to the markup for stocks. You will be charged this when you sell or close a position.

There is 0% commission on stocks though, so the costs of trading on eToro are typically far less than traditional stockbrokers and fund managers.

Trading stocks typically have the lowest fees on eToro, which is one reason why we are sticking to this market in this guide.

One way to minimise the spread fees is not to over-trade. If you become a Popular Investor you can get a partial or even total rebate on these eToro fees.

It really comes down to individual trading strategies and preferences. But to give you an idea, I tend to hold on to stocks for a minimum of 6 months.

When copying another trader you’ll be charged the same fees as they are on trades (which may not always be stocks). It’s worth checking your portfolio to see what positions they have opened.

The other fee you will encounter on eToro is the withdrawal fee (flat $5) if you want to transfer funds out of your account.

Recap: Avoiding common mistakes

I’ve gone through a lot over the course of this eToro review and covered up plenty of pitfalls along the way (high five for making it this far).

Before we finish up I just wanted to summarise for you the main mistakes in one list:

- Over-trading – this is a poor strategy for beginners and quickly racks up the fees

- Allocating more than 25% of your total equity (funds) to one single trader (copy)

- Blindly copying the most copied traders

- Copying people with absurd rates of return (what goes up often comes down)

- Copying people without properly researching their profile and activity

- Not doing your homework on stocks before investing

- Allocating more than 10% of your total equity to one of your own trades

- Using leveraged trading

- Don’t chase losses.

Useful investing resources

You may find the following resources useful on your journey to becoming a successful eToro trader:

- What is the stock market?

- eToro Trading Academy

- What is Bitcoin?

- Market information: The Motley Fool, The Economist, The Financial Times

If you have used this eToro guide and found the review helpful, please share it with your friends.

Thank you, good luck and happy trading!

Disclaimer: eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

CFDs are a type of leveraged product that we do not recommend in this guide, we are concentrating on buying and holding actual stocks you own.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as a basis for an investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoassets are highly volatile. Don't invest in crypto unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.