Student Loan refunds for Student Finance overpayment

Did you know that 100,000s of graduates have been owed money by the Student Loans Company for overpaying or repaying their loans too early? And you could be one of them!

Credit: kamui29 (background) – Shutterstock

We've previously uncovered data from the Student Loans Company (SLC) revealing that over 800,000 graduates made incorrect Student Loan repayments in 2021/22 alone, with the vast majority yet to claim a refund.

The best part is, that getting your money back is a lot easier than you might expect. There are no lengthy forms to fill in, no time limit on making a claim, and you could get hundreds of pounds back in just a few minutes. Here's your step-by-step guide to how it's done.

What's in this guide?

How many people are owed a Student Finance refund?

In 2023/24, the Student Loans Company (SLC) released its own data on Student Loan refunds for the first time.

Before then, data was only available via Freedom of Information (FOI) request. We submitted one in 2023 which gave us data from 2018/19 financial year to 2022/23 – but the figures are presented slightly differently, with only the older data showing how many people had claimed a refund at the time.

Here's an overview of how much people have over-repaid and how many have claimed a refund over recent years, depending on the different ways it can occur:

Student Loan overpayments in 2023/24

Student Loan balance already cleared in full

In 2023/24, 59,251 graduates continued to repay their Student Loan even after the balance was cleared in full. These overpayments totalled £23,134,738.

Repaying a Student Loan before the repayment period begins

| Student Loan plan | Number of graduates affected | Total repayments made |

|---|---|---|

| 1 | 1,122 | £255,434 |

| 2 | 28,720 | £4,822,382 |

| 3 | 6,137 | £1,502,798 |

| 4 | 1,738 | £326,279 |

| 5 | 5 | £397 |

| Total |

* As an individual graduate can have multiple Student Loans across multiple plan types, they may be counted in more than one row. As such, you can't add all of the rows together to give an overall number affected.

Repaying a Student Loan while under the repayment threshold

| Student Loan plan | Number of graduates affected | Total repayments made |

|---|---|---|

| 1 | 276,398 | £45,187,121 |

| 2 | 643,873 | £83,722,629 |

| 3 | 54,344 | £6,540,446 |

| 4 | 89,596 | £10,627,966 |

| 5 | - | - |

| Total |

* As an individual graduate can have multiple Student Loans across multiple plan types, they may be counted in more than one row. As such, you can't add all of the rows together to give an overall number affected.

Repaying a Student Loan under the wrong plan type

| Plan the graduate should be on | Plan the graduate was on | Number of graduates affected | Total repayments made |

|---|---|---|---|

| 2 | 1 | 17,441 | £7,063,747 |

| 4 | 2 | 2,431 | £580,666 |

| 4 | 1 | 703 | £269,415 |

| Total |

* As an individual graduate can have multiple Student Loans across multiple plan types, they may be counted in more than one row. As such, you can't add all of the rows together to give an overall number affected.

Student Loan overpayments in 2021/22

| Reason for mistaken repayment | Number of graduates affected | Total value of repayments | Average value per graduate | Number who have claimed a refund |

|---|---|---|---|---|

| Balance already cleared | 52,300 | £20,407,490 | £390.20 | 52,255 |

| Repaid early | 39,000 | £5,576,300 | £142.98 | 7,323 |

| Earning below the threshold | 856,475 | £102,479,879 | £119.65 | 18,136 |

| Wrong plan type* | 203,064 | £55,008,463 | £270.89 | 4,079 |

Student Loan overpayments in 2020/21

| Reason for mistaken repayment | Number of graduates affected | Total value of repayments | Average value per graduate | Number who have claimed a refund |

|---|---|---|---|---|

| Balance already cleared | 45,200 | £16,963,400 | £375.30 | 45,218** |

| Repaid early | 28,600 | £4,148,100 | £145.04 | 3,207 |

| Earning below the threshold | 806,400 | £95,093,600 | £117.92 | 14,669 |

| Wrong plan type* | 89,893 | £26,705,998 | £297.09 | 3,033 |

Student Loan overpayments in 2019/20

| Reason for mistaken repayment | Number of graduates affected | Total value of repayments | Average value per graduate | Number who have claimed a refund |

|---|---|---|---|---|

| Balance already cleared | 54,600 | £23,199,000 | £424.89 | 54,605** |

| Repaid early | 27,500 | £4,513,400 | £164.12 | 1,774 |

| Earning below the threshold | 756,500 | £97,945,300 | £129.47 | 14,914 |

| Wrong plan type* | 102,658 | £31,771,915 | £309.49 | 3,794 |

Student Loan overpayments in 2018/19

| Reason for mistaken repayment | Number of graduates affected | Total value of repayments | Average value per graduate | Number who have claimed a refund |

|---|---|---|---|---|

| Balance already cleared | 52,200 | £29,308,000 | £561.46 | 52,214** |

| Repaid early | 28,400 | £2,931,500 | £103.22 | 4,226 |

| Earning below the threshold | 611,400 | £72,929,100 | £119.28 | 12,877 |

| Wrong plan type*** | N/A | N/A | N/A | N/A |

* Not all graduates who repay under the wrong plan are owed a refund. For example, if you repay under Plan 2 (with a threshold of £27,295) when you should be under Plan 1 (with a threshold of £24,990), you have repaid less than intended and aren't owed a refund. Nonetheless, in 2021/22, 98,329 graduates repaid under Plan 1 instead of Plan 2, and are owed a total refund of £27,459,977.

** SLC have confirmed to us that the reported number of graduates claiming a refund often appears to exceed the number owed one because the two figures are from slightly different data sources, both of which are live and constantly changing.

*** SLC were unable to provide this data.

If you think you might be due a refund due to overpaying your Student Loan, check with SLC. Or, if they've already contacted you to let you know you've over-repaid, follow their instructions on how to receive the money you're owed.

How big a Student Loan refund could you be owed?

As you can see in the tables above, the average refund owed varies massively depending on the reason for your overpayment. In some cases, the average refund owed is just over £100, while in others it's much more.

But these are just average figures. We've seen reports of graduates reclaiming over £1,000 in early repayments, while Sammy, a member of our Facebook deals group, said her refund was just £22.

In Sammy's case, she had spotted that she was making early repayments pretty much straight away. If she hadn't, she could have ended up being owed a lot more. Of course, this would have meant paying out a lot more in the first place – a good lesson in checking your payslip every month!

Why might you have overpaid your Student Loan?

There are a few reasons why you may have overpaid your Student Loan:

-

You started repaying your Student Loan early

You shouldn't start repaying your Student Loan until the April after you graduate. So, if you graduated in July 2023, you first became eligible to repay in April 2024, giving you an eight-month break before payments could be deducted from your salary.

This is the case for undergraduate and postgraduate students alike.

However, it's slightly different if you're a part-time student. You'll either start repaying your loan from the April after you graduate or the April four years after your course starts, whichever comes first.

-

You repaid your Student Loan despite earning under the threshold

Even after you've become eligible to repay your loan, you won't make any repayments until you're earning above a threshold.

Exactly which annual earnings threshold applies to you depends on when you started uni, which level you studied at and where you lived when you started uni. Remember: it's the country that you ordinarily lived in at the time that gave you your Student Loan, not the country you studied in.

Find out the repayment threshold for your loan in our guide to repaying your Student Loan.

Student Loan repayments are usually automatically deducted from your salary before you get paid. While the all-important figure is your annual threshold, the SLC looks at your earnings each week/month and checks to see if you're over the weekly or monthly equivalent. If you're earning above it, you'll make a Student Loan repayment.

Let's say you only worked for part of the year, earned a different amount each week or month, or simply moved to a lower- or higher-paid role. You may find that you made Student Loan repayments despite eventually earning less than the annual threshold.

If by the end of the financial year (6th April – 5th April) your total earnings were less than the annual repayment threshold, you're entitled to a Student Loan refund.

For those who are self-employed, HMRC will work out how much you're due to pay based on your tax return.

It's also worth bearing in mind that the repayment thresholds have changed over the years. You can see the previous Student Loan repayment thresholds on the gov.uk website.

-

You've been put on the wrong Student Loan repayment plan

Each repayment plan has a different repayment threshold. For example, Plan 1's threshold is quite a bit lower than Plan 2's (£24,990 compared to £27,295).

Unsure what Plan you're on? These are the plans for undergraduate loans:

You got your loan from... You started uni between 1st September 1998 and 30th August 2012 You started uni between 1st September 2012 and 31st July 2023 You started uni on or after 1st August 2023 England Plan 1 Plan 2 Plan 5 Northern Ireland Plan 1 Plan 1 Plan 1 Scotland Plan 4 Plan 4 Plan 4 Wales Plan 1 Plan 2 Plan 2 Note: There is a separate plan for Postgraduate Loans from England and Wales.

It could be that your employer wrongly assumes you're on Plan 1 when you should actually be on Plan 2. This can happen since the Government's PAYE guidelines state employers should make Plan 1 deductions if they're unsure what plan you're on.

Alternatively, there could be a mistake in the Student Loan section when filing the HMRC starter checklist when starting a job.

Either way, being put on Plan 1 when you should be on Plan 2 means you'll be making repayments on a lower salary than you should.

-

You made repayments after fully repaying your Student Loan

Due to some issues with how the Student Loans Company and HMRC share data with each other, there have been a number of reported instances of graduates paying off their Student Loans in full but continuing to make repayments.

This issue only affects people who are close to repaying the balance in full but, in some cases, graduates have overpaid their Student Loans by as much as £10,000.

Again, if this has happened to you, you're entitled to a refund. Usually, the SLC will either contact you or refund you automatically. But if they haven't, and you're still making repayments despite clearing the balance, call the SLC to sort it out.

And keep in mind that the reason for overpaying your Student Loan could be a combination of two or more of the factors mentioned above.

Why do Student Loan overpayments happen?

Once you're eligible to start paying, Student Loan repayments are automatically deducted from your salary.

While this makes life a lot easier and means you don't have to worry about actually making your repayments, it also means people tend not to notice when something goes wrong – namely, repaying your Student Loan too early.

There have been a number of reported reasons for people having made repayments too soon.

For example, when you start a new job, you and your employer must confirm if you're eligible to make Student Loan repayments, and under which plan. If you or your employer makes an error filling this in, you could end up making incorrect repayments.

It's also much more likely to happen if you earn a different amount each week or each month. If your salary isn't consistent, you could make Student Loan repayments in one or more weeks or months, despite eventually earning less than the annual threshold.

Don't worry if it was your fault that you made early Student Loan repayments. Even if you're the one who made the mistake, you're still eligible for a refund, so don't be afraid to ask.

Sometimes it can just be a random admin error. For Jo Westbury, it was a mix-up with graduation dates:

I called the Student Loans Company [...] they advised me that they had two graduation dates for me which is why I started paying back earlier!

I had to call my uni (who had no idea where they got the earlier graduation date from), who then had to get in touch with the Student Loans Company to confirm that I graduated in 2016 and not 2015.

The Student Loans Company have advised that, once they receive confirmation of my graduation date from the uni, they will refund my £820 within 30 days!

How to claim a Student Loan refund

There is no set way to check whether you've overpaid your Student Loan, with a different method required depending on why you think you're owed a refund.

Here are the ways in which you can get a Student Loan refund:

-

You started repaying your Student Loan early

Contact the SLC directly by calling 0300 100 0611 (or 0300 100 0370 from Wales and +44 141 243 3660 from overseas) or getting in touch via Twitter/X or Facebook. Explain that you think some Student Loan repayments were taken from you incorrectly and that you'd like to request a refund.

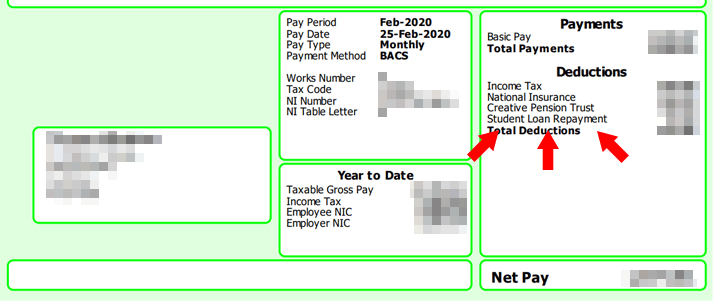

It's best to have a few bits of paperwork to hand to make the process as quick as possible:

- Your payroll number

- PAYE reference number

- Payslips.

But don't worry if you can't track these down – many graduates say they've been successful simply by ringing up and asking, even without the paperwork.

We've only heard positive things about the SLC workers on the other end of the phone. Lots of you have told us how friendly and helpful they were!

-

You repaid your Student Loan despite earning under the threshold

SLC should now email you if you've overpaid in a recent tax year. That said, there can be a delay, so you may have to wait until a few months after the end of the tax year to find out.

If they have sent you an email, it's a simple process of logging in to your Student Loan repayment account and clicking the "Request a refund" button.

However, if you haven't received an email but still think you've overpaid in any tax year, you should check your repayment plan, previous thresholds and repayments made and then contact SLC with any evidence.

Finally, make sure your bank account details are up to date to avoid any refund being paid into the wrong account.

-

You've been put on the wrong Student Loan repayment plan

Firstly, you'll need to check which plan you're on by logging into your SLC account and clicking "Download your 'active plan type letter'". Then get in touch with your employer and compare this against their records.

If they don't match and you've made an overpayment, you'll need to call SLC or contact them on social media to resolve the issue and claim your refund.

-

You made repayments after fully repaying your Student Loan

If this happens, SLC will try to refund you automatically so make sure your bank account details are up to date in your online repayment account.

If they can't refund you automatically, they will try to contact you. However, if they don't get in touch, you should contact them directly to request refund.

For all the options above, it doesn't matter how long ago you graduated. It could have been two years ago or 10 years ago, all claims are still valid.

Is it worth getting a Student Loan refund?

You may be thinking, "Why get a Student Loan refund if you're going to have to pay it back at a later date?". In theory, that's a good point. In theory.

You have to remember that there's a very high chance you'll never pay off all of your student debt before it's cancelled – in fact, you probably won't get close. For all the many failings of the Student Finance system in this country, the repayment system isn't too bad.

We go into this in more detail in our guide to Student Loan repayments. But, as you only ever repay 9% of your earnings over a threshold, your monthly contributions should always be fairly manageable.

And, as the total debt when you graduate is likely to be around £50,000 (and that's before you add the interest that accrues from day one), these small monthly repayments are rarely enough to clear the debt before it's wiped (around 30 years after you graduate – again, head to our guide to Student Loan repayments for more info).

As such, the government's own figures suggest that 77% of students with Plan 2 loans will fail to repay some or all of their loans before they're cancelled. Still think there's a chance you'll repay in time? Use our Student Loan repayment calculator to find out for yourself.

So, given that you might leave £1,000s of your loan unrepaid, why not claim back the few hundred quid that they took from you early?

When students see how much debt they're in after graduation, it can be easy to panic and try to pay it all off before it starts accruing more interest.

However, if you pay it back at the rate set by the Student Loans Company, there's a decent chance that a big chunk of it will be written off after 30 years, saving yourself loads of money in the long run. This is particularly true for students from England and Wales who started uni in or after September 2012, but before September 2023.

If you've been making incorrect repayments, I'd definitely recommend requesting a refund if you're eligible, as you may never have to pay it back.

Tom Allingham, Save the Student's Student Finance Expert

The important thing is to stay savvy. In most cases, your Student Loan repayments will be taken from your salary automatically without you having to do any work – meaning mistakes often go unnoticed.

So, always take time to check your payslips and keep up to date with any changes to repayment eligibility so you're only ever paying back what you're supposed to.

Did you know that you could be eligible for a tax rebate too?