How to check and improve your credit score

Confused or concerned about your credit rating (and still not completely sure what it is)? We've got everything you need to know plus how to improve your credit score.

Credit: james weston (background), MisterEmil (left), Aaron Amat (right) – Shutterstock

There tends to be a whole lot of confusion involved when it comes to credit scores (a.k.a. credit ratings). And to be honest, that's really not surprising.

What we do know is that having a good credit score is really important. This is especially true if you ever want to apply for things like a mortgage or credit card.

While these might seem a bit far into the future to be thinking about now, the key to building a great credit score is to get started on improving it nice and early.

We're here to fill you in on exactly why your student credit rating matters so much, and how to start improving it.

Credit scores explained

What is a credit score and what affects it?

Essentially, a credit score is a kind of grading system used by banks and lenders to work out how much money you should be given when you apply for financial products like credit cards, overdrafts or a mortgage (or whether you should qualify for these 'products' at all).

In some instances, a poor credit score could totally disqualify you from being eligible to borrow money. It's worth being aware of what it is and how it's calculated.

Your credit score is determined by a whole range of factors, most notably including the following:

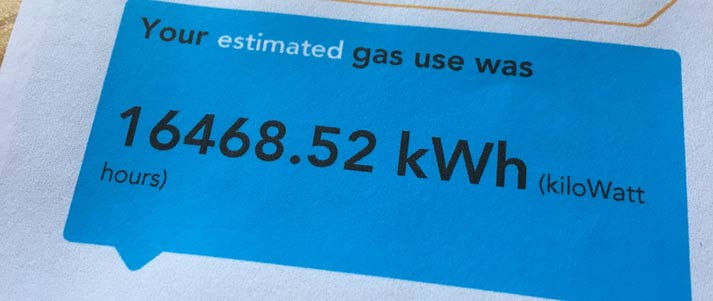

- Your track record of making payments, whether that be repaying a debt (excluding Student Loan repayments) or paying your energy bill.

- The proportion of credit available to you that you're using. In other words, whether you've maxed out your credit card and student overdraft, or are only using a small percentage.

- How often you've applied for credit. They particularly look at the last couple of years, especially if you've made several applications within a short period of time.

- Whether or not you're registered to vote.

But remember, these are just a handful of the determining factors. We'll go into more detail on how credit scores are calculated later on.

How important is your credit score?

Credit: astarot – Shutterstock

As a student, it's unlikely you'll have had much chance to make or break your credit rating. The length of your credit history also plays a role in determining your score, and only once you become an adult will you have the opportunity to build it.

But while your credit score is likely still in its infancy, and you probably won't be buying a house or taking out substantial loans for a few years now, there's nothing wrong with trying to improve it early doors. A good credit score will help you apply for a credit card and student overdraft.

Why do you need a credit score?

Your credit score is one of the most important things that banks will consider when you apply for a mortgage. It will also determine how generous they're likely to be with the repayment terms. As such, anything you can do now to improve your credit score is worth doing.

However, as valuable as a good credit score is, it's not the only factor that a lender will consider when you apply for credit.

Among other things, they'll also look at the affordability of the debt. In other words, can somebody on your salary, and with your other financial commitments, afford to make the monthly payments required?

And despite what you might've been told in the past, the idea that there's some sort of credit score 'blacklist' that prevents people from taking out loans isn't true, so don't worry! Just remember that if your credit score is low, it'll mean you're less likely to be accepted for financial products.

Also, if you think that you can try to minimise your credit history in an effort to avoid a bad credit score, think again.

Having no credit history is just as bad as having a poor credit history. Lenders are keen to see evidence of you having successfully and reliably repaid credit in the past. In other words, you can't game the system. Sorry.

What are credit scores used for?

People often assume that your credit rating only comes into play when you're applying for a mortgage or loan, but this isn't the case.

Here's a list of the main financial products and services for which a good credit score should improve the chances of your application being accepted (and with better rates):

- Mobile phone contracts

- Bank accounts (although only those with a very poor credit score are likely to be rejected)

- Overdrafts

- Credit cards

- Insurance (be it for home contents, your car or any other form where you choose to pay monthly rather than upfront)

- Mortgages

- Loans (including peer to peer loans).

These are all forms of credit. If your credit score is poor, your application for the best interest rates may be unsuccessful. You could even be rejected altogether.

Are credit ratings reliable?

Annoyingly, your credit score isn't a set, indisputable number. Instead, it will vary depending on the agency being asked to calculate it.

We'll run through the three main companies later on, but it's important to note that they all use different scales and will all probably give you slightly different ratings.

This is largely down to the fact that a credit score is the result of a complex mathematical calculation, and each organisation has its own way of formulating it.

So, as your credit score can differ depending on who's providing it, it's worth tracking your rating through multiple companies rather than just one.

To exemplify, one of the Save the Student members used two credit checkers to find out their score. The first was from ClearScore (which uses Equifax's data) and read 556/1000, while the second, from Experian, was a whopping 969/999. A pretty substantial difference, we're sure you'll agree.

While it's fairly uncommon to have such a disparity between two credit scores (in this case, it could even suggest that one of the reports has made a mistake!), it highlights how a single credit score can be unreliable.

How are credit scores calculated?

Credit: eamesBot – Shutterstock

Nobody (outside of the credit agencies, of course) knows the exact criteria used to determine a credit rating, and different credit companies use a variety of factors when grading you. This is why it's best to check with all three.

Nonetheless, we are able to say which big factors are definitely taken into consideration, and which aren't.

What IS included in a credit score

- Your past dealings with this specific lender

- Bill payments (like if a bill payment is ever late or missed altogether)

- Mobile phone contract payments

- Credit card history

- Loan history (including payday loans, but excluding Student Loans)

- Court records, including county court judgements (CCJs, issued if you fail to repay money you owe) and bankruptcy.

What ISN'T included in a credit score

- Student Loan repayments

- Parking fines

- Whether you've checked your credit rating before

- What your salary is (although the lender may ask for this separately)

- Savings accounts (only your current accounts are included)

- Gambling activity

- Council tax payments (although as a student you're exempt from paying anyway!)

- Your criminal record.

How to check your credit rating for free

If you're concerned about your credit score – or are even just a bit curious to see what yours looks like – then it's possible to check your records with all three major credit agencies for free. You can also pay a fee (be it monthly or one-off) to take a closer look at your report.

Remember that each credit company will grade your score differently, so it's best to check all three to get a good overview of your situation.

UK credit agencies

Here are the best places to check your credit score:

-

Experian

Experian is one of the leading credit reference agencies, and your credit score can now be accessed for free.

For a deep dive into your full report, including real-time tracking and notifications when changes happen, Experian offers its CreditExpert service for £14.99 a month.

However, new CreditExpert users are eligible for a free 30-day trial. Just make sure you cancel before the trial expires, or you will be charged.

-

Equifax

The best way to check your Equifax score is to apply through a company called ClearScore. You can use it free of charge, forever. On top of free reports that are updated weekly, ClearScore also provides tips on how to improve your credit score.

The two companies are not directly linked to one another, but ClearScore uses Equifax's data to present your credit score for free. They do show you what credit cards or loans you could qualify for, but you don't have to use them.

Alternatively, you can sign up for the 30-day trial directly with Equifax. Just note that an Equifax subscription will cost £10.95 a month after the free trial finishes, and unless you remember to cancel, you will be charged.

-

TransUnion (was Callcredit)

You can check your TransUnion score for free through Credit Karma (formerly Noddle) or TotallyMoney so it's worth giving this one a go to see where your score stands.

Be aware that both services will advertise credit cards, loans and other financial products in an effort to get you to apply. There's no obligation to do so, and you're always better off doing your own research on the best options for you.

How to improve your credit rating

Here's how to improve your credit score:

-

Get on the electoral roll

Registering to vote is probably the single easiest thing you can do to boost your credit rating. If you're not on the electoral roll, you'll find it a lot harder to make a successful application for credit.

A lot of students fall foul of this one because after moving away from home, registering at a new address can seem like a hassle.

But it's actually super simple to register online (literally about two minutes of your time).

Register for the electoral roll.

Did you know you can make money from elections? -

Make sure the details are correct

If you don't agree with something in any of your credit reports, or you've noticed any errors (this can happen!), you'll need to make sure something's done about it.

You can fix this by calling up the credit company themselves and asking if they'll look into the errors. They may also require you to contact the company that has given them the incorrect data (e.g. your mobile phone company or your bank) to amend it.

-

Pay all your bills on time

Credit: Damian Czajka – Shutterstock

A key way to improve your credit score is to pay all of your bills on time, including:

- Utility bill

- Mobile phone contracts

- Monthly rent

- Any forms of loan repayments (except Student Loans).

If you're good at paying your rent on time, you can also use this to score points on your credit report by setting up an account with Credit Ladder (more on this in the next point).

Just be cautious about having your name on all the bills if you're in a shared household. In this scenario, if just one person can't afford to pay up and the payment is missed, everyone's credit score could be affected.

-

Use Credit Ladder to record your rent payments

Since March 2016, it's been possible to arrange for your rent payments to be shown in your credit report. Known as 'The Rental Exchange', this is a great option for anyone who is good at paying their landlord on time and who's looking for ways to improve their credit score.

To get involved, you need to sign up to a third-party website called the Credit Ladder. Credit Ladder then verifies your rent payments when they go to your landlord or letting agent.

Every time a payment is made, they record how punctual you are with the payment and whether you paid the right amount. They then store this data to be picked up in your credit report.

-

Get a credit card and use it wisely

As long as you don't let things get out of hand, applying for a credit card and using it carefully could help to boost your credit score.

It makes sense, really. Your credit rating is used by lenders to see how reliable you are at making repayments. With a credit card, you'll essentially be 'given' money to spend by the bank each month. It's then up to you to repay it on time.

Try to only use it to spend as much money as you would if it were your own money (which, ultimately, it will eventually be). On top of that, you should always pay off your credit card in full each month. You can set up a Direct Debit to do this. Late payments will damage your credit score, and unless you repay in full each month, you'll have to pay interest too.

One technique for using a credit card responsibly is to assign a specific purpose to it, like paying for a holiday. If you only ever use it to pay for purchases related to your holiday, you should find it easier to keep track of how much you've spent on the credit card, and how much needs to be repaid.

-

Space out applications for credit products

Every time you apply for a credit product, like a mobile phone contract or a new credit card, it leaves a 'footprint' on your credit report. This is largely because banks want to know if you're currently making a lot of credit applications. It could indicate you're in a poor financial situation and are therefore less likely to be able to pay the money back.

The key is to make sure you spread out your applications as much as possible, and only apply if you really need to. If you're denied credit at any point, wait at least 30 days before reapplying.

Remember that your score won't shoot up overnight. Make sure you're aware of the risks and know the steps you can take to give your rating the boost it needs. This will work wonders in the long run.

How to avoid a bad credit rating

Here are a few pointers you should follow to prevent you from damaging your student credit score:

- Never use your credit card to withdraw cash at an ATM – Not only are interest rates on this completely ludicrous, but it also shows up on your credit report. Withdrawing cash using a credit card gives the impression you've had to resort to emergency measures, spending cash that isn't yours as a consequence of bad budgeting.

- Never take out a payday loan – Of course, we already know how terrible payday loans are for your long-term bank balance. But just having them appear in your credit report looks terrible to lenders. Taking out a payday loan is arguably one of the worst things you can do for your credit score.

- Never pay out for what's advertised as a 'credit repair service' – Essentially, there's nothing that these companies can do that will help you (except advise you on all of the above points, which we've just given you for free!). Don't waste your money on these guys.

- Don't hold on to any old store cards – This is especially true if you're not still using them. We're not fans of store cards anyway, but if you're seen to have heaps of credit sitting around and not being used, this can be damaging too.

Hopefully, we've shed at least a tiny bit of light on the complex mystery otherwise known as the world of credit scoring. We know this stuff can be a bit of a headache, but you'll get there.

The trick is just to try and show the banks that you know to look after your bills, and the banks will look after you (in theory).

If you're looking to carefully use a credit card to help build your credit rating, check out the best student credit cards on offer today.