Student Money Survey 2023 – Results

Now in its eleventh year, the National Student Money Survey 2023 lifts the lid on the immense strains that money puts on many students' health, studies and day-to-day lives.

Credit: Linda Bestwick – Shutterstock

For over a decade, we have been running the National Student Money Survey to shed light on the realities of managing money as a student.

Each year, we raise concerns about the state of Student Finance in the UK, and each year, we are disappointed by how little the government is doing to help students afford their daily essentials.

Comparing this year's survey to last year, we have seen a 17% increase in the average student's living costs. The proportion of surveyed students that have used food banks has nearly doubled – up from 10% to 18%. And nearly two-thirds said they skip meals to save money.

In much of the UK, the Student Finance packages for 2023/24 are increasing more significantly than they have in previous years.

In Northern Ireland, maximum Maintenance Loans are increasing by 40%. In Wales, maintenance support is increasing by 9.4%. And, in Scotland, financial support is rising by £900, which is an increase of between 11.1% and 17.6% depending on the student's household income.

Yet, despite pleas from Save the Student and others to improve the situation, Maintenance Loans in England are due to rise by just 2.8% in 2023/24.

Students are going hungry. What will it take for the English government to follow the example of the rest of the UK and urgently increase the funding on offer?

What's in our report?

- Key findings

- Students are struggling to get by financially

- Food poverty at UK universities

- How much do students spend?

- Which areas have the highest student living costs?

- Do Student Loans stretch far enough?

- How do students get money?

- How would students get money in a cash crisis?

- Sex work at universities

- How many students consider dropping out of university?

- Do students understand their Student Loan agreements?

- Is university good value for money?

- What students expect from graduate life

Key findings from the Student Money Survey 2023

Here are some of the key findings from this survey:

- Since our 2022 survey, the average student's monthly living costs have increased by 17%, up from £924 to £1,078. London continues to be the most expensive region in the UK, with average student living costs of £1,211 per month.

- 18% of students in this survey have used a food bank in the last academic year, up from 10% who said the same in 2022.

- 22% of surveyed students said they often skip meals to save money, while a further 42% said they sometimes do.

- The average student's Maintenance Loan falls short of covering their living costs by £582 per month. Last year, the shortfall had been £439 per month.

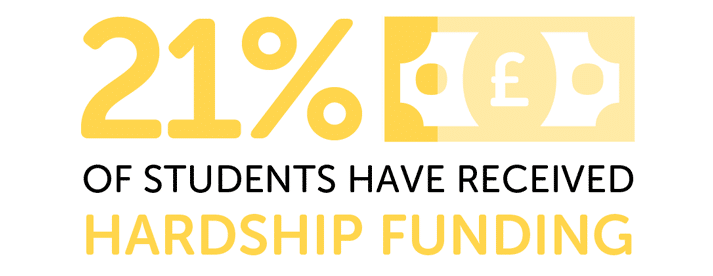

- The proportion of surveyed students who have received hardship funding from their university has nearly doubled, up from 12% last year to 21% this year. However, the average amount received per student has gone down from £1,026 to £905.

Expert comment

Save the Student's Communications Director, Tom Allingham, says:

This is the most troubling set of results we've ever seen in the National Student Money Survey.

It's clear from these findings that students have been hit particularly hard by the cost of living crisis, experiencing a rate of inflation of up to 17%.

And, while Northern Ireland, Scotland and Wales have all tried to ensure funding keeps pace with costs, England has not. As a result, the average Maintenance Loan now falls short of living costs by £582 per month, or almost £7,000 per year.

This is a dereliction of duty from the government, plunging huge swathes of students into food poverty. Around two-thirds are skipping meals at least some of the time, and 18% used a food bank in 2022/23 – close to double the figure from the previous year.

Clearly, the problem is getting worse, not better, and the government urgently needs to do more. The £276 million of 'hardship funding' supplied through the Office for Students is actually less than pre-pandemic levels, and it's barely scratching the surface.

Save the Student is calling on the Education Secretary, Gillian Keegan, to increase the Maintenance Loan to catch up with inflation, and avoid driving thousands more students into financial turmoil.

Students are struggling to get by financially

Over four in five students in the survey said they worry about making ends meet. This is consistent with the results from the 2022 survey, indicating how little has changed in the last year to improve the situation for students.

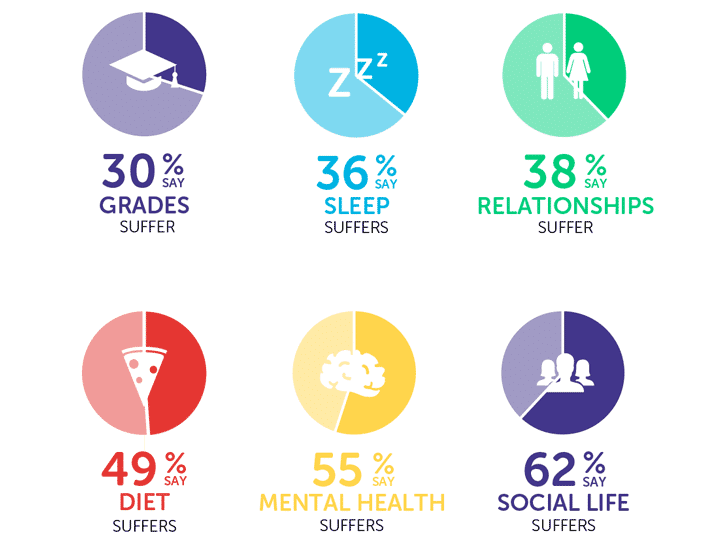

Money worries can impact a range of aspects of a student's life. The three most common areas of life that students told us were impacted by their financial issues were their diet (49%), mental health (55%) and social life (62%).

One student in the survey summed up how tough it can be to keep up with their studies when struggling financially:

The stress of worrying about money makes me want to cry. How I passed my first year I don't know but I [did] not have the energy to focus on doing financial plans and worked hard to get money as well as studying. I have the motivation in me but it is so hard and degrading going into university and constantly being told to get this book and these resources for my course and I'm worrying about [what] I'm going to eat tonight.

Students are struggling with food poverty

Something we hear from students, again and again, is how difficult it can be to afford a good, balanced diet on their tight budgets.

In the 2022 survey, one in 10 surveyed students said they had used a food bank in the previous academic year. But this year, the figure has almost doubled.

With nearly one in five (18%) students in the survey using food banks, it's more evident than ever that Maintenance Loans are, quite simply, not big enough.

This is particularly clear when we consider that the majority of surveyed students are skipping meals due to money.

Overall, 64% said they skip meals at least some of the time to save money. Broken down, this includes 22% who often skip meals and a further 42% who sometimes do.

Some students highlighted that it's especially difficult to afford food when they have dietary requirements such as allergies.

It should be a minimum requirement of the Student Finance system that students have enough money to live on. But, with so many students not able to consistently afford food, the system is clearly not fit for purpose.

What students say about food costs

- Most days I only eat dinner.

- I don't really feel comfortable using food banks but sometimes if I go a little over budget in the early weeks of my loan then I will end up skipping meals or seriously reduce my food to save money.

- I have an allergy to gluten and dairy, which makes food shops much more expensive, which in my opinion is really unfair. I don't think that the government nor universities have provided enough support to students during the cost of living crisis or in general for those of us who have to pay more just because [we] have an allergy!

- I use a food bank every week to feed myself and my children.

- My housemates and I regularly go day to day on just one main meal – we've been going to food banks in our local area since the start of this academic year, just so we can have basics in like pasta, eggs etc.

- My foods shop has doubled in the past year but I haven't received more money to make up for it.

- I have coeliac disease and therefore I have to eat a strict gluten-free diet. This food is ridiculously expensive and sometimes [I] can't afford to spend that much money on a loaf of bread.

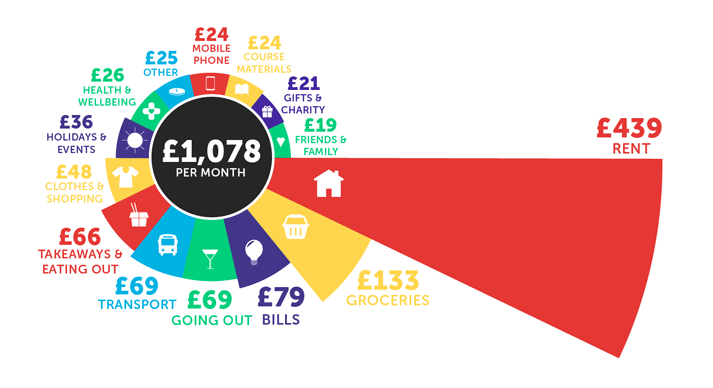

How much do students spend?

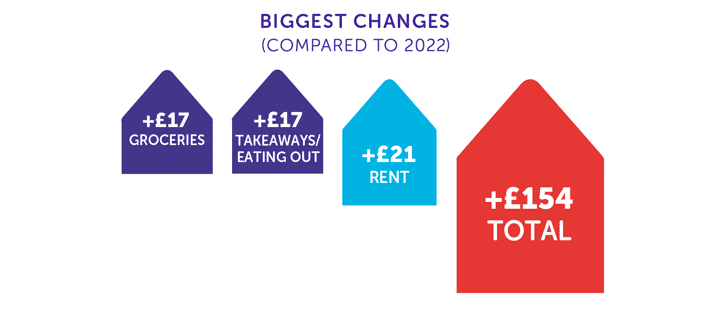

On average, students in the survey spend £1,078 per month. This is an increase of around 17% compared to last year when students were spending an average of £924 per month.

In every category of spending that we asked students about, the average amount they spent had risen since the 2022 survey.

The biggest increase has been rent, which has gone up by £21 per month on average.

Following this, the next largest increases were for groceries and takeaways/eating out. Both of these categories have gone up by £17 per month, meaning the average amount spent on food has risen by a total of £34.

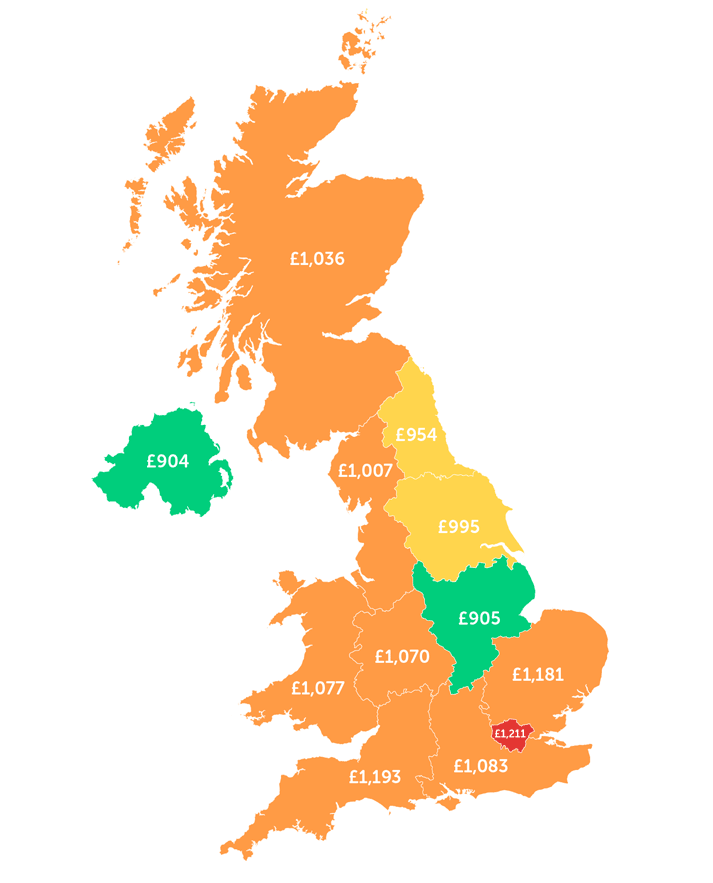

Living costs around the UK

This includes students who live away from home and with their parents.

The regional averages of student living costs across the UK look very different now than they did in 2022.

In the 2022 survey, we highlighted that each region's average was above £800. The West Midlands was at that point the cheapest region for students, with average living costs of £822 per month. London, meanwhile, had average living costs of £1,089 per month.

Now, when we compare those figures to this year's results, it's shocking how much has changed. This year, every region in the UK has average student living costs of over £900 per month. In fact, the average monthly living costs in eight of the 12 regions are above £1,000.

Northern Ireland is the cheapest region (£904 per month), closely followed by the East Midlands (£905 per month).

However, at a staggering £1,211 per month, the average student living costs in London are £122 per month more on average than they were last year.

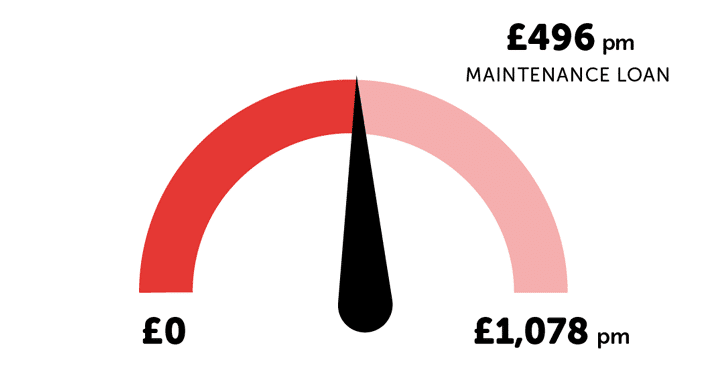

Do Student Loans stretch far enough?

Maintenance Loans have failed to keep up with the rise in students' living costs over the past year, and the gap between loans and student spending is growing.

Last year, the gap between Maintenance Loans and living costs had been £439. But this year, our calculations indicate that, for the average student, the Maintenance Loan falls short of covering their living costs by £582 per month. This means the loan amounts to less than half of their total spending (46%).

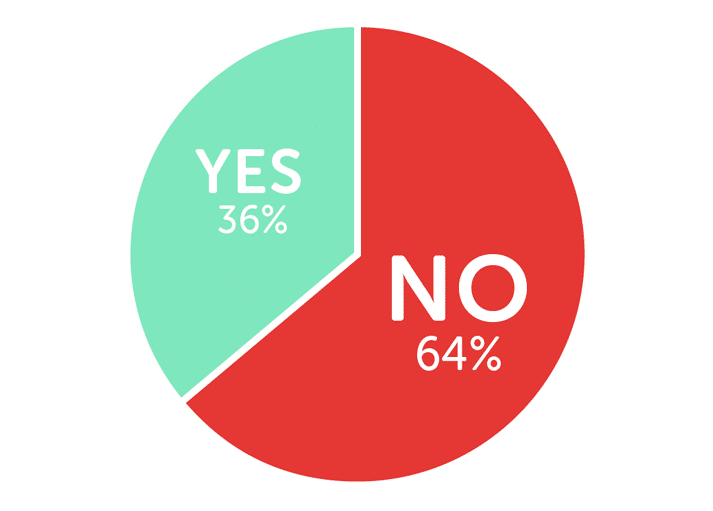

We asked students in the survey whether their Maintenance Loan is enough to live on, and this is what they said:

Do students have enough financial education?

In real terms, Maintenance Loans have been going down over recent years. This is already extremely challenging for a lot of students to deal with, but some will be finding it harder still if they've arrived at university without the skills and knowledge required to manage a tight budget.

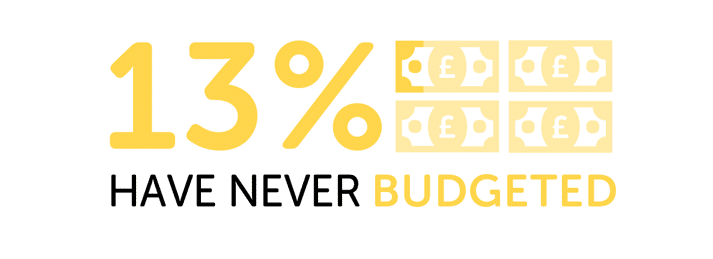

When we asked students in the survey if they budgeted, 13% said they didn't. While this is still higher than we'd hoped to see, it has improved slightly. Last year, 15% had said they didn't follow a budget.

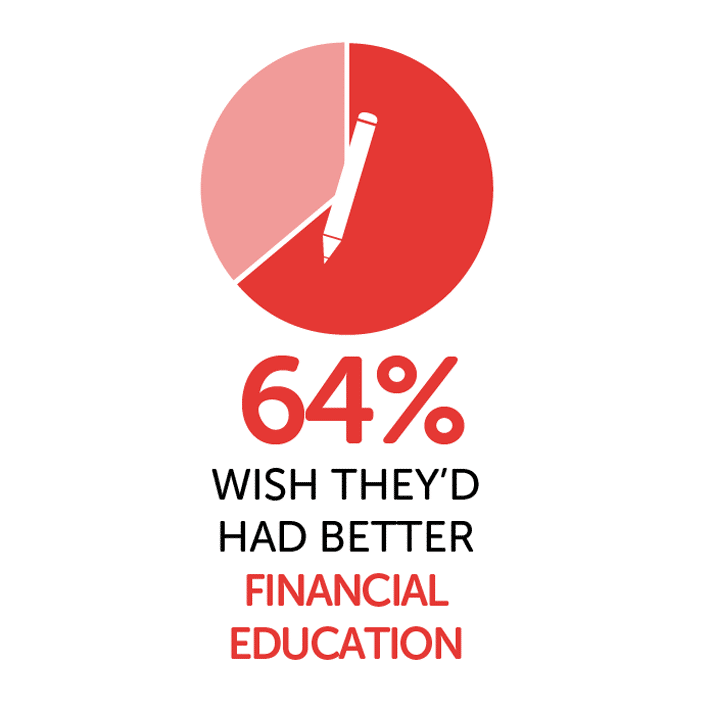

Likewise, it's disappointing that 64% of those in the survey wished they had received better financial education at school. But, again, we are seeing improvements in this area as 74% had said the same in both the 2022 and 2021 surveys.

What students say about surviving on Student Finance

- It barely covers my rent and leaves nothing for any other bills like food and transport. Even with a high Maintenance Loan I stress every day about not having enough money for basic living needs.

- Student Finance should never be based on what parents earn – not all parents can/will give money to kids for university. Even if they do, the cost of living is too high – the Maintenance Loan doesn't even cover most accommodation prices.

- Current increases in Maintenance Loan [do] not scale to the cost of living crisis. Despite getting max loan amount, it still barely covers cost of rent.

- The cost of living and buying things is going up but Maintenance Loans are not that high. Also taking Maintenance Loans on top of Student Loans leaves a huge debt. Uni is too expensive and its price does not correlate to the quality of education.

- The minimum Maintenance Loan isn't enough to cover rent, let alone food etc. and a lot of people's parents won't top them up.

- I do not get support from my parents financially, yet my Maintenance Loan is based [on] their higher than average income.

- The Maintenance Loan can't cover most students' living costs.

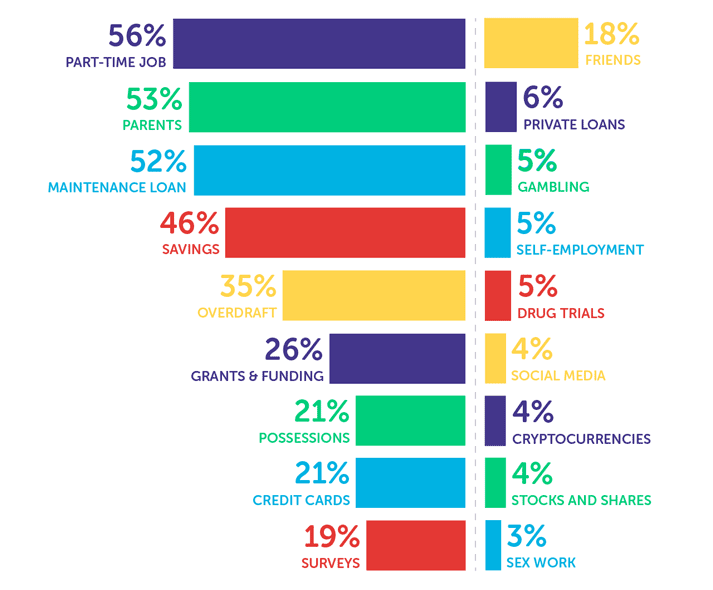

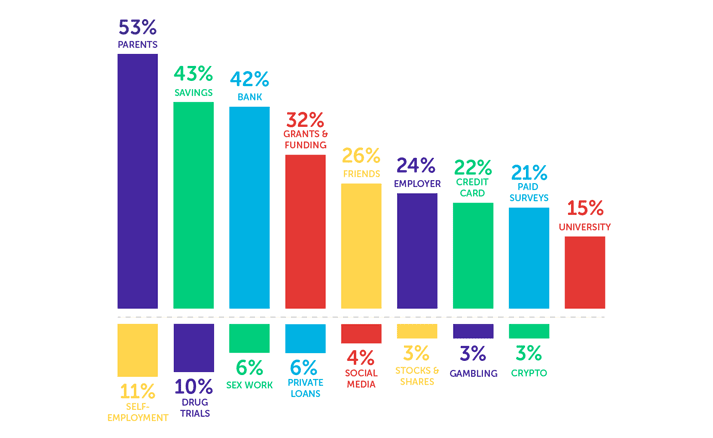

How do students get money?

When looking at students' sources of money at university, one noticeable year-over-year shift is that the proportion that receives money from their parents has dropped from 59% to 53%. This suggests it could be increasingly difficult for students to rely on their parents – many of whom will also be struggling with the rising cost of living.

On top of this, the proportion of surveyed students with a part-time job has decreased from 62% to 56%. If part-time jobs are also difficult to come by or aren't manageable with a student's schedule, this too will add to the financial strain.

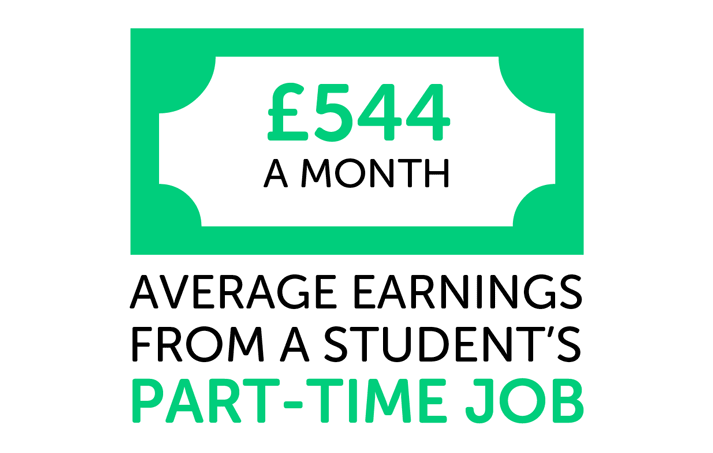

However, while a lower proportion of surveyed students have part-time jobs compared to last year, the average amount earned by those who are working has increased.

In the 2022 survey, students who had paid jobs (employment or freelance) were earning £422 per month on average, but this has increased to £544 per month this year.

10 surprising ways students have made money

Here are some of the unusual ways to make money that students in the survey have tried:

- "Consulting on the promotional material for a trial of STD test vending machines."

- "Reviewed dog food."

- "Licking a muddy foot for £20."

- "Helping a family member organise their bills."

- "Sitting on sofas talking to lecturers as nobody turned up in the afternoon on an open day."

- "Self-published a book."

- "Voice acting."

- "Written 14 articles within two days to earn enough money to get me out of my overdraft."

- "Drawing someone's desktop wallpaper for them."

- "Participated in a short informative film about smoking and young people for a health conference. I've never smoked."

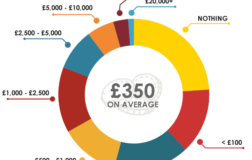

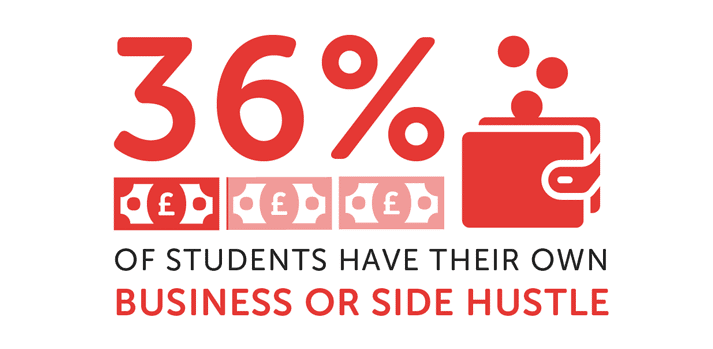

How many students have small businesses and side hustles?

Over a third of students in the survey have their own business or side hustle. This is slightly higher than last year when 31% had said the same.

However, half of those students who do have a business or side hustle have earned less than £500 from them in the last 12 months. While there's the potential for students to make a high income from them, only a small minority (2%) said they've earned over £10,000 over the past year.

Grants, bursaries and scholarships

A positive finding from this survey is that an increasing proportion of students are aware of the funding that's available to them in the form of grants, bursaries and scholarships.

In the 2022 survey, 58% had been aware of them, but in this year's survey, that figure has gone up to 65%.

There's still a long way to go until every student knows about the extra funding they could apply for, but it's a step in the right direction.

One form of extra funding that we suggest students apply for if they're really struggling for money is hardship funding from their university. And in this year's survey, there has been an increase in the proportion who said they've received this form of financial support.

21% of students in the survey said they had received hardship funding from their university in the past year. This is up from 12% who said the same last year.

However, although a higher proportion of surveyed students have been given hardship funding, the average amount received by those students is less than it was in 2022. In this year's survey, students who had been given hardship funding had received an average of £905, whereas last year the average had been £1,026.

As well as hardship funding, here are some more examples of extra funding that students may be able to apply for:

- Disabled Students' Allowances (DSA)

- NHS bursaries

- Scholarships for UK students from ethnic minorities

- Scholarships for international students in the UK

- Unusual university bursaries, grants and scholarships.

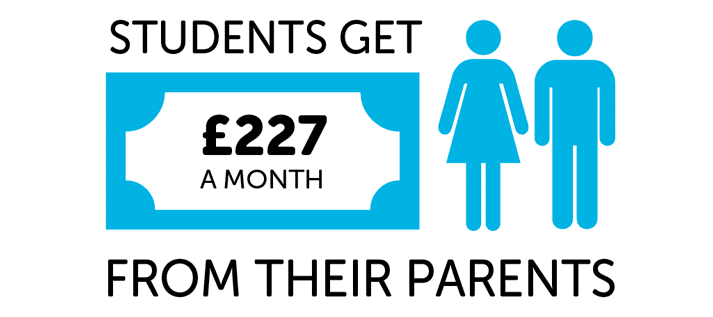

How much money do parents give their children at university?

As we mentioned earlier, the proportion of surveyed students who are given money by their parents has gone down this year. However, among those who are given money, the average amount they receive has increased.

In the 2022 survey, students were receiving an average of £149.80 per month from their parents, but this year the average parental contribution has gone up to £227 per month.

Over the last few years, we have seen a pretty steady proportion of students saying they don't receive enough money from their parents, but it has gone up slightly since 2021.

In the 2021 survey, 13% felt their parents' contributions weren't enough. In 2022, 14% said the same. And this year, the figure has increased to 15%.

We often hear from students that they feel it's unfair that there's an expectation for parents to contribute money at university.

We often hear from students that they feel it's unfair that there's an expectation for parents to contribute money at university.

Maintenance Loans are generally calculated based on household income. So, if a student's parents earn a high income, they will usually receive a smaller loan. As such, there's an underlying assumption that higher-earning parents will give students more money to make up for the shortfall.

However, not all parents feel able and/or willing to give their children money at university for a variety of reasons. As such, some students are getting smaller loans than their peers without any extra support from family, leaving them in a tougher financial position.

It is, again, an issue with the Student Finance system that is leading some students to struggle.

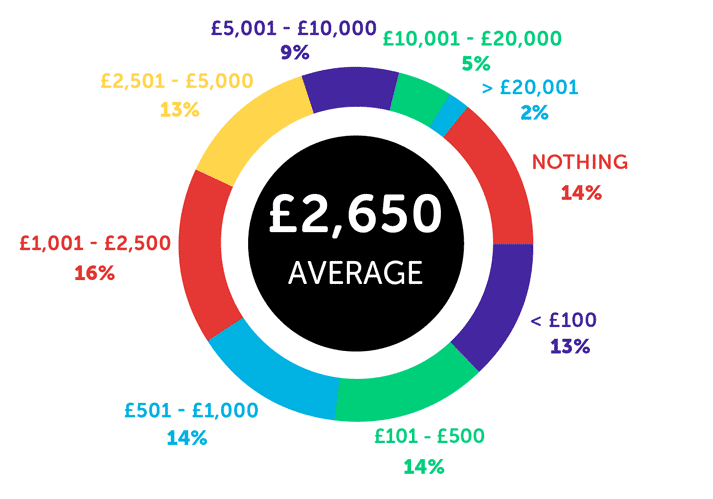

How much do students have in savings?

This year, 27% of surveyed students had less than £100 in savings. This is pretty similar to recent years as 30% had said this in 2022 and 28% had in 2021.

Despite this, there has been a steep rise in the average amount students in the survey said they have in savings. Up from £1,280 last year, the average savings amount is now £2,650.

What students say about budgeting and saving money

- I have never met a single student who knew exactly how to budget when they first arrived at university. It is my strong belief that these things should be taught to us at school.

- I keep a money-saving chart and tick off the amount I save each week. This chart allows me to save £1,000 a year.

- I have to take on a lot of part-time jobs in order to save up and to maintain savings for accommodation, transport and university placements etc. Oftentimes [I] feel like I have to decline social events or seeing family members/friends to work.

- I spreadsheet my shopping each week so I have almost memorised prices of items in Aldi.

- Every time I go for a pint or something to eat I put the same amount into my savings account.

- I am really good with budgeting so I make sure I stick to a very rigid weekly allowance so as to make sure I have enough money to last me the year, but I have friends who have less support than I do and have gone weeks without buying food shopping, fainting in uni because [they're] not eating enough and uni lecturers having to give people money to buy some groceries because they simply don't have the money to pay for any.

How would students get money in a cash crisis?

Every year, we see it as essential to ask students where they would turn for money in a cash crisis. The reality is that a lot of students do reach a point where their finances become extremely tight, as we see from students using food banks and skipping meals.

In the survey, students said they would turn to the following money sources in an emergency:

The most common way for surveyed students to get money in an emergency would be to approach their parents. However, the percentage that said they would turn to theirs in an emergency has gone down from 59% last year to 53% this year.

As we mentioned earlier, the gap between Maintenance Loans and average student living costs has grown, so it's likely that students will be in need of more money than they would have been in previous years when their loans run out.

With the financial pressures that will be on a lot of parents, too, it's possible that fewer students see it as a fair or realistic option to go to their families when money is tight.

One increase we have seen in where surveyed students would look for money in an emergency is credit cards, up from 16% last year to 22% this year.

While credit cards can be safe when used very carefully, it does concern us that over one in five students in the survey would see them as a source of money in a financial crisis. If credit card payments are missed, there's the potential for users to get into further debt. There's also the added risk that their credit score could be negatively impacted.

For students who are in a financial crisis, we would always suggest trying lower-risk ways to get money first such as hardship funding from a university or a part-time job.

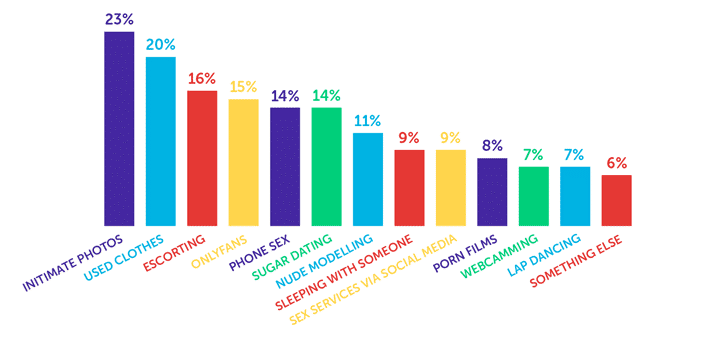

Sex work at universities

While only a small proportion of surveyed students (3%) said they do sex work to make money at university, the percentage remains relatively consistent each year.

And as 6% said they would do sex work in an emergency – double the proportion who said they have made money this way – universities should be aware of how students really feel about sex work.

It's important to recognise that it can be a positive experience for some students who choose to do sex work. However, the issue is that we often hear students talk negatively about their experiences of sex work, especially when they are doing it out of desperation for money.

As there are potential physical and mental risks involved with this type of work, we see it as vital that universities are well-informed about it.

Support advisors at universities should be prepared to talk openly and non-judgementally with students about sex work when needed to ensure they can offer appropriate advice and support.

What kinds of sex work have students tried?

Among surveyed students who have done sex work, these are the types they have tried:

What students say about doing sex work at university

- It's very dehumanising and I have to put aside time and emotions to do it despite how my boyfriend feels.

- Only done once as a desperate attempt to make money.

- I have considered sex work but do not have confidence in myself to do it – both as a way to earn money but also for confidence.

- Only once as I was desperate. I got £10.

- I dislike doing this. It carries so much risk and I don't always feel safe.

- It's not all it's made out to be. Sometimes I can make a few hundred, sometimes I make nothing. And it definitely doesn't feel safe doing it (job security wise).

How many students think about dropping out?

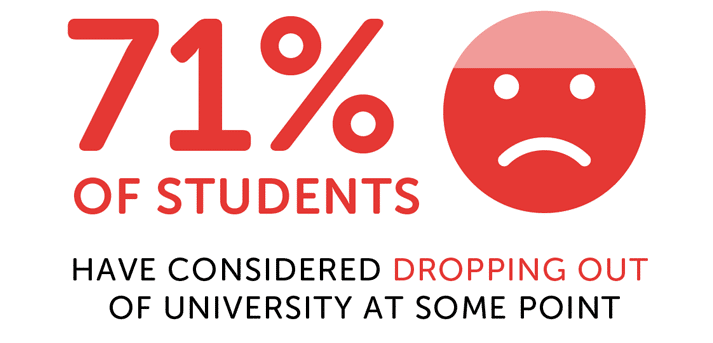

Worryingly, 71% of students in the survey said they had thought about dropping out of university at some point, with the most common reasons being their mental health (59%) and money worries (54%).

This is of course much higher than we would hope to see – it's upsetting to think of any students struggling with university to the extent that they think about dropping out. However, the percentage that's considered this is lower than last year when the figure had been 82%.

Although the overall proportion of surveyed students who have thought about dropping out has gone down since last year, there has been a small rise in the proportion saying they have considered it due to money worries – up from 52% to 54%.

One student in the survey told us that, despite making an effort to budget, they have still thought about ending their degree early because of money:

Studying has been extremely hard and I've considered dropping out due to financial strains. I'm very sensible with money and budget well but this past year has definitely tested that.

Do students understand their Student Loans?

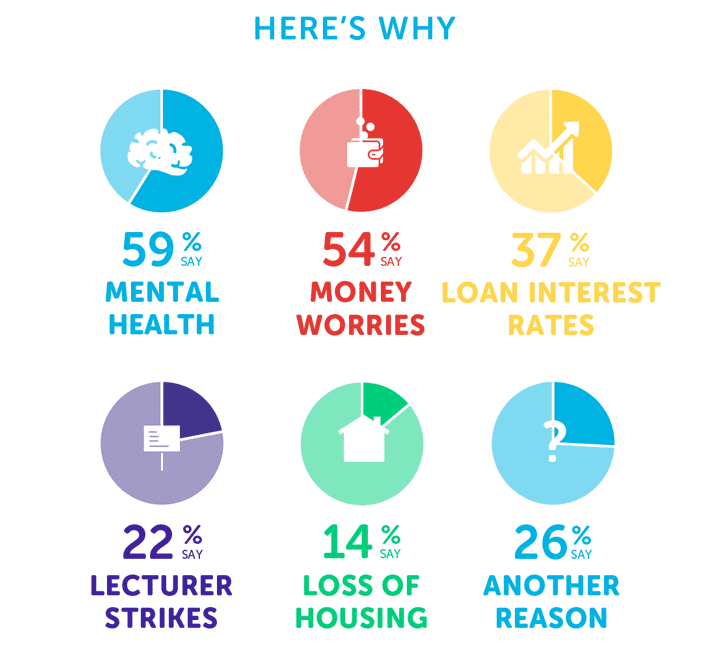

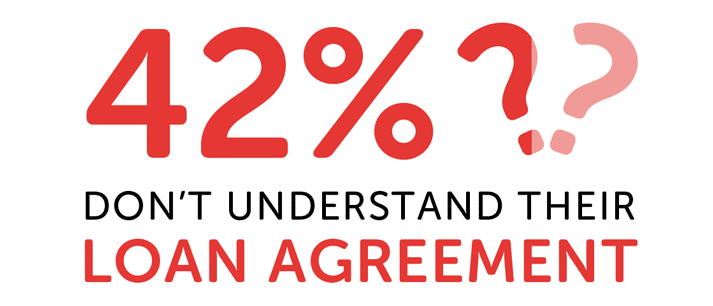

With the upcoming introduction of Plan 5 Student Loans for English students who start university in September 2023, it's perhaps no surprise that there are mixed results around students' understanding of their loan agreements.

Compared to last year, when 45% had said they don't understand their Student Loan agreement, this has gone down slightly to 42% which is a small improvement.

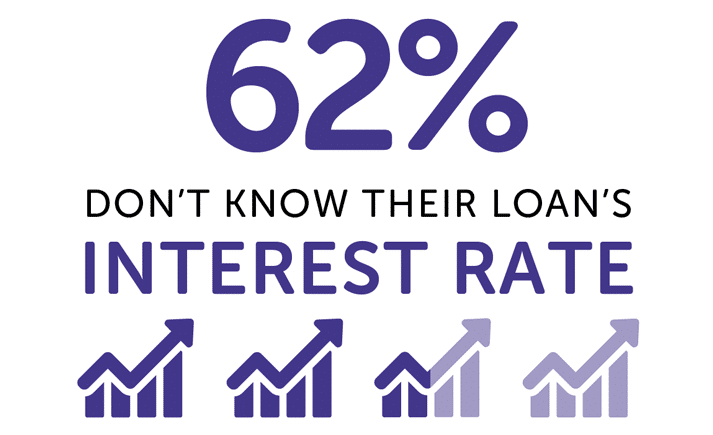

Additionally, a lower proportion of surveyed students said they didn't know their Student Loan's interest rate, down from 67% last year to 62% this year.

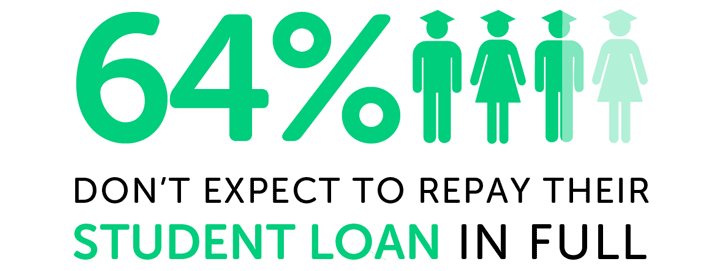

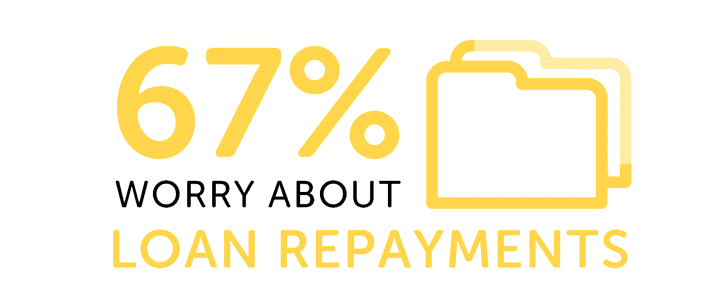

The students in this survey were more likely to expect to repay their Student Loans in full compared to last year's respondents. Whereas 76% said they didn't expect to repay their loan in full in 2022, 64% in the 2023 survey have said the same.

But, combined with this, there has been an increase in the proportion of surveyed students saying they're worried about repaying their loan – up from 64% last year to 67% this year.

It may be that some students are not fully aware of the likelihood that the debt will be written off before it's repaid in full, causing them to be more worried by the prospect of paying off their full Student Loans plus interest. It's possible that the news of the incoming Plan 5 loans (which have longer repayment terms than other plans) is causing confusion among current students.

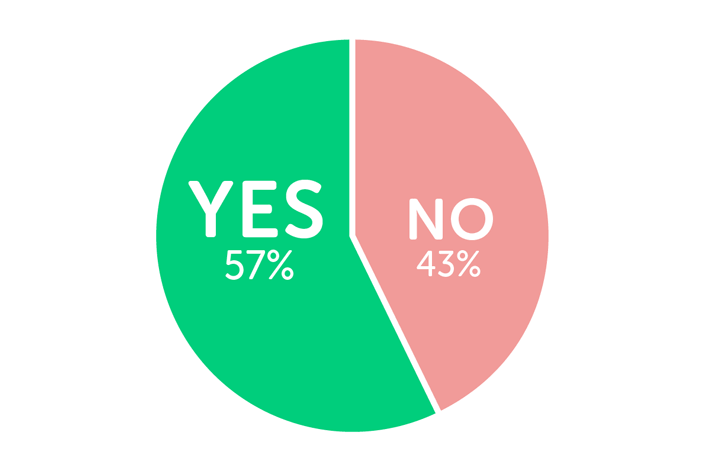

The value for money of university

When we asked students whether they felt university is good value for money, 57% said that it is. This is up from 53% who said the same in 2022, and 49% in 2021, suggesting there has been a steady improvement over recent years.

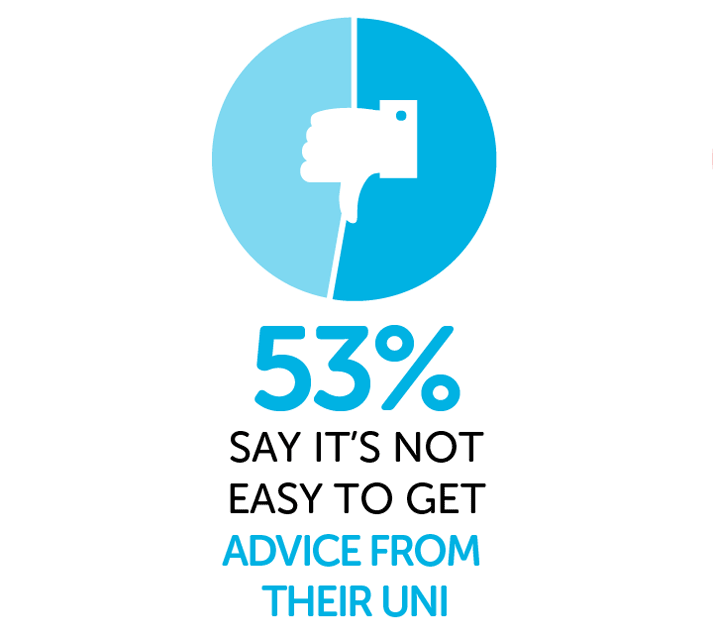

Among those in the survey who have asked their university for financial support, 53% said it wasn't easy. This is still much higher than we'd hope to see, but it's promising that there have been significant improvements in this area in recent years.

In 2022, 63% hadn't found it easy, whereas in 2021, 70% hadn't. There are clearly still improvements to be made, but it's good to see that a growing proportion of students who ask for financial support from their university are finding it easy to do so.

What students say about tuition fees

- It should be a guarantee that a reduction in [the] quality of education received [due] to strikes or restrictions should result in a reduction of tuition fees.

- [I] definitely believe that the tuition fees are way too high, especially with all the strike impact! This is something that needs to be changed for the future!

- It feels a bit unfair to me that international students have to pay more than triple of what UK residents have to pay for tuition fees.

- I don't think it's fair that Student Finance don't give Tuition Fee Loans to students studying a second degree in a professional course, such as veterinary or human medicine or dentistry. We are guaranteed jobs upon graduation and there is a shortage of vets and doctors as it is.

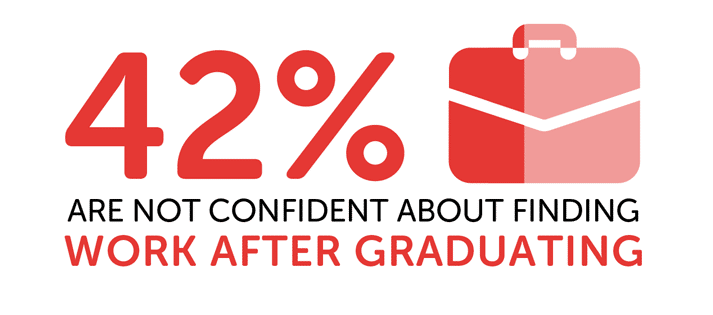

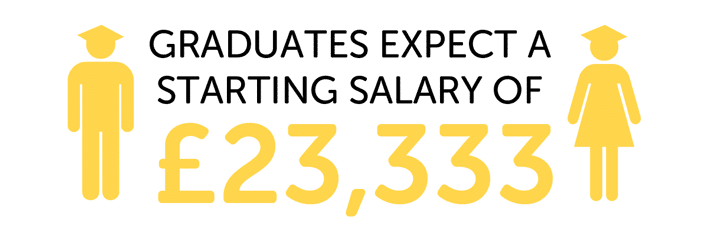

Graduate job prospects

For many students, finding work after graduation can be stressful and cause a lot of uncertainty. In fact, over two in five students in this survey said they are not confident about finding graduate employment.

But, this figure is an improvement compared to recent years, perhaps reflecting a general rise in confidence about getting graduate jobs since the coronavirus pandemic. In the 2022 survey, 45% said they weren't confident about finding work after university, while 62% said the same in 2021.

Surveyed students are also expecting a slightly higher graduate salary this year than they had last year, up from an average of £22,243 to £23,333.

What others say about the survey

Kellie McAlonan, Chair of the National Association of Student Money Advisers (NASMA), said:

It is particularly alarming to see how the findings this year compare to last year. Monthly costs have risen considerably, adding to an already significant gap between student funding income and living costs.

The system is broken when our students start their journey needing to address a gap in funding, leading many to stretch themselves with working hours that inevitably impact their student experience.

Long gone are the days when students are young school leavers, living near campus only during term time, with manageable part time work hours, and the safety net of parents. We need a system that recognises the diversity of students and properly addresses their needs, many of whom are mature, parents themselves, or without family to support them.

The survey shows the majority of respondents skipping meals to survive, which is a particularly worrying trend. This, along with food bank use among students being on the rise, makes it clear the systems in place are not fit for purpose.

The government need to consider that struggling to fund basic living costs is a reality for many students, and it isn't good enough.

Core funding packages need to be good enough to support student success.

About this survey

We've been asking UK university students about their honest experiences of managing money during their degrees since 2013. Our independent findings provide insights into the realities of student life and allow us to improve the overall content and advice on our website.

The survey was conducted entirely online.

We push it out to a mix of our own followers, distribution via student service centres and unions at some universities, as well as through social media promotion. This mix is done to ensure that we are not only polling our own users.

If you'd like to find out more about this survey, case studies or comments, please get in touch.

- Source: The National Student Money Survey 2023 / www.savethestudent.org

- Average Maintenance Loan amount calculated based on FOI information from Student Loans Company (SLC).

- The survey received 3,733 raw responses. After cleaning the data to remove any non-students and clearly false entries, we used the responses from 1,786 university students in the UK to calculate the results.

- Students were polled between May and August 2023.

- Data from our previous surveys.

- Save the Student's Press Page.

- Tools and resources.

Student Money Cheatsheet

In response to the findings from our recent national student surveys, we have created the free Student Money Takeaway resource.

This is a printable PDF, and it includes a one-minute budget sheet. In the resource, you can find the best advice from our website condensed down to a couple of pages.

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-252x160.png)

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-100x100.png)