Parents expected to give you up to £6,537 a year for uni

We can reveal that students who don't (or can't) follow the government's parental contribution guidelines are left up to £6,537 a year out of pocket.

Credit: FotoDuets – Shutterstock

As most students are well aware, Maintenance Loans are means-tested. This means that the government calculates how much money students get in loans based on how much their parents earn.

For example, in England, only students whose parents earn below £25,000 a year receive the full Maintenance Loan. Everyone else will receive less.

Generally, the more your parents earn, the less money you get. So, the government 'expects' parents to make up the shortfall (so that, in theory, all students eventually receive the same amount).

But, as every student's financial situation is different, it's very debatable whether this is a fair or adequate way to distribute loans.

How are Student Loans calculated?

Credit: Atstock Productions – Shutterstock

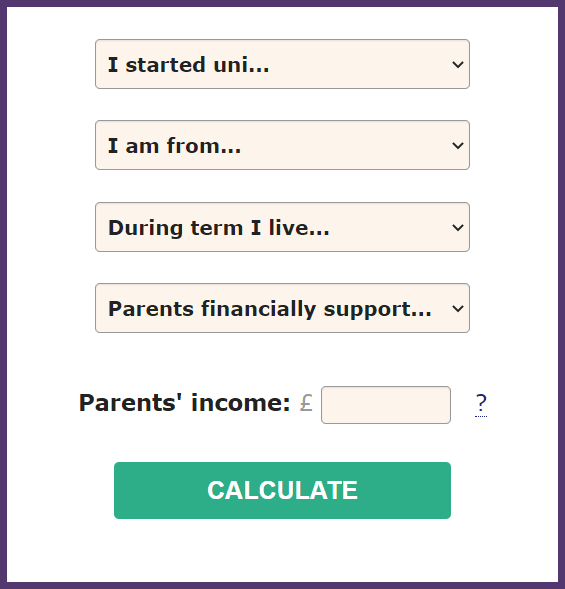

We've put together a handy calculator tool that uses the same formula employed by the government to assess loans, so you can know with confidence how much your parents are expected to contribute.

Maintenance Loans are calculated based on this information:

- How much money your parents make each year

- Whether you live in your family home while studying, or move away

- Where in the UK you choose to study (different rates for London)

- Your age

- Whether your parents have any other children under 18, or any children at uni at the same time as you.

To use the example of England again, the maximum Maintenance Loan in 2023/24 has been set at £9,978 if you're studying away from home anywhere outside of London, £13,022 if you move to London for university, and £8,400 if you choose to stay at home.

Unfortunately, according to our research, Maintenance Loans often aren't enough to cover students' living costs for the year.

Our most recent National Student Money Survey revealed that students are experiencing an average shortfall of around £582 every month, turning to measures including sex work and commercial or payday loans to make ends meet.

Parental contributions to student living costs

Our calculator reveals that if a student's parents aren't contributing as much as the government expects them to, the student could be missing out on as much as £6,537 a year (that's if they're from England and studying within London).

This is particularly worrying as the government says that parents are not legally obliged to supplement the loan. However, they are expected to pay a small chunk of their earnings towards their children's living costs at uni.

In this sense, you might call it an optional 'send your child to uni tax', as parents are expected to contribute a certain amount of their income depending on how much they earn.

Parental contribution calculator

Our calculator tool can show you how much your parents are expected to give you at university, based on all the relevant factors:

Issues with how Maintenance Loans are calculated

Credit: Yevgen Kravchenko, kamui29, Bell Photography 423 – Shutterstock

We frequently ask students how they feel about the way Maintenance Loans are assessed and dished out, and the general consensus is always the same.

Many of you consider the model to be outdated and not appropriate for contemporary living situations. For example, if parents divorce and remarry, a new partner's income is also included in the household income assessment, despite the step-parent having no financial obligation and the child potentially receiving no money from them.

And, it's often pointed out that it's extremely presumptuous for the government to assume that, even at the age of 24, a student can (or would even want to) be financially dependent on their parents in any way.

In England, the minimum parental earning threshold of £25,000 has also been stagnant for a long time. The result of this is that, over time, fewer and fewer students will be receiving the maximum loan from the government as salaries tend to increase in line with inflation.

While the government did announce some changes to the Student Loan repayment system in 2022, there was no mention of adjusting the way Maintenance Loans are calculated.

Still struggling to piece together the riddle that is Student Finance? Check out our complete Student Finance guide for everything you need to know.