Student Money Survey 2016 – Results

UPDATE: View our 2024 National Student Money Survey.

Towards the end of the academic year we stop talking and start listening to what current students have to say about their financial situation at university.

Over 2,000 of you spoke up in our National Student Money Survey this year, so a massive thank you to all of you who took part!

The opinions and insights below represent a wide spectrum of the student population - and some of the results are pretty shocking.

Strap yourself in: it's time to find out what students really think about their finances.

What's on this page?

What's it like living on a student budget?

While no one expects living on student budget to be an easy ride, we were shocked to hear 80% of students worry about having enough cash to get by.

We also found that money worries affect how (or whether!) students eat, and can even knock their grades, with some having to balance studying against paying rent and other costs.

Student comments:

- As a student I am constantly broke and worried about money. I feel as if I can't get the best out of uni life because of lack of money.

- Worrying about money has led to me skipping lunch on a regular basis to save money.

- I budget for £20 a week on food because otherwise I would not have had enough savings to buy my food for the whole uni year. This tends to mean that I don't have enough money to buy a full weeks worth of food and have to only have 4-5 meals a week.

- I don't receive enough student loan, therefore I have to work a lot which has effected my grades.

- I have had to drop out of university due to not being able to afford to live here!

- I've walked into exams emotionally and mentally drained without correct nutrition. Student finance makes us feel like we're cavemen living off of scraps at times.

- My posh flatmate eats fondue and Haagen Daas while I'm left with a loaf of bread in my fridge.

One reason so many students struggle with money worries may be due to poor budgeting skills: 1 in 4 of those surveyed admitted they'd never budgeted before in their lives! That may also explain why our budgeting guide is one of the most popular on this site, with students trying to get clued-in on stuff they say they aren't taught at school.

The maintenance loan isn't enough

The biggest financial issue for the majority of students is that the maintenance loan simply doesn't stretch far enough.

As demonstrated by the gauge above, the average student spends £790 per month (full stats here), but the average maintenance loan for a student living away from home and outside London is only £540 per month – a massive £250 shortfall every month. That leaves students struggling to make up the difference.

Unsurprisingly, the students we asked overwhelmingly agreed that the loan system sucks. The majority say they need more money to help with living costs, and a fairer way to assess how much they get.

How do students make money?

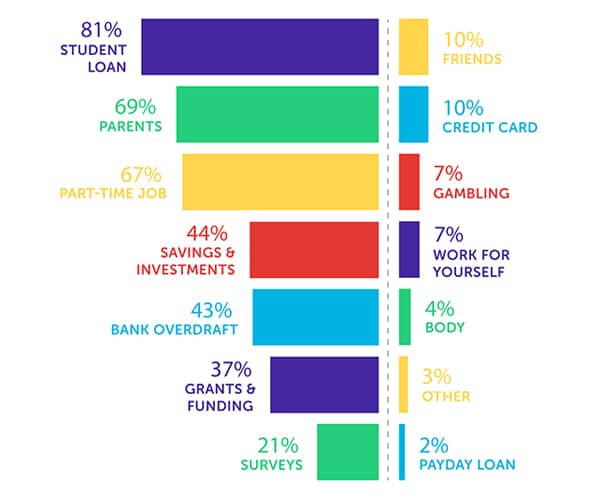

First of all, where does the money come from? Here's what students told us about their sources of income.

The student loan may not be large enough but it's still the first port of call for most, with 2 in 3 students turning to their folks to help plug the gaps. A similar number work part time while studying in order to get by.

Interestingly, the gap between the number of students relying on their parents for financial support and those turning to part-time jobs has shrunk since last year. Fewer students are asking their folks for top-up cash, while a growing number rely on part-time work - which suggests students are attempting to be more financially independent.

On the other hand, there's been a large increase in students turning to paid online surveys and gambling as their main source of income. Future students take note: it sounds as though the struggle to make ends meet is only getting harder, and many are turning to more desperate measures.

The good news is that the reliance on payday loans companies has dropped, possibly thanks to our campaigning against them.

What about savings?

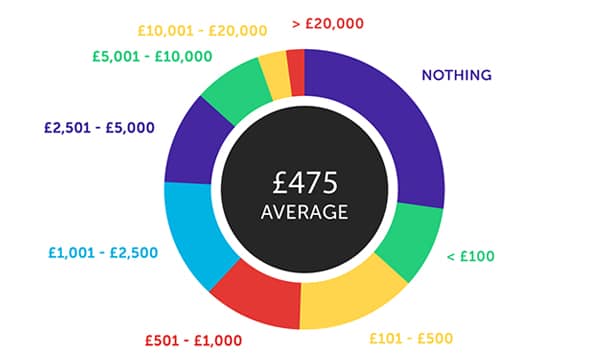

Almost half our poll say they turn to personal savings for support - but how much do students have squirrelled away for a rainy day?

The chart above paints a pretty impressive picture of savvy savers stocking-up to offset the costs of studying.

A noticeable but predictably large chunk of students have no savings at all to fall back on, but an average of £475 in students' savings accounts isn't bad at all (and it's £133 up on last year). Having said that, the average UK citizen reportedly has over £1,000 stuffed in their savings account, so it's still well below the national average!

With over half the students surveyed having less than £500 in savings, it can mean a lot of catching up to do after university as, otherwise, some financial goals (such as buying a house) seem pretty slim.

One student said:

I have used all of my savings on living expenses this year, I had £1500 before I came to university from a summer job and after complications due to the necessity to rent privately this has been depleted to £30

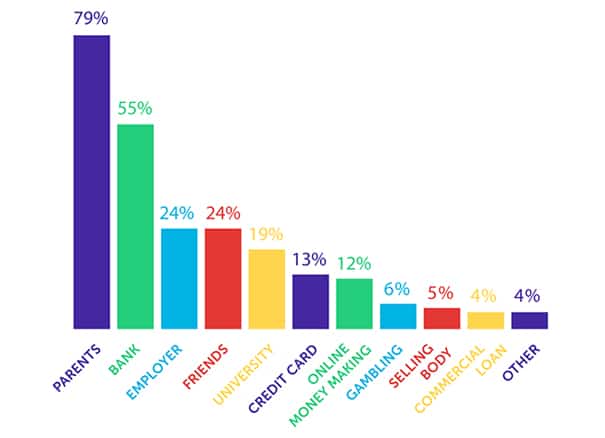

Where do students turn in a cash crisis?

With the maintenance loan simply not stretching far enough, unexpected bills or expenses can be major stresses for students.

We wanted to know how students cope in an emergency: where do they turn to first when they're in desperate need of quick cash?

The bank of mum and dad remains a sturdy lifeline but, once again, this year we found that 1 in 10 students resort to gambling or selling their body for emergency cash. Both obviously carry their own risks - not to mention the emotional fall-out.

I have 3 part time jobs totalling 40 hours of work a week and still don't have enough for the basics.

We also discovered that despite parents being a top choice for cash ...

Parental top-ups is a tricky one to address. What the government stumps up in student loans varies by how much a student's parents are earning - with the assumption that parents will pay for the extras.

However, we all know every family situation is different, and some parents are either unable or less willing to give their children extra funds.

Whether parental income should be the basis of student finance (or extra support) at all is a contentious issue, with a massive split in opinions from students caught in the middle.

Student comments:

- I find it very hard asking parents for extra finance especially when the bulk of my expenditures go on socialising and drinking

- Although my parents' combined earnings are over £50k this does not mean they are able to give me money towards my costs of living, it would be better if loans were based upon a combination of parental income, university location (cost of living), required study hours and grades

- Parents should not be expected to continue to support their child through education after 18.

- I think the way student finance is worked out is totally unfair. I have numerous friends who's parents are earning in some of the highest brackets but that their outgoings are almost the same, meaning they're not able to give their kids as much money as needed to survive uni.

- I'm from a financially stable background and have family who can support me if i need help, unlike some of my close friends who use their loan to help support their own family.

The most shocking ways students make money

We asked students to tell us the craziest things they've done to turn a buck at university. Some money makers turned out to surprisingly inventive - but others are decidedly riskier.

Student comments:

- I ate an entire flower for £20

- Ate a fish eye for a bet

- Being a date for an older lady

- Buying a Uni grammar book on eBay and then selling it back to the University book shop for a profit.

- Checking for pound coins left in supermarket trolleys and thereafter pushing the trolleys to their point of storage.

- For a dare, I stripped down for £50 (very embarrassing).

- Ghostwriting other students' coursework (I know it is not ethical, but I have no other choice to pay for my own education, so basically, when I finish my own degree, I will probably have completed at least ten other full degrees at the same time, including undergraduate, postgraduate and even two complete PhDs).

- I let a guy take a picture of my high heels, just the heels, not even my foot, for £25.

- Performing online in adult webcam shows.

- Selling my used underwear.

- I was offered a job as a professional companion. All this included was going to tea, dinner or lunch in a public place with people and having conversations with them. I had to dress to an extremely high standard - dress, heels, jewellery etc and sit and have a conversation with a client for about and hour or two. It included no touching or holding hands, no kissing or anything involved with prostitution. It was literally just sitting and speaking with these lonely people who didn't have any friends. I was paid around £200 this one time!!

- Selling Nitrous Oxide to friends.

- Selling videos of my feet (no joke)

One student even said:

Although it sounds like a joke to start with, many students will turn to illegal dealings or selling their bodies in order to get money. Due to rap songs and social media, these actions have been made commonplace.

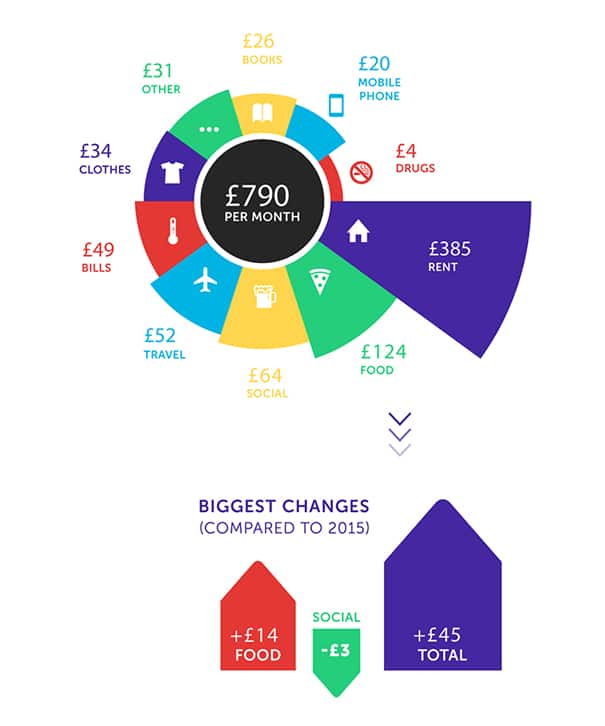

What do students spend their money on?

This year saw the average student spend jump a whopping £45 a month. Rent costs have risen, but the biggest increase we've spotted is on food – up £14 a month, equating to £168 a year.

We also noticed that average spent on socialising has dropped: are students cutting back on drinking to make ends meet? Realistically, many students can't even cover the basic cost of rent with their maintenance loan as prices have soared while the loan has remained relatively stagnant.

Although rent continues to be the biggest burden for students, rent strikes across universities in London and a recent call for the abolition of estate agency fees suggests the situation could be set to improve.

One student said:

Accommodation prices for students are too high, I get a lot from my maintenance grant and loan and I still only have £11 a week to live off once paying my rent.

Do students understand their loans?

There's been a lot of confusion lately about the supposed increase in student loan interest rates by the government, as well as the privatisation of the loans (both of which we revealed to be myths).

One thing that's clear is that students simply don't know enough about the huge financial agreement they've entered into when taking on a student loan.

Unbelievably, we found over 67% don't understand how their student loan works. That means a huge number are signing up to borrow vast amounts of money with no clue about what their repayments will be, how much interest they'll be charged, or the small print of student finance.

Most say their reason for entering these agreements blindly is that "everyone else does it" and that "there are no alternatives" to the student loan.

One student said:

I am worried about the new terms of paying back loans, I have no idea what is true or if changes affect me.

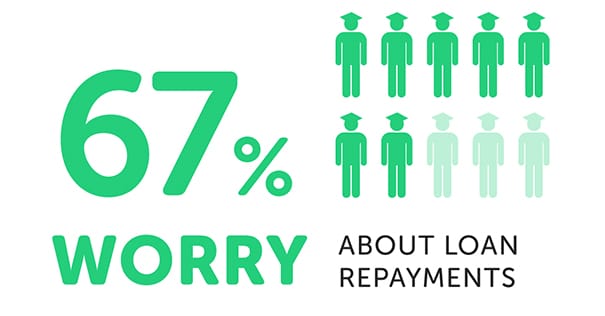

The confusion and misunderstanding leads to students living in fear of having to pay back huge debts (not helped by media scaremongering!). 7 out of 10 students say they worry about having to repay their loans, which itself comes with long-term and drastic consequences.

Student comments:

- Cheated by government with student loans repayments. That's the biggest worry now from uni.

- Totally shocked when I got my Student Loans Finance bill through the post - there was way more interest to be paid that I had realised!

- The main thing that worries me is if the government can change the terms and conditions of our student loans so it will never get written off!

- I'm very worried that I'll never be able to pay my student finance loan back. I'll be in £100,000 of debt by the time I graduate and interest alone will be over £3000/year alone

One big factor behind all the confusion may be the education young people get about loans and student finance - in fact, it's clear most don't get enough advice before or during university.

So, what's the deal - are teachers, parents and the government failing to get young people financially savvy enough to handle university?

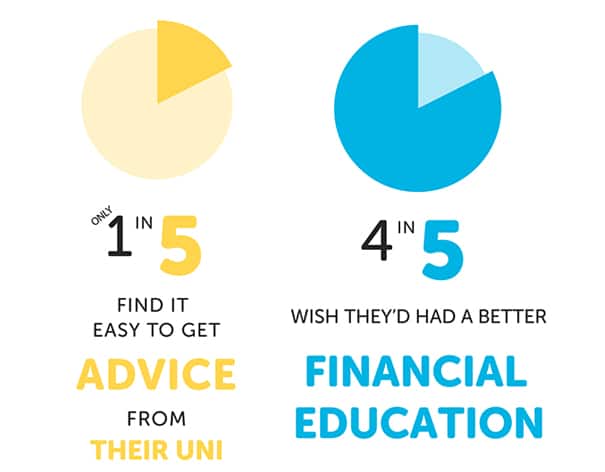

Well, 4 in 5 students claim they started university without essential money skills - that's anything from advice on renting a property to understanding the student loan interest rates.

What's more, only 1 in 5 of those who asked for money advice at uni found it easy to get. Whether that's due to a lack of support, funding or advice, or just not enough signposting to the resources, it's a glum statistic.

Student comments:

- Financial education should be in the curriculum or at least taught a little in secondary schools! It would reduce the amount of people that come out of uni with debts, overdrafts etc.

- Schools need to give better education on how to handle money, when a student leaves high school and can get a loan it usually gets blown on drinking and nights out etc.

- Universities should give more financial assistance considering we pay £9000 a year.

- NO ONE - i mean NO ONE - prepares you for the skint student life. No one explains financial support or where to go for that and absolutely no one explains how f*cking hard it is to get help!!

Is university good value for money?

Naturally, we wanted to know about the real bottom line: is university worth the spend?

Shockingly, over half of those surveyed say university is not good value for money - and one of the main reasons is the lack of job prospects after graduation. Ouch.

Student comments:

- I feel very strongly that my degree was not worth the money spent on it (£9000). I completed a BA in which I was provided with very little contact hours with lecturers and was very much left to work through my degree myself.

- What is the point of doing a degree? We are all going to end up in a part time job which we could have got, without the degree we studied and stressed over

- University course fees are obscenely expensive. I am paying the same amount (£9000) per year for an BSc(Hons) Equine degree, which is no where near as academic, time consuming or as difficult as, for example, a medical, pharmaceutical, law degree. My degree is not worth £9000.

Thinking about life after university

Student comments:

- I used to feel confident in finding a job after graduating, but since applying to a few I'm feeling more anxious about it.

- It is difficult to find work experience after graduating when many places expect you to work for nothing for placements or internships but cant afford to take on those opportunities because of money struggles.

The average graduate salary expectation of those questioned was just £22,000 - not great when you're spending £9,000+ each year on a top-notch degree. And, while most graduates can expect their salary to go up over time, a low starting salary leaves many struggling in their first few years on the job market.

You'll also notice the shocking gap between what men and women expect to earn in their first job after graduation. According to our survey, female graduates expect to earn £3,500 less than their male counterparts when landing their first job.

The worrying thing is that expecting less now may mean an even bigger gender pay gap once students get a foot on the job ladder - but just who is putting out the message that women should expect to earn, or be worth, less?

Earlier this year, the government announced a Postgraduate Loans for Master's degrees in 2016/17. The new loan will give graduates access to up to £10,000 to help with the cost of postgrad tuition fees and living costs.

Our survey showed over half of current undergrads are more likely to do a Master's degree now there's a new loan in place. That could mean far more students going into higher studies - or it could mean the competition for places on MA courses gets much tougher!

Either way, it's great to see more students having access to education beyond an undergraduate degree - but whether the money worries ease up remains to be seen.

One student said:

Even though Masters loans have come into place, they just aren't big enough, and I will always be living in debt. Is it worth it for a better education? I'm less and less sure every day.

In light of the results Save the Student's Founder, Owen Burek, comments:

The results speak for themselves: students are hard done by. Not only do they struggle to make ends meet on a lacklustre loan, but they are also disillusioned with the terms and conditions bundled in with student finance.

It's a sad state of affairs that some students are turning to drastic measures to make ends meet but, for a minority, there is little alternative. In this instance I would tell all students that if they are having any money worries at all they need to get in touch with their university or student union for support.

After three or more years of hardship, graduation doesn't always spell the end of money worries - and it seems that students are entering the graduate world wondering if their degree was really worth the money they've paid for it.

It's time to overhaul the student loans system to make it fairer and more realistic, and to give students a fighting chance in their future lives. I urge Theresa May to stand by her commitment for a fairer government by looking into student finance as a priority.

Do students get an easy ride, or do you feel under-valued and over-charged? Let us know in the comments below!

For a complete guide to budgeting and student finance, download our free “Essential Student Guide to Finance” eBook.

Want to know more about the survey, or need case studies, comments or quotes? We’re happy to help – just drop us a line.

- Source: The National Student Money Survey 2016 / www.savethestudent.org

- Survey polled 2,127 university students in the UK and ran May-June 2016

- 2015 statistics taken from the same survey conducted last year (source).