Student living costs in the UK 2025

The student budget is a tricky thing to pin down. But our latest National Student Money Survey reveals where students' money goes once and for all...

Credit: Yevgen Kravchenko, kamui29, Bell Photography 423 – Shutterstock

We all know that student living can be a pricey business. But, how pricey is it exactly?

Rather than taking wild guesses, we can tell you what your expected living costs are, based on what thousands of other students are telling us.

Whether you're wanting to budget your monthly expenses, or simply see how your spending compares to the average student, we've got all the stats on student living costs that you need.

What's in this guide?

Average student living costs

| Expense | Cost per month |

|---|---|

| Rent | £540 |

| Groceries | £144 |

| Household bills | £76 |

| Transport | £65 |

| Going out | £51 |

| Takeaways and eating out | £48 |

| Clothes and shopping | £32 |

| Holidays and events | £29 |

| Health and wellbeing | £22 |

| Interest payments | £19 |

| Course materials | £18 |

| Mobile phone | £16 |

| Other | £16 |

| Gifts and charity | £14 |

| Friends and family | £14 |

| TOTAL | £1,104 |

In our latest annual National Student Money Survey, we asked over 1,000 students where their money goes. The results were very interesting.

The average student's living costs are about £1,104 a month, but our findings reveal that Maintenance Loans often fall far short of covering students' living expenses.

It's probably no surprise that rent takes the biggest chunk out of the student budget. This year it rose to £540 a month. This is a £101 increase from 2023.

Groceries are the second biggest expenditure for students, coming in at £144 a month. This might seem like a lot, but it breaks down to around £33 a week – not too bad for a weekly food shop. Nonetheless, to cut down the costs of groceries further, check out our guide to saving money on food or even try our weekly meal plan.

Everyone knows that students love a good party, and it turns out £51 a month is spent on going out. Some might be surprised that this is more than double the amount students spend on course materials. However, with tuition fees at such a high rate, there's increasing pressure on unis to keep extra course costs to a minimum.

Students also estimate they spend £76 a month on bills, which include gas, electricity, water, broadband and a TV Licence. Our complete guide to student bills has step-by-step advice on how to set up, switch, split bills, and we also have guidance on help with energy bills during these testing times.

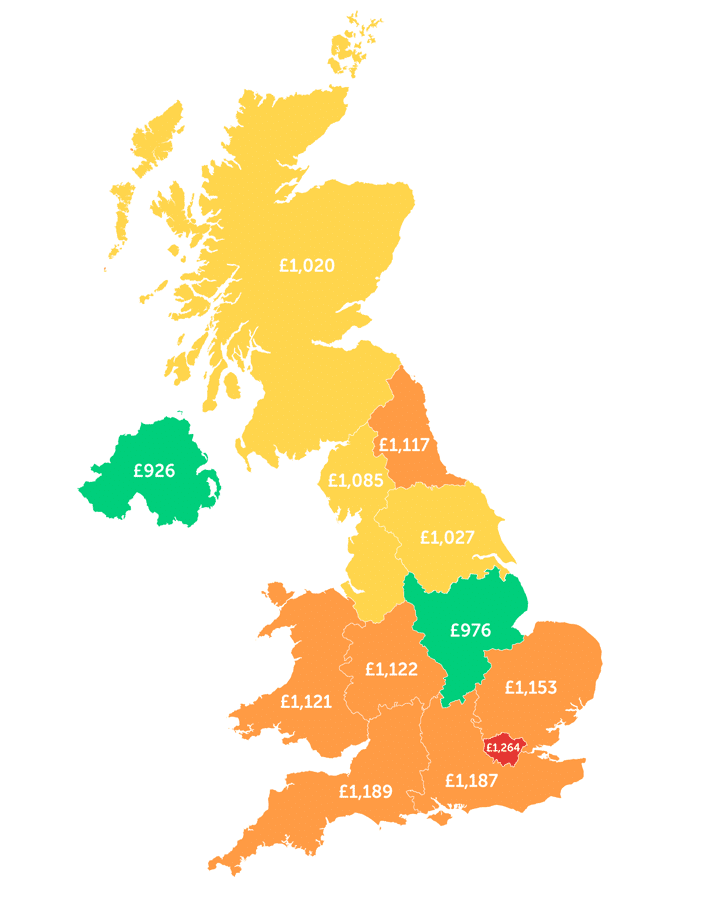

Student living costs across the UK

As the graphic above demonstrates, the most expensive places to live as a student in the UK can be found in the South of England.

London is the most expensive region along with the South East and South West. This will be partly due to the cost of rent in London and the surrounding regions, which often dwarves the amount you'd pay for an equivalent property elsewhere.

Meanwhile, Northern Ireland and the East Midlands are comfortably the cheapest regions in the UK.

But it's worth noting that in this year's survey, student living costs exceed £1,000 a month in almost every part of the country.

Which students spend the most?

Three of the universities in the top 10 for total spending (excluding rent) are based in London – University of London, Imperial College London, and Queen Mary.

The rest of the top 10, aside from the University of Sunderland, is made up from universities in the south.

The very lowest spenders are those at University of York, with students spending just £318 a month on all expenses excluding rent. Lincoln, UWE, Derby, Glasgow, Leicester, Southampton, Swansea, Plymouth and Birmingham University all came in at £400 or less.

At some unis, the average cost of bills seems very low (£9 at York, for example) – but bear in mind that these figures are averages. A lot of students' utilities will be included in their rent, so they would likely have reported that their bills cost £0.

The table below lists all universities and the average that students spend on living costs, after rent. How do you compare to your classmates?

| University | Total (£) | Groceries (£) | Takeaways and eating out (£) | Transport (£) | Going out and socialising (£) | Household bills (£) | Mobile phone (£) | Clothes and shopping (£) | Health and wellbeing (£) | Course materials (£) | Holidays and events (£) | Gifts and charity (£) | Relatives or friends (who you financially support) (£) | Interest payments | Other (£) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Aberdeen | 517 | 78 | 39 | 24 | 70 | 87 | 18 | 36 | 34 | 70 | 13 | 10 | 6 | 5 | 30 |

| Aberystwyth | 454 | 150 | 39 | 64 | 23 | 11 | 13 | 34 | 22 | 13 | 26 | 14 | 15 | 25 | 5 |

| Anglia Ruskin | 490 | 99 | 40 | 57 | 77 | 55 | 25 | 41 | 21 | 18 | 0 | 9 | 14 | 9 | 27 |

| Arden | 460 | 65 | 25 | 25 | 110 | 125 | 13 | 50 | 13 | 10 | 0 | 10 | 0 | 15 | 0 |

| Aston | 609 | 180 | 43 | 58 | 58 | 83 | 25 | 30 | 14 | 9 | 18 | 14 | 5 | 75 | 0 |

| Bath | 445 | 122 | 54 | 41 | 53 | 80 | 9 | 23 | 10 | 15 | 15 | 9 | 5 | 5 | 3 |

| Birmingham | 398 | 111 | 30 | 32 | 37 | 53 | 14 | 34 | 16 | 15 | 9 | 11 | 17 | 10 | 9 |

| Birmingham City | 622 | 136 | 52 | 57 | 83 | 150 | 18 | 26 | 21 | 20 | 33 | 15 | 2 | 8 | 1 |

| Bournemouth | 532 | 107 | 37 | 38 | 22 | 187 | 18 | 21 | 17 | 9 | 36 | 27 | 0 | 11 | 2 |

| Brighton | 770 | 149 | 49 | 41 | 62 | 97 | 17 | 40 | 33 | 127 | 95 | 2 | 31 | 25 | 4 |

| Bristol | 417 | 166 | 38 | 44 | 34 | 36 | 7 | 31 | 9 | 7 | 9 | 4 | 18 | 6 | 10 |

| Bucks New | 681 | 150 | 65 | 110 | 113 | 75 | 18 | 28 | 28 | 18 | 25 | 0 | 0 | 50 | 3 |

| Cambridge | 506 | 147 | 45 | 47 | 31 | 31 | 24 | 37 | 20 | 27 | 30 | 35 | 5 | 11 | 15 |

| Cardiff | 400 | 121 | 36 | 58 | 32 | 56 | 6 | 28 | 12 | 1 | 31 | 13 | 1 | 1 | 7 |

| Cardiff Metropolitan | 572 | 210 | 23 | 113 | 38 | 27 | 43 | 43 | 27 | 17 | 0 | 0 | 0 | 0 | 30 |

| Chester | 522 | 129 | 56 | 38 | 84 | 33 | 13 | 29 | 9 | 20 | 19 | 24 | 21 | 29 | 18 |

| Chichester | 746 | 137 | 41 | 48 | 72 | 129 | 13 | 17 | 12 | 0 | 20 | 17 | 210 | 0 | 30 |

| City, UoL | 837 | 181 | 140 | 62 | 101 | 84 | 30 | 32 | 50 | 24 | 86 | 3 | 21 | 7 | 14 |

| Coventry | 585 | 147 | 62 | 50 | 61 | 82 | 27 | 37 | 33 | 17 | 34 | 12 | 0 | 20 | 3 |

| De Montfort | 584 | 184 | 47 | 33 | 85 | 81 | 22 | 19 | 16 | 26 | 7 | 6 | 24 | 14 | 21 |

| Derby | 385 | 90 | 40 | 60 | 50 | 0 | 0 | 30 | 30 | 20 | 10 | 25 | 0 | 0 | 30 |

| Durham | 520 | 171 | 47 | 65 | 52 | 49 | 4 | 23 | 21 | 8 | 42 | 20 | 1 | 0 | 19 |

| East Anglia | 452 | 116 | 29 | 30 | 30 | 71 | 9 | 26 | 21 | 9 | 21 | 13 | 25 | 45 | 8 |

| Edge Hill | 493 | 135 | 28 | 15 | 40 | 25 | 10 | 23 | 105 | 13 | 15 | 23 | 38 | 0 | 25 |

| Edinburgh | 464 | 133 | 52 | 46 | 43 | 40 | 9 | 30 | 11 | 32 | 22 | 11 | 7 | 13 | 16 |

| Essex | 646 | 173 | 57 | 76 | 35 | 54 | 14 | 89 | 46 | 9 | 13 | 7 | 13 | 60 | 0 |

| Exeter | 461 | 151 | 38 | 64 | 34 | 44 | 14 | 23 | 15 | 8 | 22 | 7 | 12 | 15 | 14 |

| Falmouth | 416 | 112 | 27 | 28 | 50 | 69 | 21 | 20 | 15 | 7 | 20 | 10 | 17 | 20 | 0 |

| Glasgow | 392 | 93 | 75 | 37 | 30 | 47 | 16 | 17 | 9 | 8 | 19 | 11 | 5 | 5 | 20 |

| Glasgow Caledonian | 524 | 187 | 33 | 19 | 75 | 113 | 13 | 18 | 13 | 12 | 16 | 8 | 3 | 3 | 11 |

| Gloucestershire | 655 | 205 | 29 | 33 | 66 | 158 | 15 | 23 | 15 | 13 | 3 | 14 | 79 | 0 | 3 |

| Harper Adams | 448 | 195 | 14 | 25 | 40 | 47 | 15 | 7 | 16 | 62 | 0 | 4 | 18 | 0 | 5 |

| Hertfordshire | 447 | 92 | 15 | 13 | 32 | 53 | 11 | 66 | 80 | 25 | 4 | 0 | 0 | 0 | 56 |

| Hull | 406 | 174 | 20 | 22 | 60 | 80 | 7 | 12 | 4 | 9 | 0 | 11 | 5 | 0 | 2 |

| Imperial College London | 713 | 202 | 79 | 84 | 76 | 44 | 9 | 18 | 52 | 0 | 45 | 64 | 20 | 10 | 10 |

| Keele | 485 | 156 | 29 | 55 | 56 | 74 | 32 | 19 | 10 | 17 | 8 | 11 | 0 | 0 | 18 |

| Kent | 419 | 115 | 55 | 45 | 70 | 25 | 12 | 11 | 21 | 25 | 0 | 10 | 10 | 5 | 15 |

| King's College London | 503 | 97 | 55 | 53 | 81 | 55 | 15 | 38 | 15 | 8 | 38 | 17 | 2 | 21 | 7 |

| Kingston | 475 | 145 | 30 | 8 | 70 | 107 | 38 | 26 | 5 | 18 | 0 | 5 | 25 | 0 | 0 |

| Lancaster | 475 | 126 | 53 | 48 | 46 | 13 | 14 | 30 | 25 | 8 | 10 | 10 | 13 | 0 | 11 |

| Leeds | 456 | 110 | 58 | 85 | 37 | 60 | 13 | 22 | 16 | 6 | 27 | 13 | 5 | 1 | 2 |

| Leeds Beckett | 554 | 140 | 13 | 23 | 70 | 71 | 66 | 25 | 21 | 41 | 0 | 17 | 50 | 11 | 6 |

| Leeds Trinity | 518 | 158 | 72 | 40 | 76 | 51 | 28 | 14 | 6 | 21 | 0 | 5 | 4 | 37 | 6 |

| Leicester | 394 | 103 | 39 | 38 | 40 | 62 | 20 | 34 | 13 | 5 | 19 | 5 | 7 | 0 | 10 |

| Lincoln | 354 | 103 | 27 | 19 | 28 | 14 | 13 | 25 | 14 | 4 | 30 | 7 | 0 | 56 | 14 |

| Liverpool | 540 | 173 | 38 | 39 | 34 | 95 | 15 | 21 | 23 | 61 | 16 | 7 | 0 | 12 | 8 |

| Liverpool John Moores | 499 | 175 | 59 | 52 | 58 | 22 | 8 | 23 | 21 | 4 | 38 | 8 | 0 | 13 | 17 |

| London South Bank | 578 | 117 | 27 | 33 | 143 | 90 | 16 | 0 | 13 | 27 | 110 | 2 | 0 | 0 | 0 |

| Loughborough | 428 | 146 | 60 | 65 | 39 | 19 | 10 | 22 | 14 | 4 | 21 | 12 | 4 | 0 | 15 |

| LSE | 672 | 140 | 75 | 152 | 85 | 45 | 10 | 55 | 15 | 10 | 50 | 10 | 5 | 0 | 20 |

| Manchester | 563 | 111 | 56 | 74 | 78 | 54 | 7 | 44 | 12 | 15 | 13 | 20 | 27 | 3 | 47 |

| Manchester Met | 672 | 155 | 60 | 69 | 74 | 81 | 15 | 41 | 9 | 6 | 52 | 2 | 25 | 66 | 18 |

| Middlesex | 784 | 214 | 71 | 55 | 86 | 88 | 18 | 46 | 16 | 20 | 60 | 70 | 0 | 0 | 40 |

| Newcastle | 513 | 144 | 32 | 45 | 63 | 101 | 19 | 19 | 34 | 13 | 13 | 6 | 7 | 6 | 11 |

| Northumbria | 601 | 113 | 67 | 68 | 51 | 90 | 20 | 36 | 16 | 21 | 18 | 15 | 6 | 13 | 69 |

| Nottingham | 430 | 94 | 34 | 52 | 54 | 57 | 9 | 33 | 16 | 17 | 18 | 15 | 3 | 7 | 21 |

| Nottingham Trent | 543 | 125 | 57 | 72 | 71 | 39 | 16 | 37 | 20 | 6 | 33 | 6 | 4 | 45 | 11 |

| Oxford | 781 | 194 | 110 | 99 | 61 | 89 | 26 | 58 | 19 | 15 | 46 | 37 | 13 | 14 | 0 |

| Plymouth | 397 | 120 | 35 | 41 | 52 | 39 | 11 | 32 | 13 | 10 | 10 | 10 | 3 | 9 | 14 |

| Plymouth Marjon | 545 | 400 | 50 | 30 | 40 | 0 | 0 | 0 | 5 | 0 | 10 | 10 | 0 | 0 | 0 |

| Portsmouth | 516 | 179 | 50 | 50 | 20 | 82 | 5 | 23 | 15 | 4 | 26 | 24 | 22 | 0 | 15 |

| Queen Margaret | 615 | 200 | 50 | 100 | 75 | 70 | 0 | 30 | 20 | 20 | 30 | 20 | 0 | 0 | 0 |

| Queen Mary | 687 | 170 | 72 | 53 | 95 | 35 | 12 | 49 | 25 | 29 | 66 | 13 | 0 | 29 | 41 |

| Queen's Belfast | 596 | 127 | 34 | 87 | 82 | 81 | 23 | 40 | 24 | 21 | 10 | 13 | 4 | 0 | 50 |

| Reading | 413 | 75 | 40 | 53 | 32 | 60 | 9 | 37 | 20 | 10 | 53 | 19 | 0 | 0 | 5 |

| Royal Holloway | 656 | 152 | 60 | 77 | 71 | 43 | 14 | 48 | 13 | 20 | 19 | 25 | 22 | 33 | 59 |

| Salford | 553 | 124 | 53 | 51 | 76 | 56 | 15 | 20 | 7 | 21 | 7 | 21 | 79 | 0 | 23 |

| Sheffield | 422 | 123 | 33 | 55 | 22 | 70 | 6 | 35 | 8 | 7 | 19 | 16 | 20 | 11 | 1 |

| Sheffield Hallam | 585 | 163 | 55 | 48 | 73 | 112 | 13 | 38 | 9 | 14 | 31 | 9 | 21 | 0 | 0 |

| Southampton | 394 | 119 | 43 | 43 | 46 | 43 | 12 | 14 | 16 | 24 | 16 | 16 | 1 | 0 | 2 |

| St Andrews | 342 | 89 | 36 | 48 | 20 | 36 | 10 | 22 | 21 | 14 | 19 | 14 | 0 | 0 | 11 |

| Staffordshire | 421 | 130 | 29 | 35 | 34 | 68 | 16 | 29 | 16 | 12 | 6 | 3 | 35 | 0 | 11 |

| Sunderland | 733 | 160 | 64 | 74 | 98 | 112 | 16 | 28 | 10 | 10 | 50 | 11 | 0 | 60 | 40 |

| Surrey | 804 | 221 | 53 | 74 | 115 | 125 | 18 | 39 | 20 | 14 | 59 | 20 | 4 | 35 | 6 |

| Sussex | 447 | 132 | 36 | 69 | 54 | 86 | 17 | 14 | 9 | 2 | 6 | 11 | 0 | 0 | 12 |

| Swansea | 396 | 108 | 23 | 27 | 26 | 77 | 15 | 35 | 11 | 7 | 20 | 14 | 22 | 1 | 11 |

| UCL | 614 | 170 | 77 | 78 | 101 | 62 | 19 | 30 | 25 | 15 | 9 | 14 | 6 | 1 | 7 |

| Ulster | 465 | 109 | 58 | 33 | 80 | 34 | 13 | 22 | 37 | 9 | 9 | 11 | 0 | 50 | 0 |

| University College Birmingham | 411 | 110 | 75 | 33 | 48 | 67 | 10 | 27 | 17 | 3 | 3 | 10 | 0 | 8 | 0 |

| University of the Arts London | 614 | 112 | 48 | 40 | 112 | 193 | 6 | 33 | 10 | 22 | 8 | 7 | 0 | 0 | 24 |

| Warwick | 490 | 155 | 47 | 59 | 51 | 60 | 12 | 30 | 17 | 5 | 24 | 13 | 5 | 4 | 6 |

| West of England, Bristol | 360 | 92 | 27 | 38 | 55 | 40 | 14 | 20 | 15 | 8 | 15 | 13 | 1 | 17 | 5 |

| Winchester | 522 | 103 | 33 | 59 | 73 | 178 | 21 | 19 | 11 | 3 | 1 | 4 | 0 | 19 | 0 |

| Wolverhampton | 608 | 150 | 65 | 25 | 50 | 150 | 23 | 25 | 25 | 13 | 50 | 33 | 0 | 0 | 0 |

| Wrexham Glynd?r | 513 | 113 | 53 | 57 | 97 | 8 | 8 | 42 | 30 | 22 | 73 | 7 | 0 | 3 | 0 |

| York | 318 | 131 | 31 | 32 | 25 | 9 | 7 | 21 | 14 | 5 | 19 | 7 | 2 | 0 | 14 |

| York St John | 586 | 124 | 43 | 60 | 82 | 60 | 39 | 64 | 54 | 24 | 14 | 12 | 0 | 0 | 10 |

The data has been filtered to exclude universities where there were not enough respondents, or where the results included significant outliers.

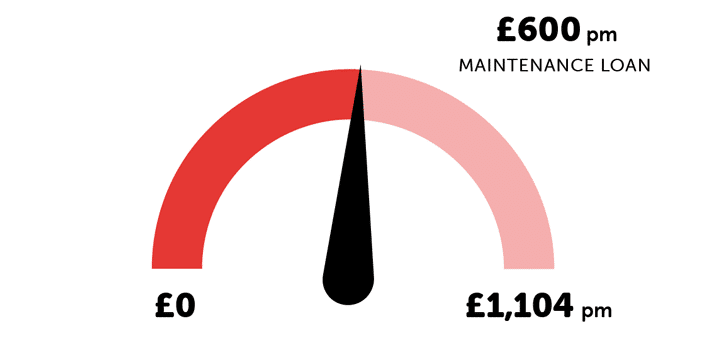

Is the Maintenance Loan enough?

It's all very well working out how much students spend each month. But the big question is, how do they pay for it?

The majority of students will be eligible for some form of Maintenance Loan to cover their living costs at university. However, most students report that it doesn't stretch far enough. The average student receives just £600 a month from their Maintenance Loan, which falls £504 a month short of covering the average living costs (£1,104 a month).

In fact, 58% believe the Maintenance Loan isn't big enough.

Students told us:

- Student Finance offers the bare minimum. I know many students that are having to find extra funds elsewhere or having to drop out.

- I avoid going out with friends to save money and it really impacts me.

- Student Finance barely gives enough money to live on! If that honestly. Rent can be super expensive and the whole idea of university is to study and learn – but the majority of that learning time is taken up by a part-time job…

Half of students (50%) turn to their parents for extra funds, with students getting an average of £171 a month from their mums and dads.

But, fewer students than last year are relying on money from their parents. Many are turning to ways to make money from home, and the proportion of students getting a part-time job rose from 56% in 2023 to 58% in 2024.

Some students turned to less conventional ways to fund themselves during university – from stocks and shares (4%) and social media (3%) to cryptocurrencies (3%) and sex work (2%).

It's clear that the Maintenance Loan isn't enough to cover living costs for the vast majority of students. The government needs to make some serious changes to Student Finance in order to fix this.

To make your Maintenance Loan last longer, check out our guide to budgeting at university.