This is what your tuition fees actually get spent on

Research by the Higher Education Policy Institute (HEPI) revealed exactly where your tuition fees get spent – and it's far from just the cost of teaching you.

Credit: Pajor Pawel, Space Images – Shutterstock

With tuition now costing as much as £9,250 per year for many students, it's only natural to wonder what that money is spent on. And, surprise, surprise, it doesn't all go to teaching! Universities have many costs, including management, advertisement, university buildings, and more.

While it differs per university, we've taken a look at some of them to give you a general idea of where tuition fees actually get spent.

How do universities spend tuition fees?

Credit: Paramount Pictures

In 2018, around 45% of the funds generated from each student's £9,250 annual tuition fees in England was spent on the cost of teaching.

The remaining funds were spent on other necessary expenses. This includes things like buildings, technology and libraries, university administration, welfare support such as mental health services, and spending on the students' union.

According to the 2018 HEPI report, very few students (less than 20%) wanted their money to be spent on management staff, recruitment of students, advertising, or community work. Nonetheless, around 20% of funds were spent on these areas.

Contrastingly, over 60% of students believed that paying for teaching facilities and teaching staff is a "reasonable use" for the money raised by their tuition fees. That said, the report estimated that UK institutions only spent 45% of this income on teaching.

The remaining money collected was spent on a range of other services, including administration and infrastructure costs.

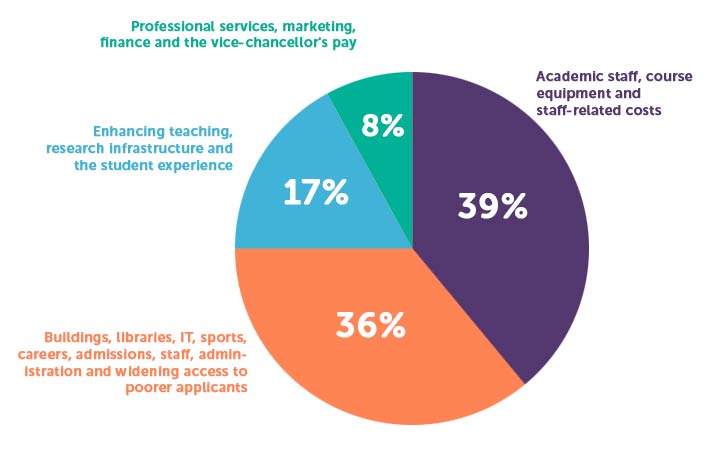

As a representative example, a breakdown of how tuition fees were spent by Nottingham Trent University was shared.

Figures for Nottingham Trent University (2018)

Academic staff, course equipment, and staff-related costs received 39% of the overall funds collected from fees.

Other services and infrastructure, like buildings, libraries, IT services, sports facilities, careers help, admissions, employees, administration and welfare support received 36% of the fees.

The university used 17% of the income for "enhancing teaching, research infrastructure, and the student experience".

The remaining 8% was left for professional services such as marketing, finance, and the vice chancellor's pay packet.

Should universities say how they're spending your tuition fees?

Nearly three-quarters of students called for more information on how and where their universities are spending their tuition fees.

As concerns grow over the value of degrees in the UK compared to their cost, something must be done to address the perception that a degree is now no longer worth the financial outlay.

MPs have previously said that the debt graduates leave higher education with outweighs the benefits they get from studying for a degree. What's more, according to the Office for National Statistics, 47.5% of recent graduates were not working in graduate-level jobs between 2011 and 2019.

Why do universities charge for education?

Credit: Steve Cadman - Flickr

HEPI's research shows that UK universities have varying levels of dependency on the income from tuition fees. The difference can be huge.

For the University of Cambridge, tuition fees only made up 15% of their income. At the other end of the scale, Falmouth University got a huge 83% of its income from tuition fees, while at Nottingham Trent the figure stood at 81%.

This is why, for many of these institutions, there is overwhelming pressure to recruit new students every year. Previously, an unnamed university had to be given a £1m bailout emergency loan by the Office for Students to avoid running out of money and being unable to pay its bills.

While the money was repaid, and the university regained financial stability, the incident exemplifies the challenges all universities face with reliance on student intake and fees – both of which can fluctuate from year to year.

In 2018, Nick Hillman, director of HEPI, told the BBC:

Tuition fees were introduced 20 years ago and they have been tripled twice. Ministers and regulators have repeatedly demanded information on where the fees go. Yet there is still little information available.

The Office for Students added:

We can identify and will act when they are not transparent about value for money or are not delivering strong enough outcomes for students or taxpayers.

What will happen to university funding?

Today, the future of higher education funding in the UK is shrouded in uncertainty. Most people agree that something needs to be done, but we're not sure what that will be.

There has been talk of reducing tuition fees. However, university chiefs have suggested this may not actually benefit those who need the financial burden lifting.

They argue that if universities have to lessen the income they receive from fees, they will likely have to reduce the support they provide to students in the form of student bursaries and other financial help.

A reduction in fees may also mean that institutions have to limit the number of places available on courses, owing to a reduction in money available to spend on teaching and facilities.

And, of course, fees aren't the only problem. At Save the Student, we believe that Maintenance Loans are a far more pressing concern.

Our research has found that the average student's Maintenance Loan leaves them around £582 short of their monthly living costs. And with the scrapping of Maintenance Grants, most students are now graduating with at least £50,000 of debt.

Ever wondered how much each lecture really cost you? Use our calculator to find out how much your course cost per hour.