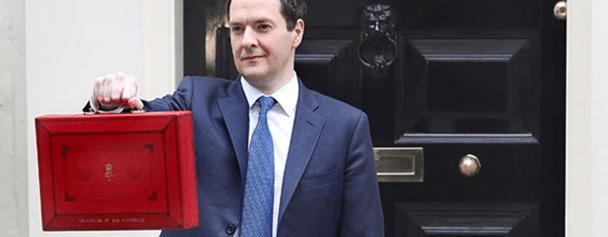

The Budget 2016 – How does if affect you?

Another year, another budget. It seems each time this government comes out with another update things just seem to be getting worse... We watched this year's budget announcement and there were a lot of complicated terms and red herrings involved. We've picked out the important points for you and presented them in a way that actually makes sense.

We watched this year's budget announcement and there were a lot of complicated terms and red herrings involved. We've picked out the important points for you and presented them in a way that actually makes sense.

So, what are the main points affecting students and young people from the budget this year?

The new Lifetime ISA

This is the big one!

It appears as if the government are already looking to phase out the Help to Buy ISA with a view to getting rid of it completely by 2019. This new ISA seems to be the planned replacement.

The finer points are still being ironed out but here are a few things you might want to know about it now:

- You can pay a max of £4,000 into it a year

- The government will then pay you 25% of that (so a max of £1,000/year)

- You are eligible for the bonus on savings up to the age of 50

- You can't claim the bonus until you buy a home (first time buyer) or you are over 60

- The max house value you can use it towards is £450,000 (anywhere in the country)

- You can combine your bonus with a partner to buy a house

- It opens in April 2017

- You are allowed to have a Help to Buy ISA open at the same time but you cannot use the bonus from both

- You can transfer any Help to Buy funds into it

- If you withdraw early (ie. before 60 without putting it towards a house) you lose your 25% bonus, interest & have to pay a 5% fee.

More info here.

It is better than the Help to Buy because you can use it towards a higher value house and have the opportunitiy to build up a larger bonus than just £3,000. However, it comes with a sharp sting if you ever need to withdraw the money early.

Sugar tax on drinks

By 2018 there will be a sugar tax introduced on fizzy drinks.

Details are yet to be fully disclosed but you can expect your favourite can of sugary drink to go up in price in the near future.

Tax free allowance raised to £11,500

This basically means that until you earn over £11,500 a year you won't have to pay any tax.

Anything you earn over this amount will be taxed at 20% (until you reach the higher tax rate).

Beer and cider duty is frozen

In other words, the price of alcohol will not be going up any time soon.

Some good news for students at last!

Other interesting points

- Foreign firms selling on Amazon/eBay will have to pay VAT. This could mean the end of super cheap deals on some items 🙁

- Schools can now finish at 4:30pm instead of 3:30pm

- Fuel duty is frozen

- All schools to become academies by 2020.

More details will be released over the coming hours/days as analysts look through the whole budget document. We'll be sure to keep you updated if there is anything else that will affect students in particular.