Investing for beginners

Figuring out how to invest money, and where to invest it, can be complicated. With these tips, you'll be ready to start investing soon!

Credit: Vladimir Sukhachev, Open Studio – Shutterstock

Investing involves setting cash aside to grow in 'real terms'. That is, your money accumulates faster than inflation (the rising costs of goods and services).

While all investments have some level of risk, sensible investment isn't about gambling. There's a difference between financial planning and get-rich-quick schemes. The greater the potential short-term rewards seem to be, the greater the risk of losing your investment.

If all of this sounds a bit intimidating, don't worry! This guide on how to start investing will take you through all the steps, including some great tips from investment experts Rodney Hobson and Andrew Hallam.

What is investing?

When investing, you're buying assets with the expectation that the value will increase over time.

'Assets' include stocks, bonds, property or even valuable collectables or art. It also applies to the likes of Bitcoin and NFTs. The aim is usually to buy low and sell at a high price to earn a profit.

It's important to remember that no investment is without risk. Some are less risky than others, but there's always a chance that the value of your assets can go down.

The most common way to invest money is through the stock market. By buying stocks or shares, you essentially buy a slice of a company (like Apple, Amazon, Tesla or Tesco). If the company's value goes up, the price of your share will increase in value too.

Andrew Hallam has previously said:

If you're going to invest, buy assets that appreciate over time (investments which rise in value). Cars lose their value each year, so it's best to spend small amounts on depreciating assets (like cars) and more on assets that increase in value.

How to start investing

Here's how to start investing money today:

-

Set your investment goals

Before you put money into the stock market, it's important to set some goals.

Do you want to build capital (by stocks that increase in value) or generate income (through dividends, for example)? Are you planning to invest for your retirement or do you want the money back sooner?

Keep in mind that investing is usually a long-term strategy. You'll often be looking at five to 10 years (if not longer).

If you know you'll need the money sooner than that (to buy your first home, for example), it may not be the best idea to risk any large sums of money. This is because the stock market is volatile. The more time you keep your investments in the stock market, the more time it has to ride out any dips.

-

Figure out how much you want to invest

Credit: Ubermensch Matt – Shutterstock

Once you've set your investment goals, it's time to look at how much you can invest. While you might find it tempting to throw your entire Maintenance Loan into stocks to earn a quick buck, you should never invest more than you can afford to lose.

Buying stocks and shares is the most common way to invest money, but there are always risks involved. The market can go up and down, so it's best to leave your money in the stock market for as long as possible (we'll explain why later).

Therefore, investing shouldn't be seen as a way to make money quickly. If you need money soon, like for a holiday, it's best not to risk putting it in the stock market. You never know what could happen. If the market crashes, you won't have enough time to let it recover.

-

Pick your investments

Choosing what stocks, shares or funds to buy can be a little overwhelming, especially when you're new to investing. But this is where the research comes in. Always make sure you know what you invest in. Just because someone on Twitter said a certain stock is a good option, that doesn't mean it's true!

There are different types of investments you can make in the stock market. You can buy shares of individual companies, which is a more hands-on approach, or you can buy index funds (such as the S&P 500 or FTSE 100).

Index funds track the value of a group of stocks or bonds. For example, the S&P 500 tracks the top 500 companies in the US and the FTSE 100 tracks the top 100 companies in the UK.

Rather than having to buy a single share of every company (which would be very expensive and time-consuming), you can invest in an index fund instead. Because your money is spread across different companies, it's often seen as an easy and lower-risk way of investing.

Diversifying your portfolio is the best way to minimise risk. You can do this by investing in index funds, but also by spreading your investments over different markets, geographical areas and industries. Even if one company or market drops in value, you'll have other companies and markets to even out the losses.

Andrew Hallam said:

If you think that Warren Buffett and a slew of Economic Nobel Prize winners offer valuable advice (these guys aren't selling products) then you'll be keen to build a diversified, low-cost portfolio of tracker funds.

In the U.S., these are called index funds. They're extremely low-cost unit trusts that beat more than 90% of professional investors over 20-year study periods, after all fees, attrition, and taxes.

-

Know what you're investing in

When you invest money, it will be temporarily held by a company or organisation to fund their activities. Check how you feel about some of these activities and whether you want your money to be used to fund them.

Ethical investors will look to invest in companies that have high standards when it comes to the environment, society and how they are run. For example, they would usually avoid companies that are involved in fossil fuels, arms, gambling or tobacco.

Research any potential investments to ensure they meet your ethical standards.

The Environmental, Social and Governance (ESG) criteria can help. These assess an organisation's practices based on certain ethical and sustainability issues.

-

Open a Stocks & Shares ISA or brokerage account

Before you can buy your first investment, you need a brokerage account. This is an online platform where you can buy, sell and track the price of your stocks and shares.

When choosing your brokerage account, make sure they offer the type of investments you want to buy. If you want to buy index funds, for example, the brokerage account should allow you to do so. You should also check the fees and ease of use, especially if you're new to investing.

If you're based in the UK, you also have the option to open a Stocks and Shares ISA. Similar to the cash ISA, this account allows you to grow your money tax-free. You can add up to £20,000 into the account per year and any capital gains or dividend payments will be completely tax-free. This is a great option, especially if you plan to invest for a long time.

Obviously, you can also open a regular brokerage account. But remember that you will have to pay tax on the profit if you go over the annual threshold.

Even if you won't reach the threshold anytime soon, opening a Stocks and Shares ISA can save you a lot of money in the long run – particularly if you leave your investments to grow over a long period. Remember, when you invest your capital is at risk and you could get back less than you put in.

To open a brokerage account, you'll most likely need:

- Proof of identification

- Your National Insurance Number

- Personal details (name, email, address, bank account, etc.).

For Stocks & Shares ISAs take a look at Wealthify or Vanguard.

For general investing, see our eToro review.

-

Buy your investments

Credit: Pavel Ignatov – Shutterstock

Before you buy any investments, do your research. Know what you're buying and whether it lines up with your investment goals.

When you're ready to buy your investments, log into your online brokerage account and find the stock or funds you want to buy. While all brokerage platforms work slightly differently, buying shares is pretty straightforward. Find the company or index fund you want to invest in and add the number of shares you want to buy.

When buying and selling shares, you may have to choose between a market or limit order. Here are the differences:

- Market order – You buy or sell a stock as soon as possible for the best price available

- Limit order – You buy or sell a stock at a specific or better price.

When setting a limit order, you can get a better price for the shares, but it may take a bit longer to buy.

Some brokerage accounts also allow you to set up automatic investments. This means it will automatically buy a number of shares/funds every month.

-

Keep track of your investments

Always keep track of your investments and sell them when you think it's the right time. But if you have a long-term strategy, this may not be for many years.

You don't necessarily have to log into your brokerage account every day. However, it's good practice to check in at least every few months.

Don't stress when your investments are going down slightly. The market goes up and down constantly. Remember to look at the bigger picture. But you can always re-evaluate your strategy, if necessary.

The way you make money with investing is by selling a stock that has increased in value, or by receiving dividend payments. Unless you have your investments in a Stocks and Shares ISA, you will have to pay tax on your capital gains or dividend income if you reach over the threshold.

Is now a good time to invest?

Now you know how to invest your money, you may be wondering whether this is the right time to start. With the price of stocks constantly going up and down, you want to make sure you buy at the lowest price to maximise your profits, right?

A good investment is one where you understand exactly what your money is doing. You should never invest in something you don't understand. Just because someone on social media said a company will do well, there's no guarantee it actually will increase in value. Always do your own research and never invest more than you can afford to lose.

When you spread your investments (in an index fund, for example) and leave them for a few years, there isn't necessarily a bad time to invest, just a bad time to sell.

The longer you leave your money in these low-risk investments like index funds, the more time it has to grow out of any dips. It's all about time in the market, not timing the market.

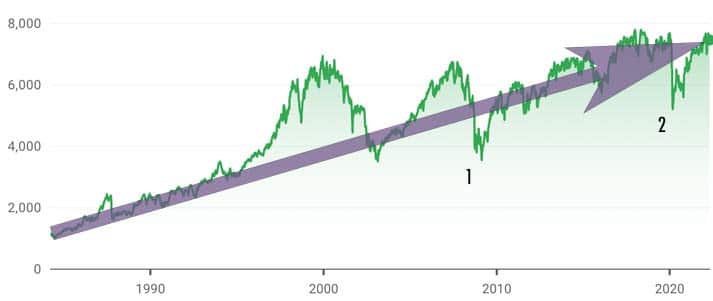

FTSE growth chart. Credit: Google

If you take a look at the graph above, you can see the value of the FTSE 100 index fund (a collection of the 100 biggest companies on the London Stock Exchange) since it was created in 1984.

Even though it's experienced some ups and downs over the years (the financial crisis of 2008, highlighted by number one, and the start of the COVID-19 pandemic, highlighted by number two), the market has continued to recover and grow even further.

This is why it's important to give your investments time to grow. Your investments are likely to go down in value at some point. However, the longer you're willing to leave them, the more chance you have of them outgrowing any dips.

Andrew Hallam said:

If you're 20 years old, you could realistically have money working for you until the day you die. Sure, you'll be selling some of it to cover living costs as you retire, but you don't want costs to anchor your money over a lifetime.

Other ways to invest your money

There are other places to invest your money other than the stock market, including:

-

Put cash in the bank

- Pros – Low risk

- Cons – Low returns (usually less than inflation).

Putting your money in the bank is seemingly a safe option.

However, cash on its own isn't a great investment. This is especially the case given the low rates of interest generally paid by banks and building societies.

If interest rates are lower than inflation, your money will lose value in real terms. In other words, you'll be able to buy less with the same amount of money.

If you don't want to take any risks with your money, putting your money in a savings account (or a tax-free cash ISA) is a great option.

Financial journalist Rodney Hobson said:

Whatever you do, just don't keep your cash under the mattress. Thanks to inflation, it's losing you the most money there. And if you get burgled you could lose the lot!

-

Buy and sell antiques, art, wines, collectables

- Pros – Fun way to invest if you're interested in the things you're buying

- Cons – You need to be an expert on what you're selling, and items aren't guaranteed to go up in value.

There are lots of things you could buy and sell for money.

You might already have some childhood toys worth a lot of money. Just remember that buying these types of items doesn't bring immediate income and the profits depend entirely on what someone's willing to pay for them.

You also need to be an expert in whatever you're collecting. Otherwise, someone who does know what they're doing can use this to their advantage.

A good starter strategy is to source desirable items where there are fewer buyers (such as Gumtree or a car boot sale) and sell them where the demand is highest (such as eBay). Check out our guide to selling on eBay for more tips.

-

Invest in property

- Pros – Long-term, stable investment

- Cons – Requires a lot of up-front costs and it's not as easy to sell if you need the money for something else.

The single best investment for most people, and the one that you should generally consider as soon as your income allows it, is to buy your own home.

Rodney Hobson said:

Historically the value of housing rises faster than inflation, and one day you will clear the mortgage. Rents rise year by year and you will always need somewhere to live.

Once you're on the property ladder, you can climb up to more expensive properties as your income improves. As an investor, you can go one step further with buy-to-let, owning property that produces income as well as increases in value.

The big disadvantages of investing money in property are that you need to commit large amounts of money to each investment, and it can be time-consuming keeping an eye on the property and the tenants. Make sure you set aside some money to cover hefty maintenance bills (which crop up whether you can afford them or not!).

If you haven't already, read our step-by-step guide to getting a mortgage. -

Buy bonds

- Pros – Less risky than stocks

- Cons – Lower returns.

Simply put, a bond is a loan taken out by a government or company. Those issued by the UK government are known as gilts because the certificates used to have gold leaf around the edges to reassure investors how safe they were. By buying bonds or gilts, you technically lend money to them.

But what's in it for you? Bonds and gilts have a guaranteed interest rate and (usually) a date on which they will be redeemed. That's when the borrower buys them back at full price, known as the nominal or par value.

The yield on the bonds (the amount of interest you get each year for every £100 invested) will reflect how safe or risky the investment is seen to be by investors. The safer the debt (the less likely the borrower is to renege on its debts), the lower the yield.

When interest rates are low, the price of bonds will rise, which reduces the annual amount you'll receive for your investments. But when interest rates are high, the market value of bonds goes down.

Rodney Hobson said:

Bonds issued by governments are known as sovereign debt and are generally regarded as safer than company debt because governments are less likely to go bust than companies. However, bear in mind that Argentina defaulted on its debts back in 2005, and Greece has been struggling to honour its obligations more recently.

Unlike fixed-term savings accounts, it's possible to sell your bonds at any time. But if you do so before the set date, you may receive less money than you originally paid for them.

Unsure what premium bonds are and whether they're worth it? Our dedicated guide covers the key things to know. -

Put money in cryptocurrencies

- Pros – Able to trade 24/7 and it's possible to have high returns

- Cons – High risk, very volatile, haven't proven themselves to be a solid long-term investment.

Cryptocurrencies like Bitcoin have been getting increasingly popular among young investors.

Especially on social media, it may seem like cryptocurrencies are a get-rich-quick scheme. And while you can make money with cryptocurrencies, the market is incredibly volatile and the risks involved are huge.

Bitcoin is the cryptocurrency you are most likely to have heard of, but there are hundreds! Obviously, some are even more unstable than Bitcoin, so it's important to know the risks before putting any money into Bitcoin or other cryptos.

If you haven't heard of Bitcoin before, check out our full guide that explains what Bitcoin is and how to buy it.

Need some extra cash to invest? We've listed some quick ways to make money.