Student Money Survey 2015 – Results

UPDATE: View our 2023 National Student Money Survey.

Towards the end of the academic year we stop talking and start listening to what current students have to say about their financial situation at university.

Almost 2,000 of you spoke up to reveal the true costs of uni in our National Student Money Survey 2015. Thank you for being so vocal about the things that matter, that you wish were different, or that just plain got your goat. Here's what we learned.

What's on this page?

What's it like living on a student budget?

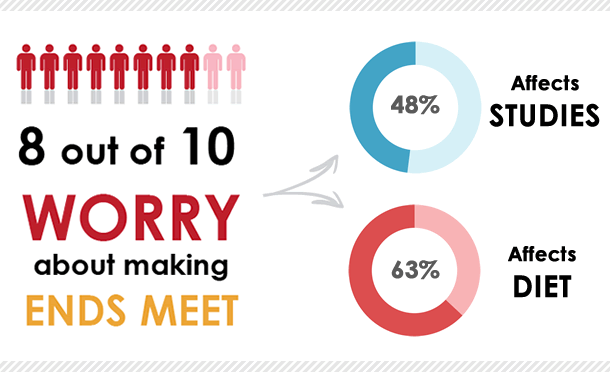

A massive 80% of you told us you worry about having enough money to get by - so much so that it affects the one (official) thing you're at uni to do: study.

A massive 80% of you told us you worry about having enough money to get by - so much so that it affects the one (official) thing you're at uni to do: study.

Food also takes a hit in the student budget, with 2/3 having to pay rent and other costs ahead of eating healthily or as often as you should.

Student comments:

- Bills, travel and food prices are going up, but funding isn't

- Sometimes I have to work more than I attend classes just so I can afford to stay in uni

- I have gone 1 or 2 weeks living off crackers or toast ... which definitely does not help you concentrate in class

- Student rent is an institutionalised rip-off

- Everything is overpriced, especially food on campus, where a sandwich alone can be £4

- I have had no choice but to get a job. I don't believe that FULL-TIME students also have to get a part-time job!

One thing we heard repeatedly is that students are really struggling to make ends meet on their income, with subsidies from the maintenance loan not fit for purpose. Many told us they thought the calculations were unfair, toughest on middle-income families and unrealistic (not even covering the cost of rent for some).

One thing we heard repeatedly is that students are really struggling to make ends meet on their income, with subsidies from the maintenance loan not fit for purpose. Many told us they thought the calculations were unfair, toughest on middle-income families and unrealistic (not even covering the cost of rent for some).

Student comments:

- My maintenance loan doesn't even begin to cover the cost of the cheapest uni accommodation, let alone general living

- I've been fine with money. Maybe that's because I don't follow the typical student lifestyle of drinking and clubbing

- Those whose PARENTS are high earners are suffering in uni. We are adults and should not be judged based on somebody else's earnings

- My loan has initially gone towards rent and bills but my living costs come from my part-time job

- I personally think that students are ridiculously lazy when it comes to saving money and taking care of their finances.

Click to find out!

How do students support themselves?

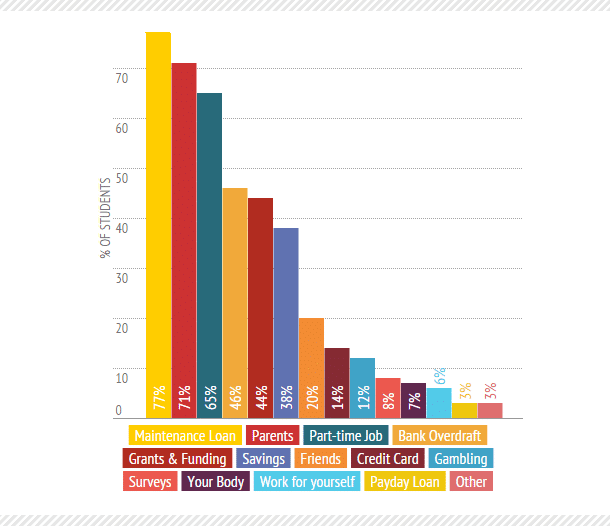

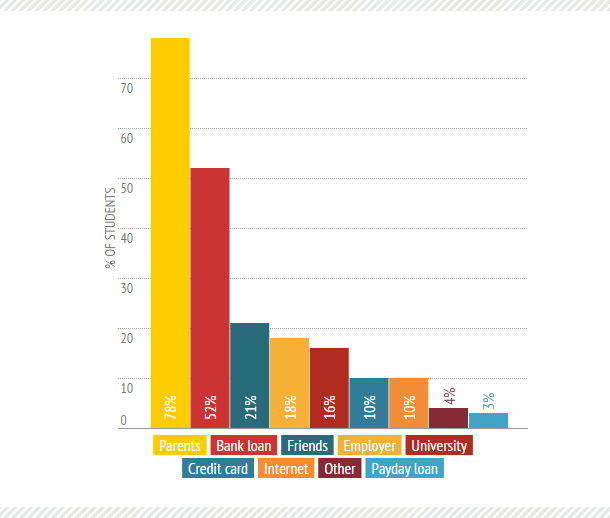

With the maintenance loan, savings and even part-time work not always enough, it's still parents who are leaned on most to cover basic living costs. The number resorting to payday loans is slightly up this year (from 1% to 3%), while those relying on savings jumped from 10% to 38%. A part-time job is still first port of call for most students, but many complained of a lack of availability and low wages - although more of you are starting businesses for yourselves.

With the maintenance loan, savings and even part-time work not always enough, it's still parents who are leaned on most to cover basic living costs. The number resorting to payday loans is slightly up this year (from 1% to 3%), while those relying on savings jumped from 10% to 38%. A part-time job is still first port of call for most students, but many complained of a lack of availability and low wages - although more of you are starting businesses for yourselves.

Student comments:

- I worked in McDonald’s before trying 'topless talking' online. I earned three times as much and I didn’t have a schedule (nor did I come home smelling of pickles…)

- Did a paid medical study where I was infected with flu and monitored in a quarantine for two weeks

- Met a girl on a night out who said she wanted to have sex, so I joked and said "That'll be £20", but then she gave me £50 in advance

- I'm broke, my overdraft is EMPTY & I have two zero-hour contracts jobs

- I feel the damage I have done through payday loans etc. will haunt me for the rest of my life and reduce my future job prospects.

This is the most worrying finding of this year's survey. Students struggling to manage on the maintenance loan and denied access to jobs/fair pay are turning to high-risk alternatives including betting, medical testing and Adult work (especially web cam gigs).

This is the most worrying finding of this year's survey. Students struggling to manage on the maintenance loan and denied access to jobs/fair pay are turning to high-risk alternatives including betting, medical testing and Adult work (especially web cam gigs).

More strange ways to earn a buck:

- I had to be a 'burp' for an online kids’ TV programme and got paid £10

- I hired my dog out as a stud. He's only had one job so far, might put him up on Gumtree?

- Running McDonald's trips for friends. I buy them McDonald's with money they give me + money for my personal delivery. Didn't cost anything to walk to McDonald's for me, nor was the extra pay too high, but I usually earned an extra few pounds per trip

- Holding a stranger's cat while she went shopping in Furniture Village. Made £20 out of it

- Confidence coaching (basically fake dates to help shy people)

- Taking the blame for someone's flatulence at a party

- Sucked my friend's toe for £100

- Friend was unable to gamble due to lack of ID but still wanted to put bets on. So he gave me the money and told me his bet. His bet choices were always terrible so I took the money and risked paying out myself if the bet came in. None of his bets ever came in.

Where does the money go?

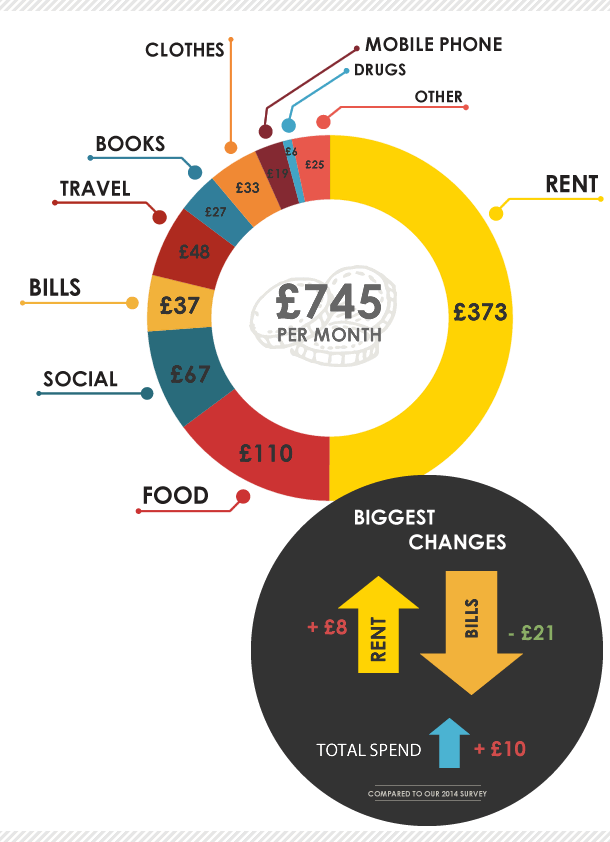

This year saw a modest £10 increase in average monthly spending, which may reflect smarter ways students are trying to make ends meet - especially when it comes to bills. But, while spending £21 less per month on bills equates to £250-worth of savings over the year, increased spending elsewhere means there's no obvious surplus (or splurging).

Rent remains the biggest cost, sucking up exactly half of total spend.

Student finance failing students

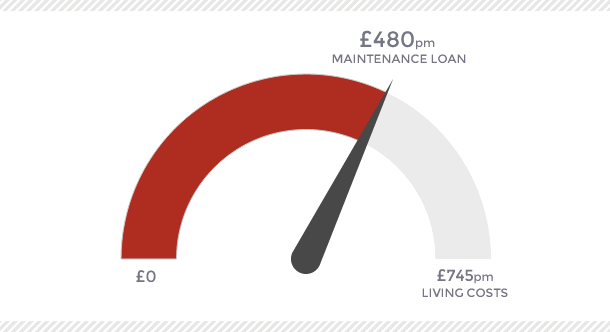

From the results above, we can see that the average student in 2015 spends £745 a month. When you consider that the average maintenance loan (for a student living outside of London) only covers £480 of living costs each month, it leaves students with an extra £265 or more to find each month.

How much do students have in savings?

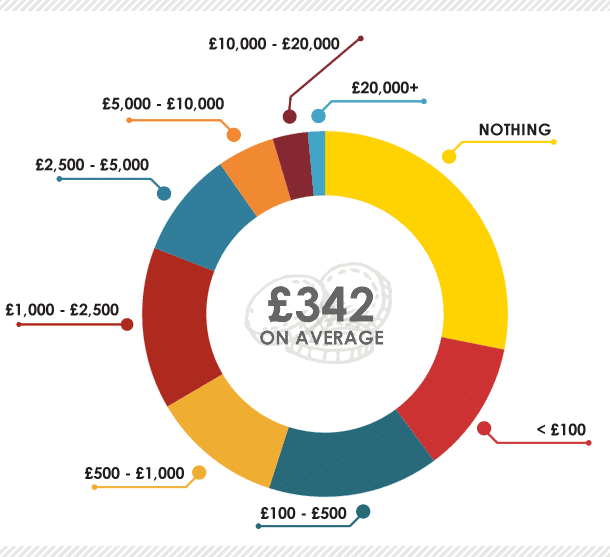

While the maintenance loan isn't enough to live on for most, more than half of the students we talked to had less than £500 in savings (or to put it into perspective, just over one month's rent for most folk). That leaves many without emergency funds or a nest egg to help with life after uni.

Student comments:

- I definitely would've saved a lot more money if I knew how expensive student accommodation was before I attended university

- As a low household income student I get an incredibly generous amount of bursary from my university - much more than I need

- Living in London has completely rinsed my savings (which were quite substantial) before uni

- Without coming to uni with savings, my parents and my job at home, its likely that I would've dropped out by the end of first year

- It's frustrating when you're already paying off multiple credit cards at 19.

Where do students turn for emergency money?

With more and more students struggling to keep up with rent and the growing costs of living, it’s important to think about who or where they turn to in a financial emergency.

Students told us that they would rather ask their bank, friends or employer for financial help before turning to their university. Here are our full findings:

It seems that in a time in their life when students are looking to become more financially independent, the majority still depend on their parents for financial support. However, one-third of those surveyed also feel that they do not receive enough help from their parents.

This is a more complex issue: many students are frustrated by the strain higher education puts on the household budget (something of which students are actually very aware).

Many feel guilty asking for support, or furious that their hard-working folks are being penalised by the Government. The majority (82%) say the calculations are unfair in not accounting for individual circumstances, parents' ability to pay, and the real costs of living.

Tom Levin of the National Association of Student Money Advisers, comments: "My advice to students and parents would be to familiarise themselves with the support services on offer at their institutions: NASMA members around the country are keen to engage with students to improve financial capability and help those in hardship."

Student comments:

- It's hard seeing others from poorer families getting large sums of money and going drinking and shopping all the time, its not fair

- I came to university to be independent, not to still rely on help and financial support from my parents

- [In Brighton] our rent is so much more than northern universities, yet only students in London get extra money from Student Finance

- University is affordable if you are very poor or very rich - not if you are in between!

- I'm learning how to survive on a budget and it's better than missing out on my education!

- I feel bad that my parents give me an allowance. I would rather borrow more and pay more back

- The student loan system [isn't fair] as I get minimum but my parents are putting 3 people through uni

- I think it is really important for students to be taught budgeting and saving techniques not just for uni but for life in general

- Unfortunately its easy to cheat the student finance system, the best way to do this is by having divorced parents

- Students should be treated the same regardless of their family background/income to make uni life more affordable.

How well equipped are students for uni life?

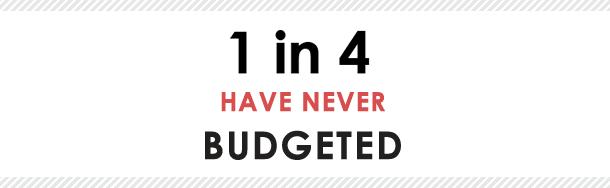

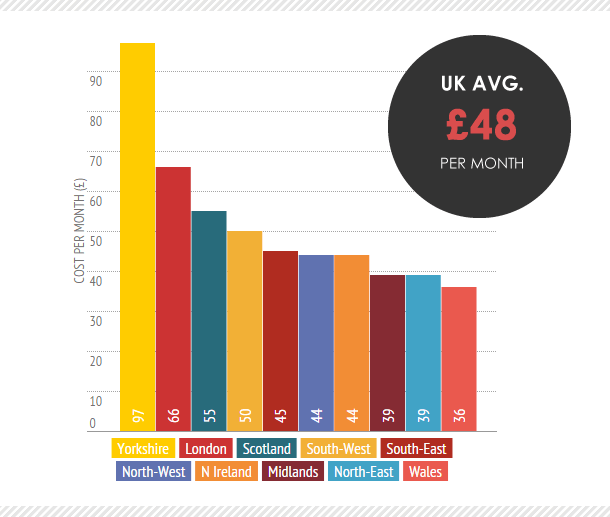

Despite many students being significantly worried about money or struggling to cope, a quarter still don't track their spending at all. If that's you and you just don't know where to start, you'll find everything you need in our guide to budgeting.

The realities of financial hardship at university catch many students by surprise, with the majority telling us they wished they'd learned more about money management before starting a degree. Only 1 in 5 students said they found it easy to get help or emergency cash from their university.

The realities of financial hardship at university catch many students by surprise, with the majority telling us they wished they'd learned more about money management before starting a degree. Only 1 in 5 students said they found it easy to get help or emergency cash from their university.

How much does uni choice affect living costs?

We took a deeper look at how far the student budget stretches in different parts of the country, concentrating on three key spends: rent, travel and socialising.

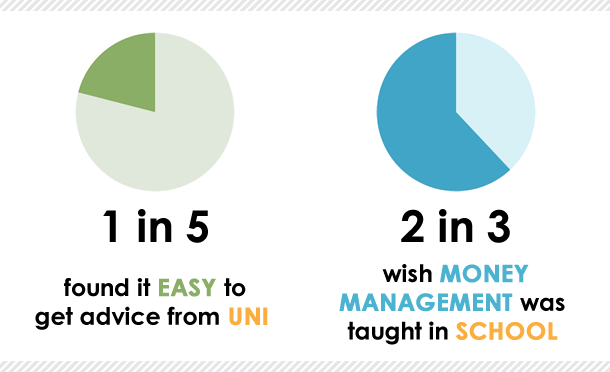

Rents by region

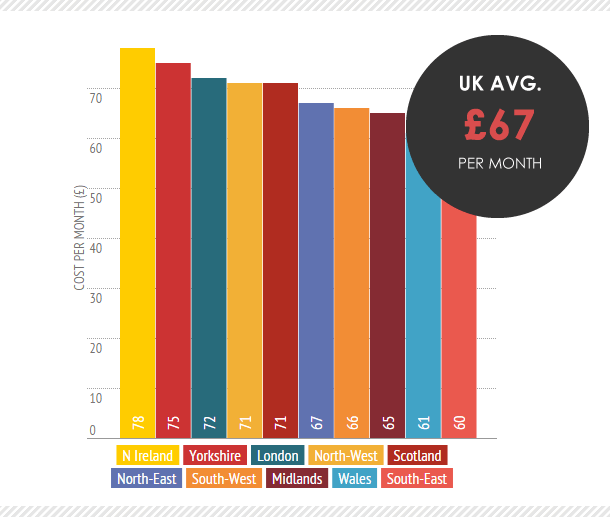

When totting up how much uni is going to set you back, it's well worth comparing how costs vary around the country before you sign on the dotted line. While it's no surprise that London charges the highest rents, students in Northern Ireland reported paying up to 2.5 times less (yet they receive just £500 less than the average maintenance loan that students in England can get).

Generally, it still pays to head north, with costs falling the further you go. Our sums show that you'll be hard-pressed to find rent for less than the UK average of £373/month south of the Midlands.

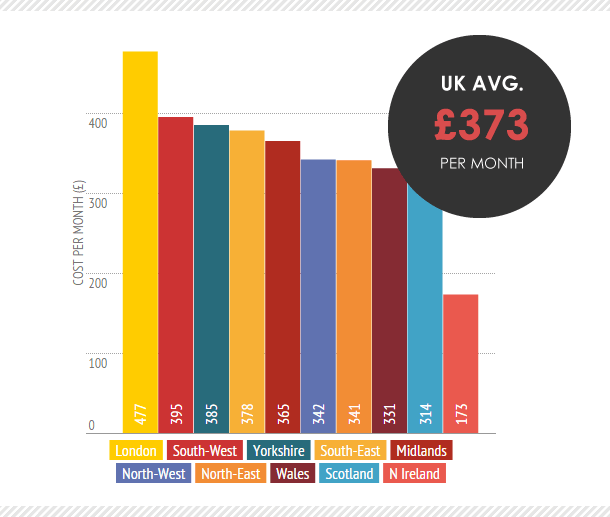

Travel costs

One aspect of the budget you don't want to under-estimate is travel, with students telling us they pay an average of £48 a month across the UK, while students in Yorkshire pay twice that.

This is one figure that's tied to cheaper housing but, while it can be cheaper living further from campus, it can inflate your travel costs to get there and back every day, even with student concessions.

Socialising

This year's survey showed a slight increase in the cost of getting your kicks, with students setting aside just £67/month to socialise. Subsidised costs on campus and student discounts elsewhere are essential to getting more for your dollar, though, with the average cinema ticket otherwise costing a tenth of the monthly spend (£6.54 before snacks, though some cities charge much more).

The low monthly spend doesn't match the cliché of students supposedly living it up on easy street, and leaves us wondering just how easy it is to unwind away from the stresses of studying and surviving.

Student comments

- Paying first month's rent and deposit at the end of the year and housing over summer is £1,800 I don't have

- Not buying drinks out ever is a brilliant way to save - hip flasks and pre-drinking are the way!

- I came to uni with £3,000 in savings ... Ended up spending all of that in first year because campus accommodation was too expensive

Is university a good deal for students?

Finally, we wanted to know how valuable students think their degrees will be. We asked two questions to help answer this: whether students think their course is good value for money, and how confident they feel about getting work experience or a full-time job after graduating.

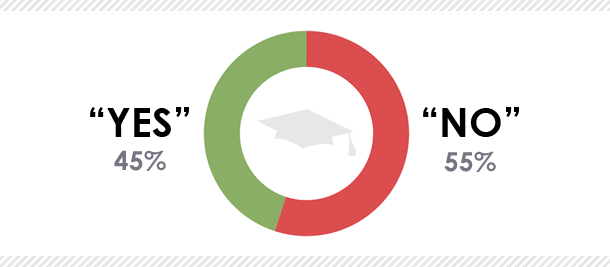

Just over half (55%) said they don't believe their course provides value for money. Others we've since talked to are equally unaware that they're entitled to complain.

Just over half (55%) said they don't believe their course provides value for money. Others we've since talked to are equally unaware that they're entitled to complain.

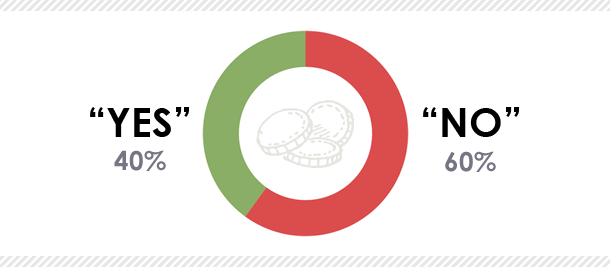

Only 2 out of 5 (40%) were confident about finding work later on.

We also found that, somewhat worryingly, half of the students surveyed didn't understand the terms of their loan agreement (the same number of students also worried about repaying the loan when the time came).

We also found that, somewhat worryingly, half of the students surveyed didn't understand the terms of their loan agreement (the same number of students also worried about repaying the loan when the time came).

Student comments:

- I am a medical student so I have a nearly guaranteed job at the end of my degree

- I'm paying £9,000 a year to be in for 8-10 hours a week

- Finding stable work after graduation is probably the scariest thing I've ever experienced

- University is too expensive and there's not enough jobs for it to be worth it right now

- My lecturers either just read off the lecture slides, discuss material that is completely irrelevant to the course, are impossible to understand, or have an extremely poor teaching style

- The holidays are very long, which when uni was free, was fantastic. At £9k, it's not exactly value for money

- The benefits of graduating with a degree and gaining a well paid career far outweigh the negatives of living with a limited amount of money.

There's clearly a lot more work to do to get students up-to-speed on planning for uni and knowing where to get help when the shilling hits the fan. But ultimately, student finance needs to urgently review the amount of basic maintenance loan it provides to all students to help cover basic living costs.

Save the Student’s Editor-in-Chief, Owen Burek:

1 in 2 students tell us they don’t understand the loan repayment conditions, yet are signing up for debts which aren’t fit for purpose. Maintenance loans don’t reflect real living costs, regional differences and parents’ ability to contribute – frankly, they’re out of touch with individual circumstances and student needs.

We’ve filled the knowledge gap of money management for thousands with our ‘Big Fat Guides’ to student money – but until access payments become fairer and more relevant, all we’re doing is papering the cracks. In the meantime, we aim to show all students where the money is, whether it’s from the system or by being smarter about saving.

Do students get an easy ride, or do you feel under-valued and over-charged? Let us know in the comments below!

For a complete guide to budgeting and student finance, download our free “Essential Student Guide to Finance” eBook.

Want to know more about the survey, or need case studies, comments or quotes? We're happy to help - just drop us a line.

- Source: The National Student Money Survey 2015 / www.savethestudent.org

- Survey polled 1,900 university students in the UK and ran between 1-12 June 2015

- 2014 statistics taken from the same survey conducted last year (source).