Student Money Survey 2020 – Results

UPDATE: View our 2024 National Student Money Survey.

The National Student Money Survey 2020 arrives at a time of huge financial uncertainty for many students. The results give a timely insight into what lies ahead in the new academic year...

Every year, we use our National Student Money Survey to ask thousands of students about what it's really like to manage money at university. Now in its seventh year, this survey comes at a time when, more than ever, students need clarity.

The survey's an impartial and unapologetic look at the realities of student money in the UK. And this year, 3,161 students responded, ensuring this remains the biggest independent survey of its kind.

Looking at everything from students' daily spending habits, to the most common ways to make money, to the ongoing shortfalls of the Student Finance system, here's a rundown of the key findings from the 2020 survey.

What's in our report?

- Key findings

- What's it like living on a student budget?

- Does Student Finance stretch far enough?

- How many students drop out of university?

- What do students spend their money on?

- Where do students get money from?

- How would students get cash in an emergency?

- The truth about sex work at uni

- What are the cheapest universities?

- Do students understand their Student Loans?

- Is university good value for money?

- What students expect from graduate life

- Expert comments on our findings

Key findings from the Student Money Survey 2020

Before we go into our findings in more detail, here's a quick overview of some of the key stats from this year's survey:

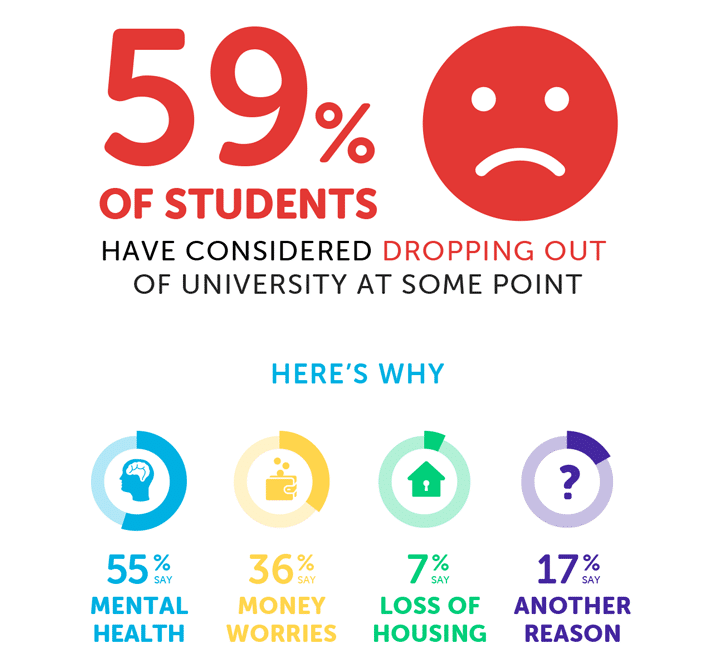

- 59% have thought about dropping out of university, with 36% considering it due to money problems.

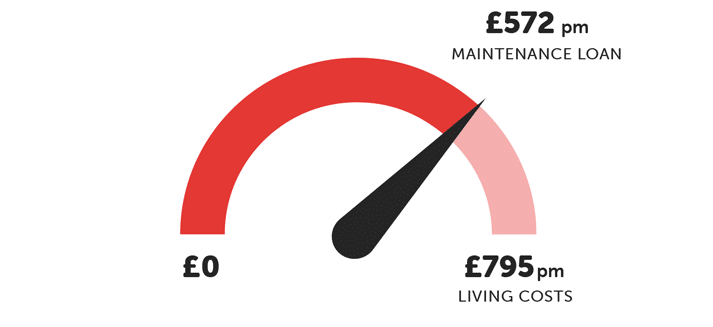

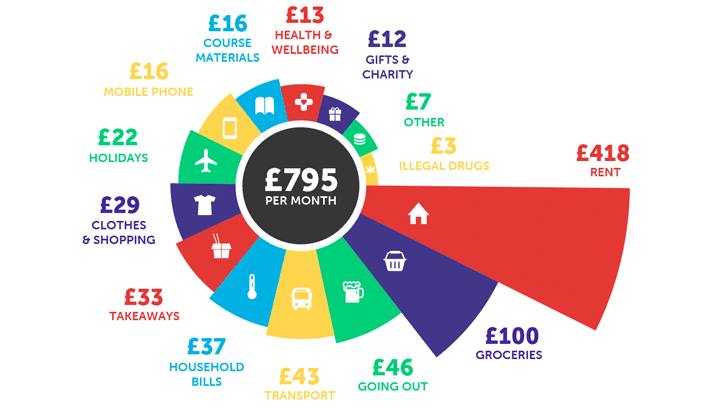

- The average student spends £795pm, which is £223 less than they generally get from their Maintenance Loan each month.

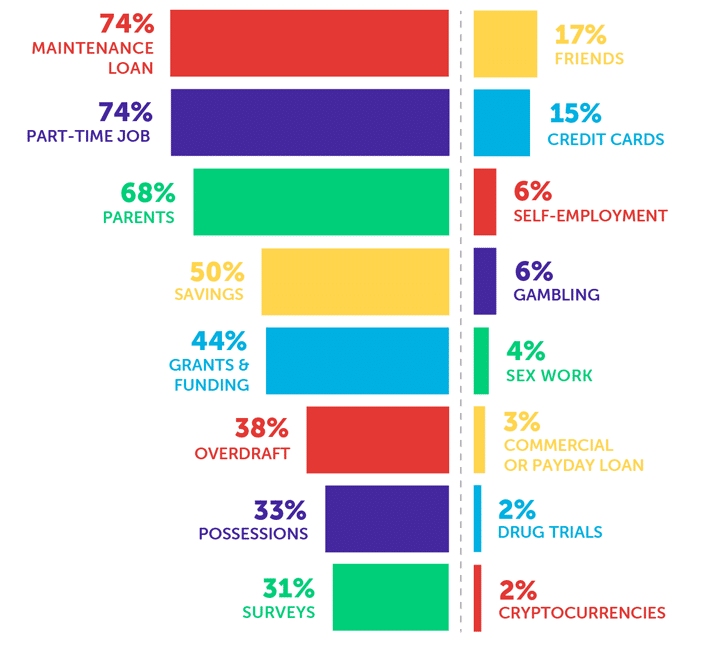

- 74% of students rely on part-time work for money.

- Three quarters of students have turned to their university for mental health support.

- 4% have done sex work, but one in 10 would do it in a cash emergency.

- Average starting salary expectations have risen from £19,707 to £22,107 – but there's a very concerning gender pay gap.

What's it like living on a student budget?

At first glance, there seems to have been an improvement since last year in terms of how students feel about their money.

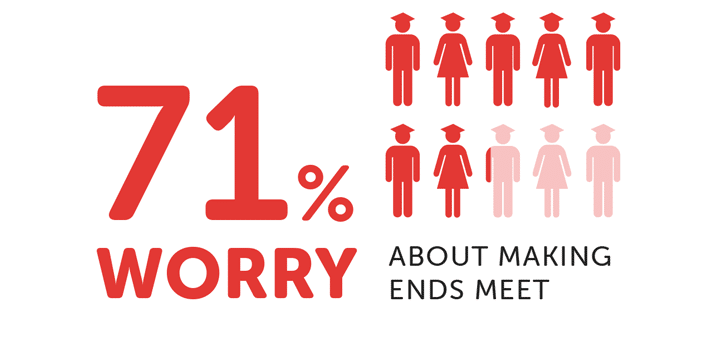

At 71%, the proportion of students worrying about making ends meet is down from 79%, as we'd seen in 2019 – despite the financial challenges posed by the coronavirus pandemic.

However, it's important to bear in mind that the survey opened in early April, before the full impact of the pandemic on personal finances and the economy as a whole was generally known.

When we separated the stats to look specifically at the impact of COVID-19 on students' finances, we found that 81% of students are worried about money due to the pandemic.

This is particularly worrying when you consider how much money worries can impact various aspects of a student's life.

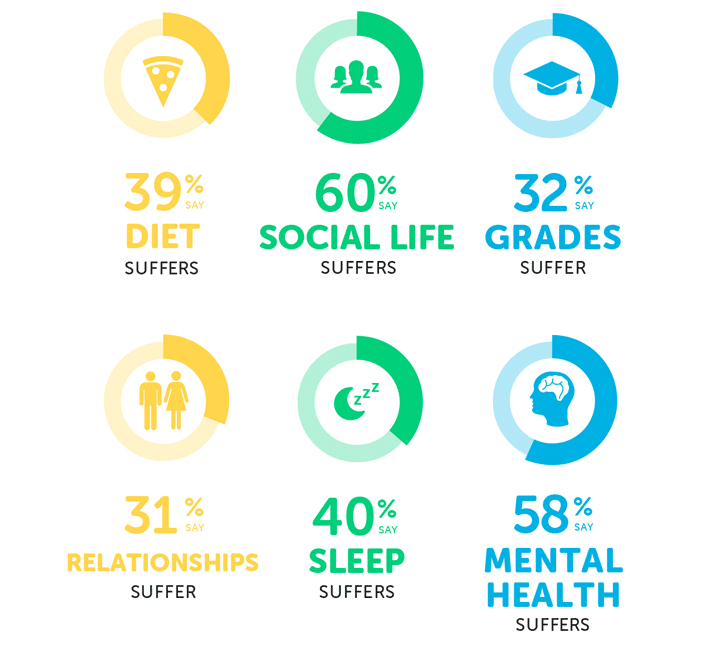

With three in five students saying that money worries affect their social life, and almost as many saying that their mental health is impacted, the majority of students are feeling the pressures of financial issues.

These stats are particularly alarming as 75% of students said they've turned to their university for mental health support. As the survey shows, for many of those students, money worries would have been a contributing factor.

On top of this, just under a third of students consider money problems to be damaging to their grades.

Student Finance should be there to facilitate the education of students. The fact that so many have their work hindered by money highlights fundamental flaws in the government's funding system.

What students say about living on a budget

- Ringing Santander pleading with them to not charge me excess fines for going over an authorised overdraft limit was difficult but a lesson nonetheless.

- A lot of people like to assume that the only reason students have financial problems is because they waste money on shopping or alcohol or takeaways however the overwhelming majority of students manage their money well and just find that there isn't enough of it to go around.

- After necessary expenses for the semester, my weekly budget doesn't cover emergencies I may have.

- Student life is tough, especially when you are in control of your own finances for the first time in your life. It is worth it though, and university teaches you so much and you learn a lot about yourself. Get a part-time job, budget well, and you will be just fine.

Does Student Finance stretch far enough?

For the average student, the Maintenance Loan works out as £223 less than their monthly living costs.

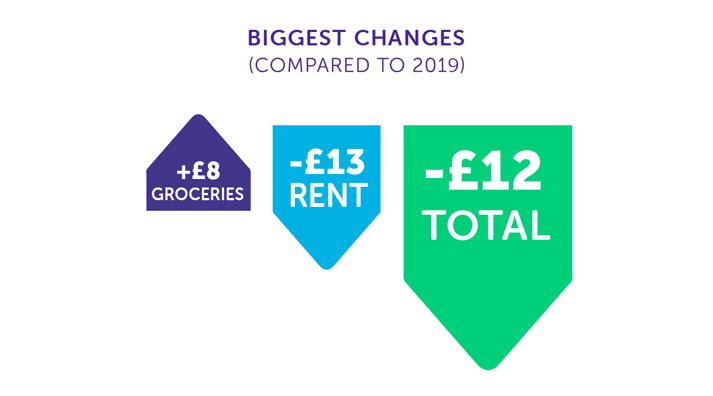

While this shortfall is still causing serious financial issues for many students, it's worth noting that the gap has actually shrunk since last year, albeit only slightly.

In our 2019 survey, we found that the shortfall was £44 more a month (£267), and one of the contributing factors to this is that students are generally spending less (find out more about student spending habits below).

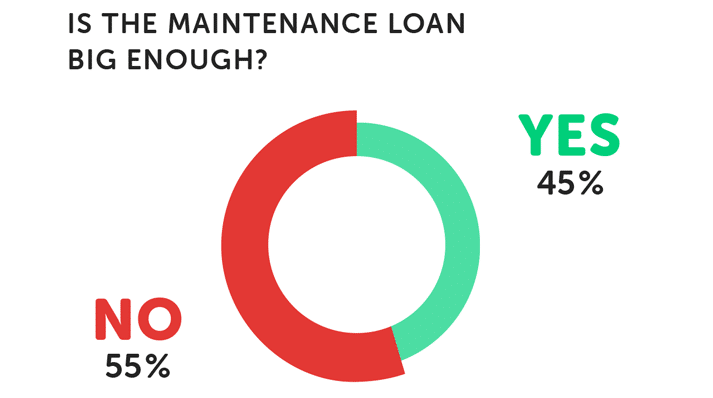

But, despite the improvements, is the Maintenance Loan actually going far enough for most students?

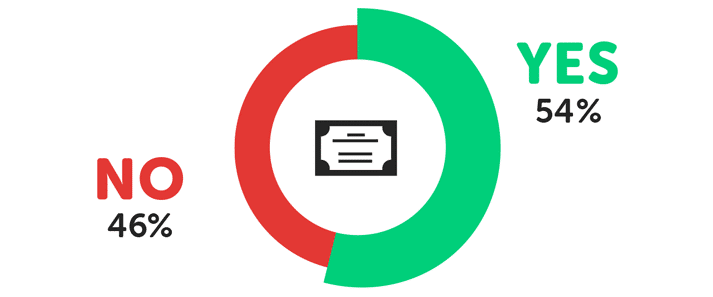

For over half of students, the Student Loan is still lacking, falling short of what they need to get by.

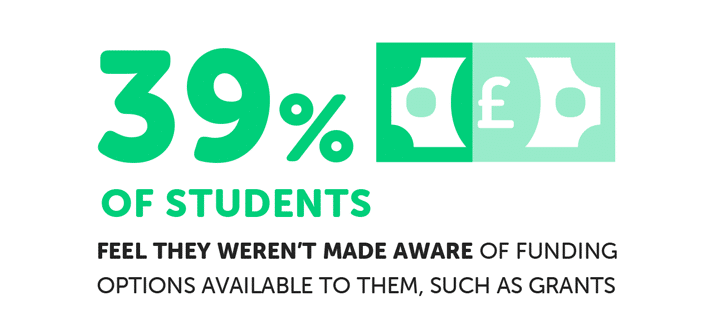

Because of this, it's all the more important that students are as well-informed about personal finance as possible, receiving the advice they need to manage their money effectively. Worryingly, though, this isn't always the case.

Do students get enough guidance about Student Finance?

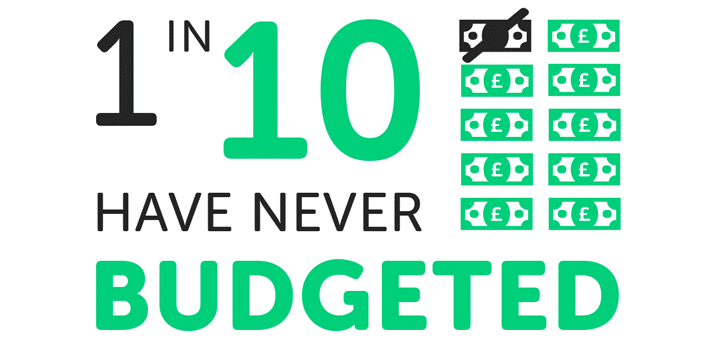

With the Maintenance Loan failing to cover the average student's living costs, money management skills are essential to help make limited funds stretch further.

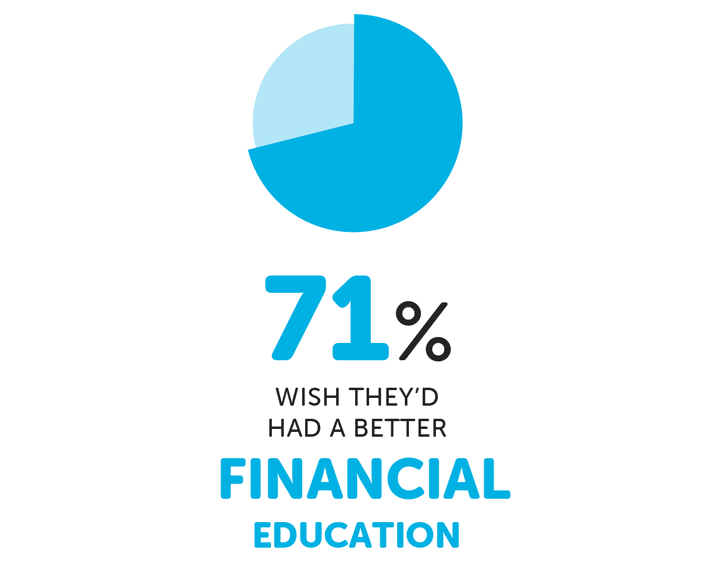

There has been a slight improvement on last year, with the proportion of students wishing they'd had better financial education decreasing from 77% to 71%.

This improvement in students' financial education is likely a contributing factor to a rise in student budgeting. While it may still seem like quite a high figure that nearly one in 10 students have never budgeted, it is a pretty significant drop from last year, when it had been one in six.

But with over two thirds still arriving at university without a solid understanding of how to handle their finances, it's making a tough financial situation that much tougher for students.

What students say about surviving on Student Finance

- They expect my single mother to pay more money than she is able to and my loan doesn’t even cover half of my accommodation.

- We go to uni to become independent adults. Yet it is purely based off how well our parents have done. I will never understand this, I wish the government knew how unfair their Student Finance system is. I wish I never went to university.

- Most of the students I know have Maintenance Loans that do not even cover their rent, thereby they have to save and work hard alongside studying.

- Student Finance is a pain – life would be better if Maintenance Loans were not linked to parents' earnings!

- My parents shouldn't be expected to give me money because they have a higher income. They have worked hard and I feel the system is unfair to those with higher family incomes.

University drop-out rates

There are a huge number of reasons why students might drop out of university. But as 59% have thought about leaving uni early, and a further 8% have told us that they've gone through with it, it's clearly very common for students to at least consider it.

Among the students who had dropped out, 18% said that it was due to money worries, while 44% said that it was due to mental health.

For too many students, homelessness has led them to either drop out of uni or, at the very least, think about it. In fact, one in 10 of those who had dropped out said that it was due to homelessness.

What students say about dropping out of university

This is probably the hardest year of my course so far. I have mental health problems already and juggling this with expecting my first baby, the COVID situation and trying to complete the year is too much. I would drop out if I could afford to.

What do students spend their money on?

Rent makes up the biggest chunk of students' monthly living costs but, at an average of £418, that alone can be 73% of their Maintenance Loan for the month.

And, as numerous students have told us that their Maintenance Loan works out as less than their monthly accommodation costs, it's no wonder so many students are finding that Student Finance is not nearly enough.

Here's a quick overview of how students' spending habits compare to last year...

Where do students get money from?

As we've seen in previous years, parental support and part-time jobs are two of the major sources of income for students. However, this highlights a very concerning risk for students in the new academic year, as many could find these sources of income hit by the pandemic.

The survey highlights that a lot of students have already been struggling with money issues in the past year. Without sufficient support from the government, this could greatly worsen.

To make up for lost income, we'd urge students to look into additional forms of funding that could be available to them, such as scholarships, grants and bursaries. Frustratingly, just under two fifths of students haven't been made aware of the full range of student funding options.

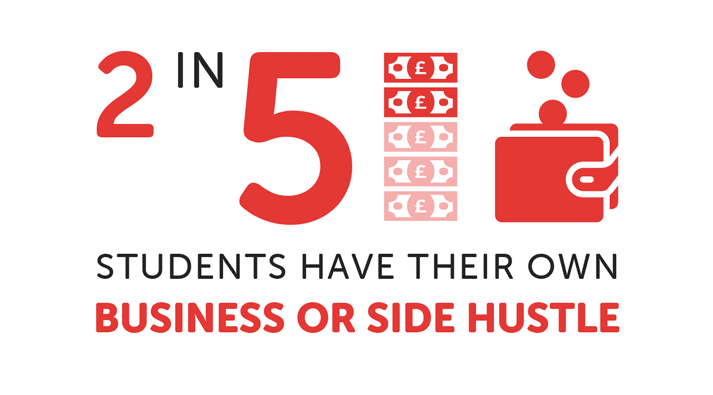

However, it's important to note that the survey has also highlighted the brilliant resourcefulness of students, with 43% making money through side hustles and business ventures.

For a lot of students, profits from their own businesses are unlikely to be enough to fund their living costs entirely, with most making less than £500 from their business.

For a lot of students, profits from their own businesses are unlikely to be enough to fund their living costs entirely, with most making less than £500 from their business.

But there is, of course, the possibility for them to earn more than this. And, for some students, the extra cash they make from a side hustle would make a massive difference if they've lost a part-time job.

In the process of running a business or working on a side hustle, students will also gain great work experience which would help them stand out among others in the competitive job market.

How much money do parents give their children at university?

On average, students get around £130 a month from their parents.

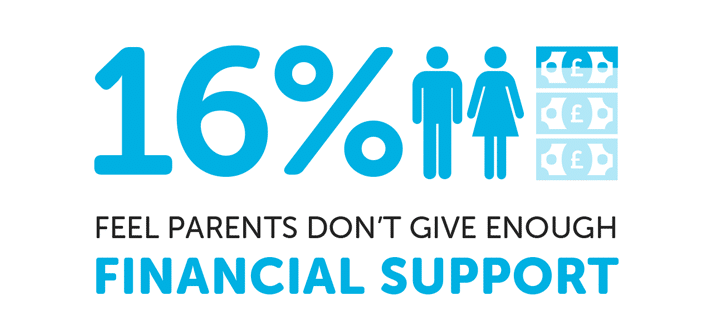

However, an ongoing issue that we see with the Student Finance system is that Maintenance Loans are calculated by the government with the assumption that parents will contribute a certain amount – but this isn't always the case for students.

The more their parents earn, the less a student will receive from Student Finance – though not all parents realise this, or are able to financially support their children at uni.

Particularly as 21% of students' parents are also needing to support another student, the Maintenance Loan system is putting disproportionate weight on some families, highlighting an ongoing issue with the way in which the government calculates loans.

How many students save money for university?

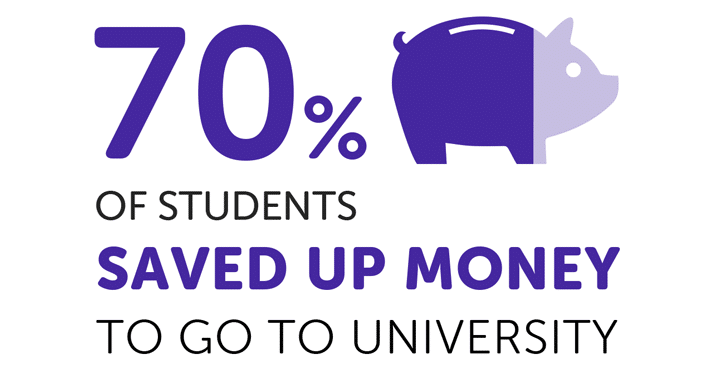

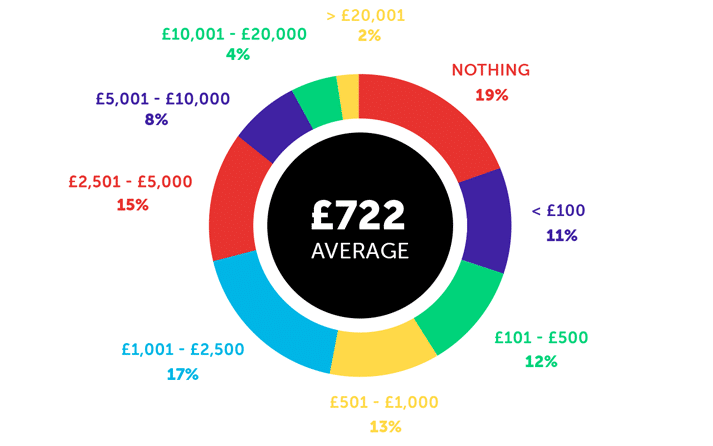

Interestingly, there's been a rise in the number of young people saving up for uni – up by 4% from last year.

And, on average, students have over £700 in savings – this is up significantly from last year, when students had an average of £587 in savings.

But despite this, 19% of students have nothing in savings, relying only on their income each month to cover university costs.

What students say about making ends meet

- I've been skipping lunch every single day at uni just to save money and to be able to buy other things that I would need.

- Sometimes, I find it hard to sleep while I think of how to spend within my means.

- I had four part-time jobs to keep myself afloat as I did not receive money from my parents.

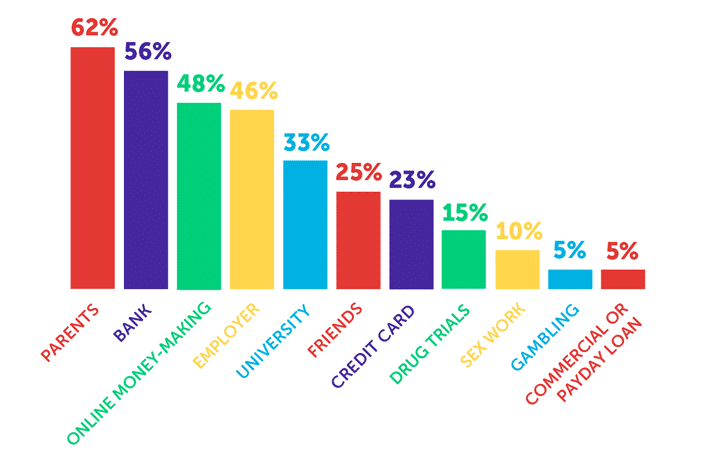

Where would students turn for cash in an emergency?

Now more than ever, given the current economic climate, it's important for students, teachers and parents alike to understand where young people would consider turning to for money in an emergency.

Here are the main ways students would try to get money in a cash emergency...

While 4% of students have made money from sex work, one in 10 have said they'd consider sex work in a cash emergency. This is up from 6% who had said the same last year.

For some students, sex work is a positive decision, and a way to make money that's enjoyable and financially rewarding.

However, a concerning aspect of sex work among students is that it seems to be increasingly seen as a way to earn money as a last resort, rather than out of choice.

The realities of sex work at university

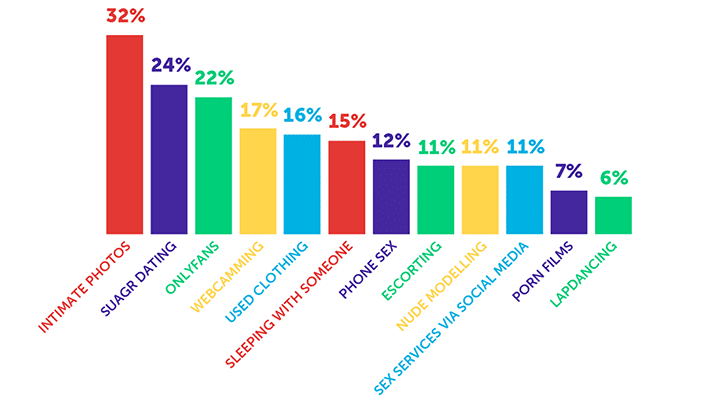

Although some people assume that sex work only involves sleeping with someone or performing sex acts for money, this isn't always the case.

It doesn't necessarily need to include physical contact as it can refer to a number of forms of work that involve nudity or erotica, such as online sex work.

Overall, the proportion of students doing sex work is the same as last year (4%). However, for the majority of the categories in the below chart, we saw an increase in responses, suggesting a general trend towards more students doing multiple forms of sex work.

What kinds of sex work have students tried?

The above chart gives a rundown of the most popular forms of sex work among students who have done it.

Sharing images is the most common way for students to make money through sex work. And this is especially noticeable as over a fifth of students who do sex work have done so using one particular site – OnlyFans.

OnlyFans is increasingly popular among students; on the site, people can share images – often of a sexual nature – and charge others a monthly subscription fee to view them.

What students say about trying sex work at uni

- I hate that it has come to this for me to earn money. It makes me feel sick and I'll regret it for the rest of my life. I've put my own safety at risk a handful of times just so I had enough money to pay for essentials. Why has it come to this 🙁

- Not a regular thing, just turn to it when I really need money!

- Have previously sold used socks and foot pictures when unable to pay rent, was very uncomfortable but had no other option.

- Too scared to give it a go because of judgement or consequences of it going wrong.

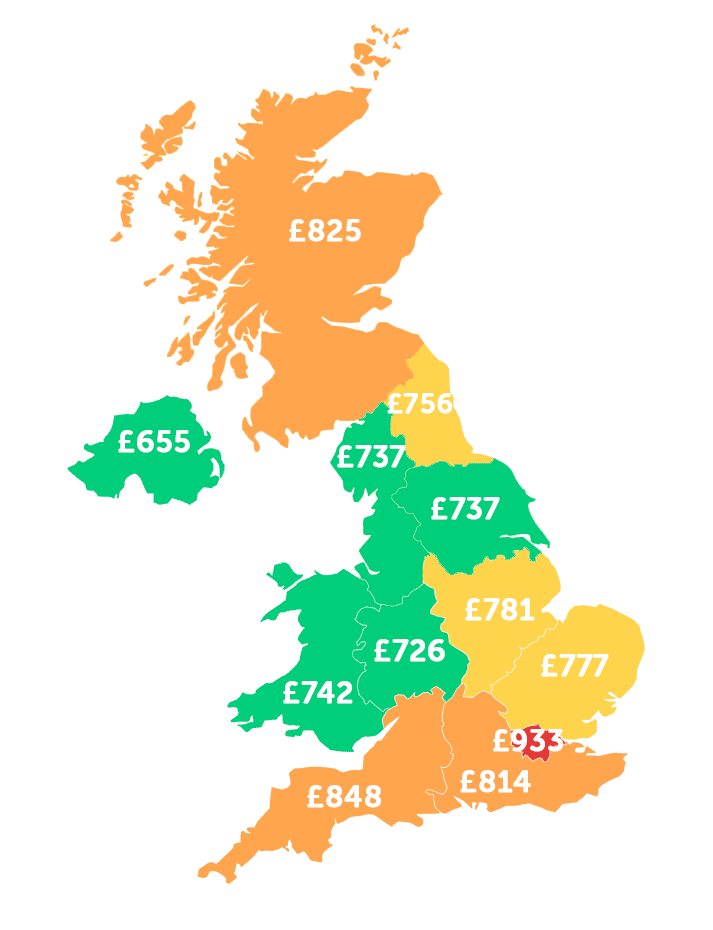

Living costs around the UK

This includes students who live away from home and with their parents.

Cheapest universities in the UK

| University | Monthly cost* |

|---|---|

| Leeds Arts University | £469 |

| University College Birmingham | £495 |

| Rose Bruford College | £534 |

| University of Wales Trinity St David | £540 |

| University of Hull | £556 |

* This only includes students who live away from home (not with their parents).

Interestingly, although the average student living costs in Yorkshire are £737, the cheapest uni in the UK for students who live away from home is Leeds Arts University (located in West Yorkshire). There, students can expect to spend an average of just £469 per month.

10 surprising ways students have made money

Here are some of the most unusual, shocking and creative ways students have made money this year:

- "Did a logo design for a UAE royal Princess"

- "Sending anecdotes to magazines"

- "Volunteering my body for studies e.g. biopsies, laser heat, testing eye drops"

- "Begging"

- "GCHQ ambassador"

- "Writing a stand up set for someone"

- "Mascot work"

- "Sold FIFA coins"

- "ServeLegal – paid to buy alcohol"

- "Helping someone who lied about having a friend to other people and faking being this 'friend'".

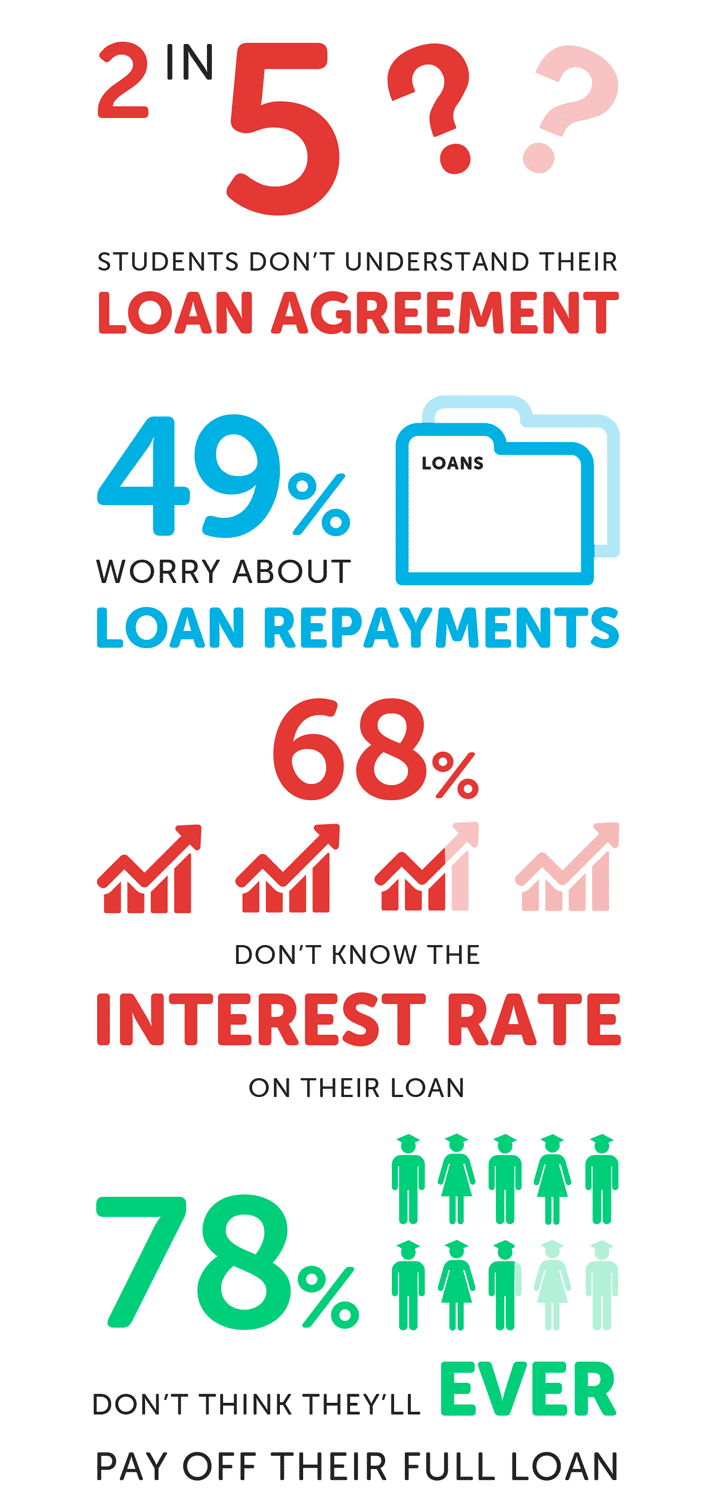

Do students understand their Student Loan?

As the main source of funding for the average student, the Maintenance Loan is pretty fundamental in helping students get by at uni – but are students getting enough info about it?

There's most likely a link between the numbers of students not understanding their Student Loan agreement and those worrying about repayments – we think that both figures are higher than they should be.

As the survey highlights, there are flaws with the Student Finance system – but one aspect that students shouldn't need to worry about, particularly while still at university, is the loan repayment system.

The system's designed in such a way that graduates repay it in small chunks, and only when they're earning above a certain amount. If a grad's income drops below the threshold, the repayments stop until their earnings rise again, thereby helping to avoid anybody paying beyond their means.

With just under half of students worrying about loan repayments, this is unnecessarily adding to the other difficult money worries that they face at uni.

Perhaps with clearer communication from Student Finance about the loan agreements, ensuring more students understand the nature of the debt they're taking on, we could see a drop in students expressing concern about repaying their Student Loan.

Is university good value for money?

Interestingly, despite the disruptions caused by the UCU strikes and the coronavirus pandemic, there has actually been a decrease in students viewing uni as poor value for money, down from 55% to 46%.

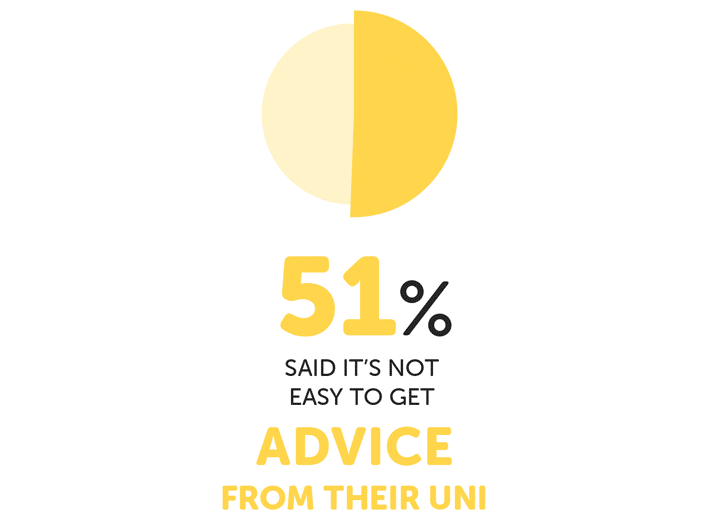

And likewise, for students who have asked their uni for help, there again seems to have been an improvement. Although 51% still said it's not easy to get help, this is at least down from last year, when 62% had said the same.

But, despite these improvements, we've still heard from numerous students who have struggled to pay for university.

What students say about paying for university

- It's ridiculous how we pay over £9,000 in tuition fees, yet are still expected to pay for printing, including those who need to print and bind their dissertation, and fork out a small fortune on 'essential' textbooks and other materials.

- I have savings due to previously working full-time for several years, however all money I have is being spent on my degree as I have to self-fund. I do not believe the year I have had at uni was worth the £9,250 I paid. Due to strikes and COVID-19, I believe students should be issued refunds for the 2019/20 year.

- Students need help from the Government, we have been left behind. We should not have to pay full tuition fees this year.

- My part-time job to pay for my living costs takes up much of my time resulting in less time for my studies, social life and sleep.

Life after university

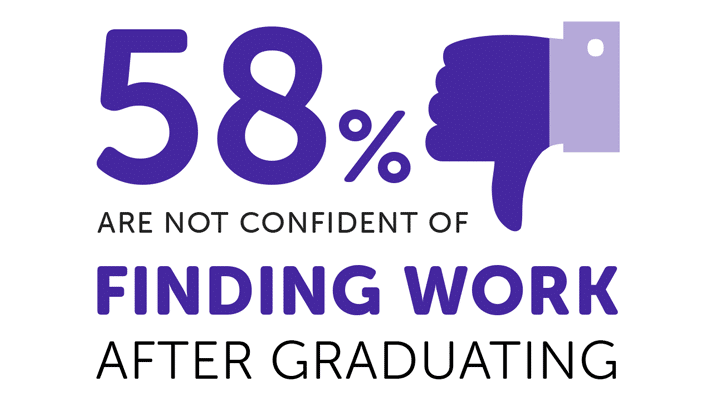

Students and recent graduates are currently facing a very challenging job market – and this is reflected in how students view their chances of getting a graduate job.

Compared to last year, graduate job prospects have worsened, with 7% more students saying they're not confident about finding a job after uni.

However, despite confidence in getting a job going down, students are actually reporting higher expected starting salaries.

Last year, students said they expected to earn an average of £19,707 in their first graduate job, but this has increased to £22,107 this year.

Among the expected salaries, though, is quite a noticeable gender gap.

Students who identify as male expect to earn £2,140 more than those who identify as female. But, students who identify as non-binary have told us they anticipate earning even less, giving an average expected starting salary of £17,750.

Not only does gender affect how much students expect to make, but there's also a strong correlation between how much their parents make, and how much they expect to make.

As this table shows, the more parents earn, the more students generally expect to earn.

| Household income | Expected starting salary |

|---|---|

| >£25,000 | £21,044 |

| £25,001 – £35,000 | £21,956 |

| £35,001 – £45,000 | £22,036 |

| £45,001 – £55,000 | £22,553 |

| £55,001 – £65,000 | £24,553 |

| £65,001+ | £24,772 |

Expert comments

This year's survey comes at a time when students are facing a lot of uncertainty over what to expect in the year ahead.

While it's promising to see that there have been some improvements from last year, the 2020 survey also highlights the vulnerabilities of students in the coming year, who could be yet to experience the full financial impact of the pandemic.

Jake Butler, Save the Student's money expert, comments:

That the majority of students have considered dropping out of university is an incredibly sobering revelation, even moreso that the driving force is a lack of financial support.

This has to be a real wake up call to the government and British universities who can simply not afford to witness students dropping out in their droves as they attempt to navigate a hugely uncertain future themselves.

Students are heavily reliant on income from part-time jobs and their parents to get by, because Maintenance Loans do not reflect the true costs of student living.

With these vital top-up sources at increasing risk due to the COVID-19 pandemic, thousands of students this year may have little choice but to drop out of university or turn to alternative ways of earning money such as sex work.

Addressing student funding has to be the highest priority for Universities Minister, Michelle Donelan.

Meanwhile, it's more important than ever for students to be aware of the financial pressures from the outset, so they can plan and budget effectively.

Sara Khan from the NUS adds:

Students shouldn't have to worry about working to cover basic necessities and should be able to focus on enjoying and thriving in their studies.

Education is a right that students should access freely from cradle to grave, especially considering that without an education one cannot find suitable employment, and the cycle of poverty perpetuates itself.

The UK government must therefore fund maintenance grants for students in place of the profit-driven Student Loan system, and fully fund our education.

And Kellie McAlonan, Chair of the National Association of Student Money Advisers (NASMA), also adds:

Now more than ever, it is important to have clear statistics on how students are approaching their finances and coping in the current climate.

Save the Student's annual Student Money Survey gives clear insight into how students manage, and the impact that financial challenges have on their overall wellbeing and ability to engage in their studies.

The key stats from this survey will allow colleges and universities from across the country to better support students by understanding the challenges they are facing, particularly at a time when many students are still experiencing the financial impact of the COVID-19 pandemic.

About this survey

Our findings are completely independent: we don't conduct this survey to sell products to students, or to please universities and advertisers.

Since 2013, we have reached out to university students all over the UK for their honest opinions about the costs of university. We crunch the numbers to tell it like it is and improve the advice we provide across our website.

Want to know more about the survey, need case studies, comments or quotes? We're happy to help – just drop us a line.

- Source: The National Student Money Survey 2020 / www.savethestudent.org

- Average Maintenance Loan amount based on FOI information from Student Loans Company (SLC).

- Survey polled 3,161 university students in the UK from April – August 2020.

- Data from previous surveys.

- Save the Student Press Page.

- Tools and resources.

Student Money Cheatsheet

At Save the Student, we're committed to offering free and accessible advice to help our readers manage their money at university. And, in response to the alarming findings from our recent student surveys, we've created the Student Money Takeaway resource.

This resource is a free, printable PDF which includes a one-minute budget sheet. On just two easy-to-follow pages, we distil the very best advice from our website.