15 common money scams to avoid

Students are generally a savvy bunch, particularly when it comes to the online world. But that doesn't make you invincible to scams, so listen up.

While most people know not to respond to emails from foreign princes who claim to offer good fortune in exchange for your bank details, scammers have definitely upped their game in recent years. As such, sniffing them out is now tougher than ever.

Both online and offline, fraudsters are getting increasingly sophisticated at stealing your hard-earned cash. That's why it's crucial to keep your wits about you at all times.

To give you a helping hand, we've highlighted some of the most common money scams to look out for, as well as how to avoid them.

Current money scams in the UK

Here are some of the most common money scams students should watch out for:

-

Phishing

Not sure what this term means (when it's not on a tub of Ben & Jerry's)? 'Phishing' is what digital thieves do when they're trying to 'phish' for your card details online.

You'll receive an email, disguised as being sent from a trusted payment source, which tries to convince you to share your personal details.

Often, it will come with an invented back-story that claims you've been hacked and asks you to follow a link to save yourself from impending doom.

Student Finance scams

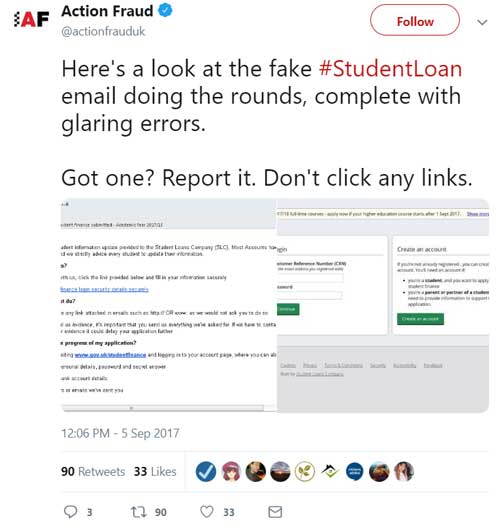

We regularly hear about phishing scams targeting students. This can include scammers pretending to be from the Student Loans Company (SLC) asking for personal, security or payment details, so it's worth being prepared.

The bottom line is that SLC, HMRC, banks, PayPal, eBay, etc. will never ask you to reveal personal details over email. If you're asked to do it, don't.

Common ways to spot a cunning trap include emails with links starting "http://" instead of "https://" (the indicator of a secure site) or slight alterations to well-known addresses, such as "www.hot-mail.com".

You should also pay close attention to the sender's address, as an odd-looking email can often be a tell-tale sign. That said, as one scam involving the Student Loans Company showed, sometimes a fake email can look real!

If in doubt, report it.

Don't forget to hit the 'report' button on your email account if you think something is a scam. That way, you can protect other (potentially less-savvy) people from falling for these traps. -

Smishing

The name might be even more ridiculous than 'phishing', but this is no laughing matter.

The word 'smishing' is a mix between 'SMS' and 'phishing'. As you can probably work out, it refers to phishing scams that take place over text. We've reported on them before, like the case of this student who lost £5,400 from a scam text.

Like phishing emails, smishing texts will usually claim to be from a bank or popular company whose services you may have used. They'll usually supply a link and ask you to click it, at which point you'll be prompted to enter your payment details.

Just as real banks and other companies will never ask you for personal details via email, they won't request them by text either.

If you receive a message asking to you disclose any sensitive information, do not respond. Instead, visit the company's official website and contact them directly. This way you can clarify the situation with them, and if it is a scam, they can hopefully look into taking it down.

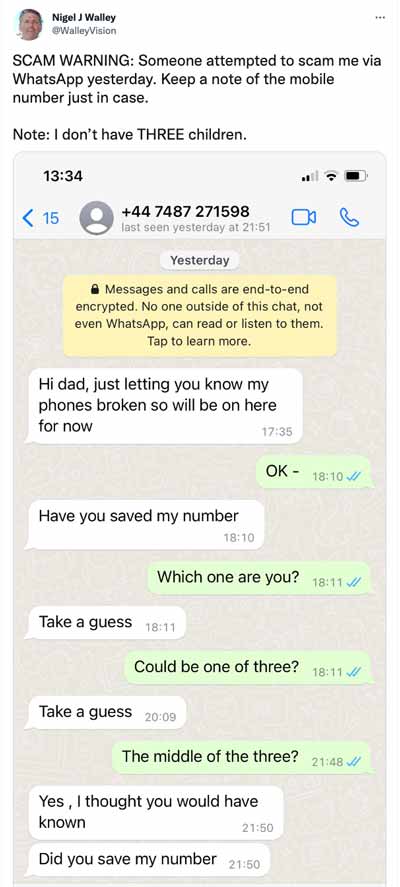

Wondering what a smishing text looks like? Below, you can see an example of a scam. Scammers pretend to be someone's son or daughter, asking for money.

-

Money muling

This might sound like a rare situation to get yourself into, but money mule scams are a lot more common than you think. And, unfortunately, young unsuspecting students are the perfect target.

In fact, according to Cifas (the UK's fraud prevention service), there were nearly 4000 cases of people aged 21 or under involved in money muling between January and June of 2023. Young people aged 21 and under now account for one in five (23%) of cases indicating money mule activity.

When people are recruited as money mules, they will be approached by someone (perhaps on social media, in a bar or even by someone they know relatively well). The person approaching them might say that for some reason or other, they can't pay cash into their own account.

Perhaps they're working cash in hand so can't be seen paying too much hard cash into their account in case they get chased for tax. They ask you to pay the cash into your own account and transfer it to them digitally, and they'll give you a 10% cut for your trouble. Simple, right?

Wrong. Never offer to do this for someone! For a start, money laundering is illegal and if you get caught, you could face up to 14 years in prison.

Secondly, you have no idea where this money could be coming from. If it's linked to drugs or some other crime and your account is linked to the case, the police will probably come looking for you. Don't take the risk!

-

Fake websites and products

Credit: Atanas Bezov - Shutterstock

Since it's so much easier and more common to buy from sites abroad, it can also be harder to suss out which are genuine and which are out to just get your money.

It's scarily common for websites to advertise products that are completely different to what they actually sell (which is a crime in itself). Or, the items may not really exist at all, and the site just wants to take your details and run with them.

It can be difficult to tell the difference between copycats and the real deal, but it's a good idea to check out reviews of the store online. They can point you to any negative experiences from other shoppers.

TrustedReviews and Trustpilot are great (and more importantly, independent) review sites that you can use to find out what a company is all about.

If you've still got your suspicions, only buy from a site with PayPal. This offers an extra layer of protection, as would using a prepaid credit card.

-

Ticket scams

There are very few things in the world more heartbreaking than getting scammed on gig or theatre tickets, so make sure you don't get taken for a ride.

As a general rule, don't buy tickets on the street. You could end up with fake tickets or be totally ripped off on the price.

Exercise the same caution online too. You'll also find unofficial touts on viagogo, TicketSwap, Gumtree and eBay.

Since these sites are just a platform for others to sell and buy tickets on, they're not liable if you receive a fake ticket (or none at all).

If you do buy from a smaller retailer, check out the site first and pay with a credit card if possible. That way, you can cancel the payment if the tickets don't show.

-

Competition scams

This is a common trick that most people have become savvy to, but we still hear about people being ripped off by online competitions.

Fake Facebook competitions are extremely popular these days, and sometimes it's hard to know if it's the real deal or not. When you see thousands of people engaging in a competition on what looks like the official British Airways Facebook page, it seems pretty legit. But how can you tell if it isn't?

Some of the tell-tale signs of a fake account include:

- A full stop at the end of the page name (e.g. "British Airways Official.")

- No info on the 'about' section of the page

- No T&Cs involved with the competition

- The company's official website leads you to a different Facebook page.

On Instagram, it's also common for fraudsters to impersonate the accounts running legitimate giveaways. They'll set up a fake account that looks like the real deal and reach out to people who entered a giveaway, saying they've won but will need banking details before being able to process the price.

If you enter legitimate giveaways on Instagram, always check if the account that is messaging you is legit. Remember they'll never ask you for payment details if you've won a giveaway.

Sadly, prize scams don't just happen online, they can also take place over the phone and by post. You'll be told you've won something fabulously awesome, and all you need to do is cough up a small deposit.

Crucially, if you don't remember entering a competition, you probably didn't, which means you certainly can't have won it.

No legitimate competition will ever ask you to pay to get your prize anyway, so steer well clear.

We have a full guide on how to enter competitions safely and effectively. -

Dodgy cash machines

Credit: Syda Productions - Shutterstock

Cash machine tampering has always been popular, but it's getting harder to spot.

From cameras that film you entering your PIN, to card slots that scan and record your card details – make sure you're always on the lookout for anything out of the ordinary.

If the machine has scratches, masking tape or any sort of indication that someone's been messing around with it, don't take the risk.

You should also be wary of anyone trying to speak to you whilst you're withdrawing cash. The moment you've become distracted, you've become the perfect target to have your cash nabbed on the spot – and sometimes without you even realising. It might sound a bit extreme, but it does happen.

-

Distraction scams

It's not just cash machines where scammers will cause a distraction.

Pretty much any tourist hotspot, both here and abroad, will usually have some scammers targeting unsuspecting members of the public who aren't familiar with their surroundings. Their choice of distraction technique will vary, but some of the more common ones include:

- Buskers with a large crowd around them

- Dramatically bumping into you

- Staged fights between accomplices

- Having a child go and talk to you.

Whatever ruse they go for, it serves to divert your attention to something other than your personal belongings. They'll use this as their chance to steal something from your pocket or bag. And in the case of the conversational child, it may even be the kid who grabs something while their parent is apologising.

Avoiding a scam like this can be tricky, as it essentially forces you to pay attention to just one thing. If you're heading to a tourist attraction, make sure that all of your valuables are safe, secured, and with you at all times.

Aside from not being scammed, there are plenty of easy ways to cut the cost of a holiday. -

Store cards

This one's not technically a scam. But some store cards can involve dodgy tactics that are definitely worth watching out for.

Reports have shown that shop assistants often encourage customers to lie about their earnings to help them meet their commission targets.

This means you'll be given a bigger credit limit (because the store thinks you earn more than you actually do). This massively increases the chance of you piling up mountains of debt that you'll be unable to pay off.

We wouldn't advise getting any type of store card at all, so don't be pressured into it. If you don't have the budget to spend at that moment, don't spend.

If needs must, it's a better idea to look into a 0% credit card instead. Check out our guide to using credit cards for more information.

-

Job advert scams

Credit: Gonzalo Aragon – Shutterstock

Scammers prey on the desperate, and a penniless student looking for a job could be a prime target. In fact, as many as one in three online job scams target students and fresh graduates.

Fraudsters will try to lure you in with catchy phrases such as "no experience necessary" or offers of full-time pay for part-time work. The fact is: if it looks too good to be true, it probably is.

Be wary of any job that asks you to ring a premium rate number (0845, 0844, 0870, 0871 etc.) or anyone who wants you to make an upfront payment.

Other things to be suspicious of include companies without a physical location, or a kebab shop popping up when you check out their address on Google Street View.

If you think you might have been a victim of a job scam, report it to Action Fraud.

-

Bogus landlords

Being cautious of accommodation scams should be a top priority for students, as young people are unfortunately a prime target. Fraudsters know how tough it can be to find affordable housing as a student, which is what makes this such a profitable scam.

Bogus landlords may have their own website or advertise on sites like Gumtree or Facebook, but you could fall into something dodgy just by answering an ad on a local noticeboard.

Alarm bells should be ringing if they try to convince you to make an upfront deposit to hold a property or prove financial capability.

It's true that early deposits are sometimes essential for students hoping to secure an apartment over the summer, but doing this through an agency will ensure you'll actually have a house (and a landlord!) when you arrive in September.

Going through your SU or university accommodation services can also help. They will ensure you only contact legitimate landlords.

If you're an international student and need to make a payment in advance, never make a transfer using services such as Western Union. Also always ask for a UK address, postcode and phone number for the company (and look them up).

Find out how these students were ripped off by this shady landlord's Jumanji horror home rental. -

Door-to-door scammers

We all detest people coming and knocking on our door and disturbing our Game of Thrones marathon.

But the thing to remember is that scammers who go for the door-knocking method are counting on the fact you'll feel a bit awkward. If you're desperate to get rid of them, you may donate a few quid or sign your name.

However, once they have your name, and maybe your phone number and address too, they can use these details frivolously.

Obviously, there are many well-intentioned door canvassers out there, too. Just make sure you look for official ID and branded clothing before you make any decisions, and certainly before you let them into your home.

-

"Free" trials

Credit: Boiarkina Marina – Shutterstock

Everyone loves a bargain, particularly a freebie. But be careful when signing up for free trials offered online. Often, you'll accidentally commit to a payment at a later date that you can't get out of.

While many legitimate sites (such as Amazon, Audible and Spotify) do offer a free taster of their services, some scams make it almost impossible to opt out once you've signed up.

You'll often have to provide payment details in order to access the free trial, and this can result in them taking cash from your account as soon as the trial is up. Make sure you always read the fine print before signing up.

In fact, even the legit sites can be a bit sneaky with the way their free trials work. We hear plenty of stories of students who don't realise their free trial of Amazon Prime is up and end up paying for it.

It's fair to say that these sites probably don't do as much as they could to remind you that you'll be paying once your free trial expires. When you sign up, it's best to add a reminder on your phone to guarantee you don't get caught out.

Love real freebies as much as we do? Check out our curated list of the best free trials. -

Investment scams

In recent years, investment scams have changed and have started to target younger people. Many of these scams are done over social media, where scammers will claim that this is a promise to some quick cash. With the financial hardships students face nowadays, it can be very tempting.

There are fake cryptocurrency schemes, where scammers will show fake (inflated) numbers to encourage you to deposit more money.

Another investment scam to watch out for is the "money-flipping" scam. Here, victims are told to deposit a small amount of money and are promised to get double (or triple) their investment back shortly, but they never see their money again.

With more students investing in stocks, looking into cryptocurrencies and buying NFTs, it's incredibly important to watch out for people trying to take advantage, especially on social media. Always do your research and don't risk money you can't afford to lose.

-

Pyramid/MLM schemes

Pyramid and MLM schemes are some of the most common Instagram money scams.

Ever received an annoying Instagram DM out of the blue from someone you went to high school with telling you about an "exciting business opportunity"? Well... you probably dodged a bullet there.

While Pyramid schemes are illegal in the UK, these Multi-Level-Marketing (MLM) businesses are very similar. Someone will reach out to you and explain the amazing perks of joining this online business opportunity, where you'll receive a commission for every product sale and an even bigger bonus for recruiting new people.

To join the business, you'll generally have to make an initial investment or purchase a "starter package", which they promise you'll earn back in no time. But obviously, that's easier said than done.

These businesses are more focused on taking on new recruiters than they are on selling products. It's usually only those at the top who will make a significant profit, while the rest will be left with no or minimal earnings. It's best to avoid these types of "business opportunities" altogether and don't trust random people in your inbox!

Hopefully, you're now clued up on some of the most common money scams to watch out for.

Have you been a victim of a money scam? Get in touch – we want to hear about it.