Student Banking Survey 2016: Results

UPDATE: View our 2024 Student Banking Survey.

Whether you're about to start university or heading back for more, it’s time to crunch the numbers that count! Here’s how UK banks stack up for students.

Hot on the heels of our research into how students manage their cash at university, it’s time to turn the spotlight on the banks that help (or hinder!) your ability to make ends meet.

Hot on the heels of our research into how students manage their cash at university, it’s time to turn the spotlight on the banks that help (or hinder!) your ability to make ends meet.

More than 1,500 of you answered our Student Banking Survey 2016 to give us the highs and hells of customer service, borrowing and bank charges – thank you!

Read on to see how your bank compares, whether you can get a better deal, or if you’re missing a trick or two...

What’s on this page?

Choosing the right bank account

How do students choose their accounts?

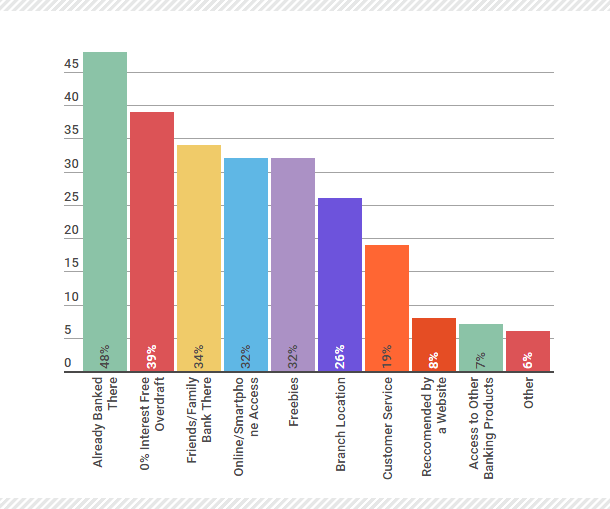

We asked students to tell us what prompted them to plump for their main account – and the results were pretty surprising. Why? Because despite most mainstream advice against picking an account just because you already bank there, nearly half of you do just that.

We also found an almost even split between choosing an account for its 0% overdraft (which lets you borrow emergency cash for free) and because friends and family banked there. And, contrary to the perception that students are always glued to their gadgets, almost a third of you say you pick your bank because of physical location.

1 in 3 of you also told us you don’t have a student account at all, preferring to rely on bog-standard banking instead. While that can work in your favour if you’re on top of your scratch, ditching student accounts when you’re eligible means losing out on the perks of free borrowing, freebies and flexibility.

If you just don’t know where to start, head over to the best student bank accounts to pick yourself a winner!

Are students savvy about switching?

There are good banking deals out there, and then there are duds – but, whichever you’ve got right now, how actively are you looking for better offers?

Well, a staggering 82% of you say you aren’t looking to trade. If that’s because you’ve got the best of the bunch, good for you! If not, you could be missing out on the free money triple-decker: 0% overdraft, interest on positive balances, plus freebies to boot.

Reckon switching is too complicated? It’s not: it takes less time to switch online than it does to whip up an essay.

Student comments:

- I got £150 for switching to First Direct (from HSBC who are the same company!) They don't have any branches or I'd give them a perfect score (sometimes you want to go and see a real person!)

- Easily accessible via the internet so you don't have to go all the way down to the branch to withdraw savings.

- The free 4-year rail card saves me a lot of money on my travelling to and from uni

- I was with Barclays originally, but after seeing my friends use Santander and how they were treated I decided to switch banks.

- I already had a normal account for a few years before switching to a student account – switch was hassle-free and they even gave me a credit card with £1,000

- No reason to change but I’m never excited about my bank

How satisfied are students with their bank?

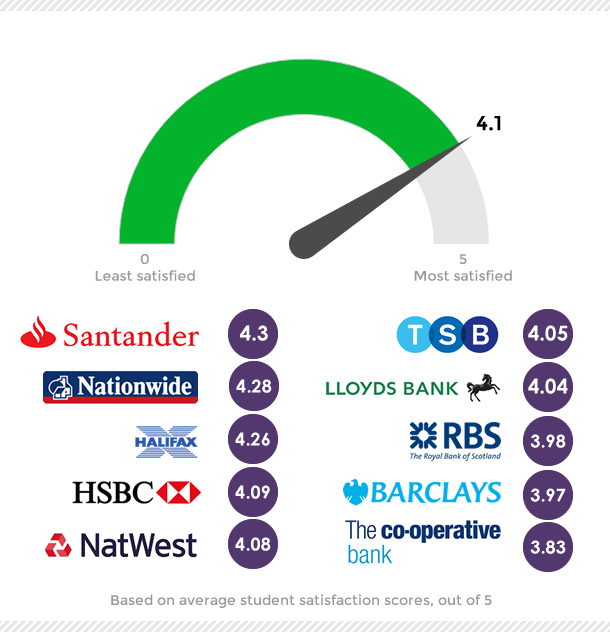

Having tackled how you lot pick-and-switch accounts, we wanted to know how you really rate your bank. The results here were surprising – but in a good way! The majority of banks featured in our survey get the student seal of approval, scoring at least 4 out of 5 for satisfaction.

Santander just comes out in pole position this year (up from second place last year), with Nationwide and Halifax incredibly close behind.

Remember that if you’re not satisfied with your bank, you don’t need to take it lying down: you need to speak up! Our guide to complaining the right way can help you sort it.

What are the most popular banks with students?

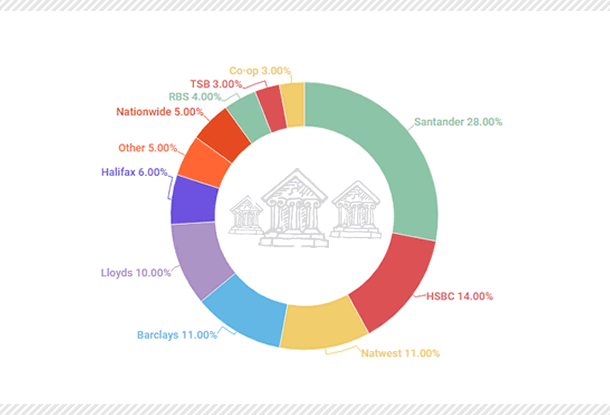

We have a winner! Almost a third of our survey (28%) told us they bank with Santander. As the bank you lot also rated the highest, Santander appear to be doing something right when it comes to winning hearts (and your cash). They’re followed by HSBC (14%) and Natwest and Barclays (11% each).

Student comments:

- Very gaff-prone, but they always fix the problem in the end and often in a way that benefits me overall. Two years worth of banking errors meant that I was recently repaid £85. It's as though I'd been saving and simply had no idea.

- They're evil but I ended up owing them a staggering amount of money and they aren't chasing me up for it (yet) so I can't be completely damning.

- They didn't give me my freebie and I gave up chasing them for it 🙁

- They have been really lovely for the past year. The person who helped me set up the account was great and the free railcard has been a lifesaver already.

- £750 overdraft helps greatly but shocking customer service

- they treat me like a human and pay me £5 to bank there

Student borrowing

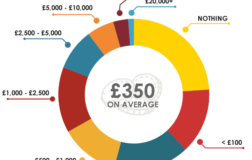

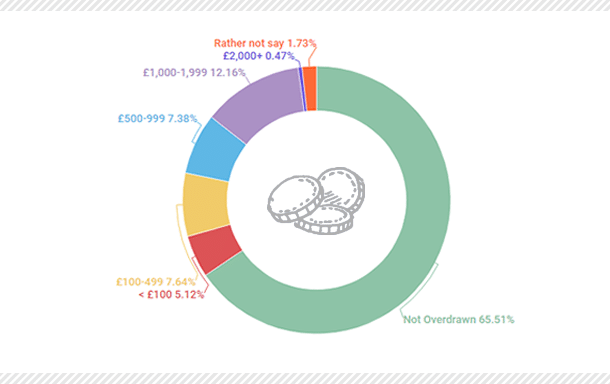

With a worrying 70% of students saying Student Finance leaves them short every month, that extra cash has to come from somewhere – but it’s not the bank. Two-thirds of you told us you’re not currently overdrawn, while the one-third living on borrowed cash are overdrawn by £500 or less.

Used the right way, overdrafts are cheaper than loans (or charges for accidental borrowing!), and can make it easier to manage debt: full deets in our guide to student overdrafts. Either way, get your hands on free student bursaries too.

Student comments:

- I wouldn't be able to get by without [an overdraft]. It is completely essential.

- The £2,000 student overdraft is very generous and does help towards paying rent/bills, maybe even the odd night out...or 10!

- I asked to not be able to go into overdraft, and put a limit of 0 on my account, but I once accidentally went over and didn't receive a warning or message, which got me a fine of 40 pounds

- I feel like they really benefit me being a student when I am stuck for cash

- Overdraft is good amount whilst a student. However a lot of interest added when you leave.

- Again the overdraft … having no interest makes less debt for students, especially ones who cannot even afford rent (even with student finance)

What do you think: does your bank help you out or take you for a ride? Share your tips, tactics or warnings below!

Need extra info? You'll find everything you need to know about managing your money at university in our free money cheatsheet.

About the Student Banking Survey 2016

- Want to know more about the survey, or need case studies, comments or quotes? We’re happy to help – just drop us a line.

- You’re welcome to reference or re-use data from the survey with credit and a link back to this page: "Source: The Best Student Banks Survey 2016 / www.savethestudent.org"

- Survey polled 1,505 current or recent students in the UK between 3rd-23rd August 2016

- Background reading: National Student Money Survey 2016

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-252x160.png)

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-100x100.png)